A new report from the New York State Comptroller Thomas P. DiNapoli reveals that the number of securities-industry workers in New York City has hit a twenty-year high - even as layoffs in the banking industry rise and deal activity continues to slide.

DiNapoli said the total headcount at securities firms in NYC increased to 195,100 (based on year-to-date data), the highest level in over 20 years.

He added, "Whether firms will retain these additional positions as profits return to normal remains to be seen. Lower profits have also resulted in smaller bonuses, with the bonus pool estimated to be down 21% yearly, meaning a decline in related income tax revenue for the City and State."

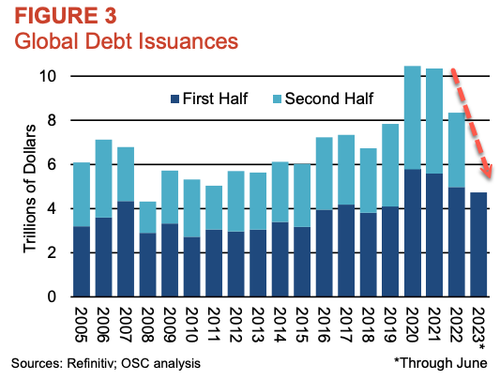

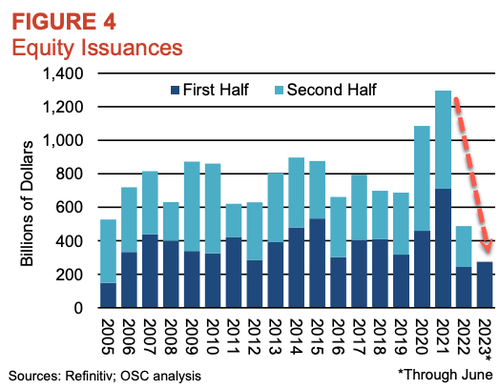

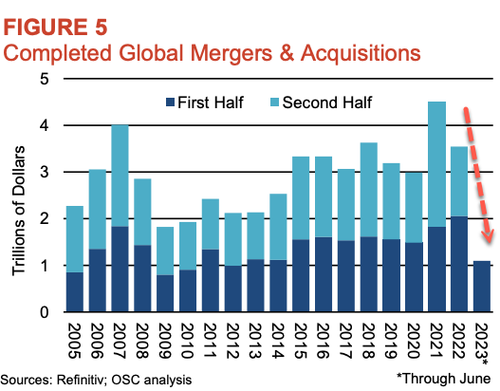

Revenues from commissions and underwriting activities plunged by 46.8% over the last two years, as the high cost of credit triggered a massive slowdown in equity issuances, debt issuances, and mergers and acquisitions.

Global debt offerings fell from $10.3 trillion in 2021 to $8.3 trillion in 2022 to $4.7 trillion in the first half of 2023.

Equity insurances have also tumbled.

Global M&A activity has crashed.

"These are volatile times in America and globally, and Wall Street's relatively stable profits and employment levels could change quickly," DiNapoli said in a statement to Bloomberg.

A slide in deal flow has softened earnings and revenues for major banks, including Citigroup, Morgan Stanley, and Goldman Sachs, who have all trimmed their respective headcount.

He continued, "Further declines could weaken New York's tax revenue from the securities industry and have repercussions for our state and city budgets."

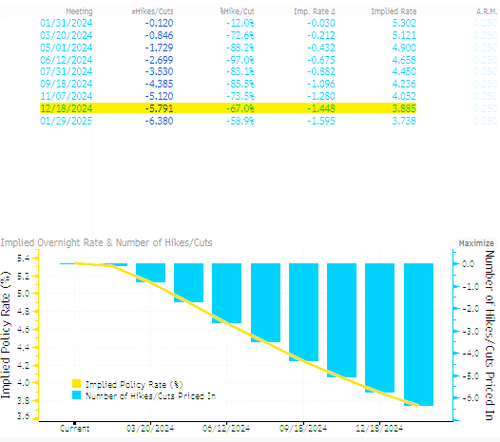

While markets have expected the Federal Reserve to hold interest rates at elevated levels for an extended period, it appears the Fed has signaled a major dovish shift on Wednesday, with rates markets pricing in more than five cuts next year.

The current freeze in M&A activity could thaw in 2024.

Will 2025 be another bust year for Wall Street?