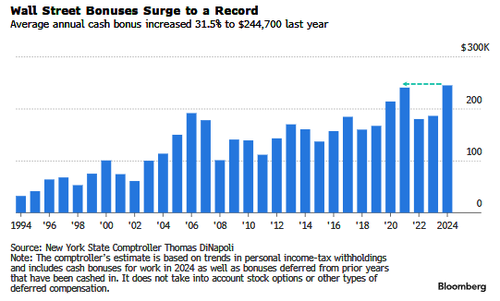

Average Wall Street bonuses have hit a new record high as capital markets—frozen over the past several years—began thawing in 2024, with further improvement expected this year.

A new report released by the office of New York State Comptroller Thomas P. DiNapoli shows that Wall Street's bonus season, which runs through March, hit a record $47.5 billion—up 34% from previous year—with the average bonus payout soaring to a fresh record high of $244,700, a 31.5% jump from the previous year.

"The record-high bonus pool reflects Wall Street's very strong performance in 2024," DiNapoli wrote in a report.

The big bonus payouts follow capital market improvements last year.

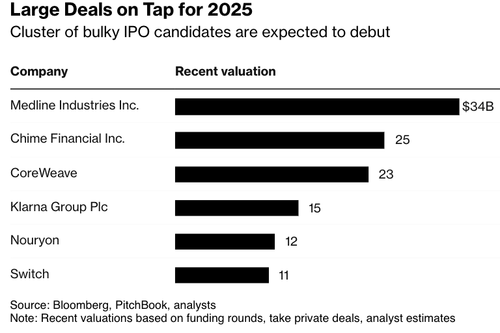

Dealogic data shows that companies going public raised $39.32 billion in 2024, more than in 2022 and 2023, but below the Covid mania peak in 2021. This year, capital markets are expected to receive further tailwinds from President Trump's relaxed regulations and potential for interest rate cuts in the second half of the year.

"Deregulation will make it easier for earlier-stage companies to gain traction and grow in their specific business markets," Ross Carmel, a partner at IPO-focused law firm Sichenzia Ross Ference Carmel, told Investopedia at the start of the year.

Carmel said, "If they trade well post-IPO, I expect other mature companies will follow suit and go public in 2025."

Returning to the comptroller's report, he explained: "This financial-market strength is good news for New York's economy and our fiscal position, which relies on the tax revenue it generates."

"However, increasing uncertainty in the economy amid significant federal policy changes may dampen the outlook for parts of the securities industry in 2025," he warned.

DiNapoli pointed out that Wall Street accounts for 19% of taxes collected by NY State and 7% by NYC. These bonuses are expected to generate $600 in revenue for the state and $275 million for the city.

DiNapoli added that Wall Street securities employment topped 201,500 workers last year, the highest annual level in three decades, exceeding the previous peak in the Dot Com mania. NYC's share of securities industry jobs nationally has slid to 18% from 33% in 1990 as Wall Street firms moved to Florida, Texas, and other Red States to escape violent crime and taxes in NYC.

Earlier this month, NYSE Group President Lynn Martin told Bloomberg at the Invest conference in New York that first-time share sales could hit $50 billion: "We're still gearing up for an active second quarter from an IPO perspective which, depending on how those deals go, we think will inform the way the rest of the year will progress."

Here's the IPO pipeline...

The only way capital market improvement can be derailed and bonuses stagnate is if market volatility remains elevated and interest rates rise.

Loading...