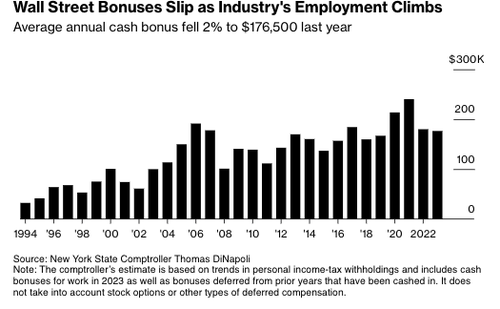

Wall Street bonuses have declined for two consecutive years, falling to levels last seen in 2019, according to the latest yearly figures released by New York State Comptroller Thomas P. DiNapoli. This trend is occurring amidst a multi-year downturn in capital markets due to the Federal Reserve's interest rate hiking cycle.

According to the report, the average Wall Street cash bonus fell 2% to $176,500 in 2023, the lowest level since 2019. The drop was far less than the 25% plunge in 2022. Last year's bonus pool was $33.8 billion, unchanged from the previous year but far less than the $42.7 billion during the stock market mania in 2021.

"Wall Street's average cash bonuses dipped slightly from last year, with continued market volatility and more people joining the securities workforce," DiNapoli said in a news release on Tuesday.

He continued: "While these bonuses affect income tax revenues for the state and city, both budgeted for larger declines so the impact on projected revenues should be limited."

"The securities industry's continued strength should not overshadow the broader economic picture in New York, where we need all sectors to enjoy full recovery from the pandemic," he added.

Despite the slump, the report said Wall Street's profits rose 1.8% last year, "but firms have taken a more cautious approach to compensation, and more employees have joined the securities industry, which accounts for the slight decline in the average bonus."

The report showed the industry employed 198,500 people in 2023, up from 191,600 the prior year. This expansion occurred during a period when US banks laid off 23,000 jobs.

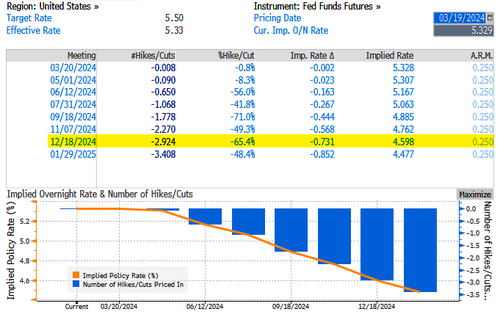

Given that swaps traders and economists at Goldman Sachs Group are forecasting fewer Fed interest-rate cuts this year, a higher-for-longer rates environment will continue to discourage capital-market activity.

There's about a 50% chance of a June cut. Over the last several months, the Fed's interest-rate target implied by overnight index swaps and SOFR futures went from 700bps of cuts to currently 292bps of cuts for the full year.

Any delay in the easing cycle will only mean another year of depressed bonuses for Wall Street.