Corporate media was out in full force on Wednesday, eagerly highlighting new data showing that Tesla sales in Europe plunged in February. These outlets claim that Elon Musk has alienated some EV buyers who oppose his DOGE initiative, which supports the president's efforts to drain the DC swamp of corrupt officials and NGOs.

Successive reports of slowing EV sales led to an abrupt top in Tesla shares in mid-December, around the $479 handle, and have since plunged 43% over the last few months. This bear market appears to be approaching the round-trip point of the post-election rally.

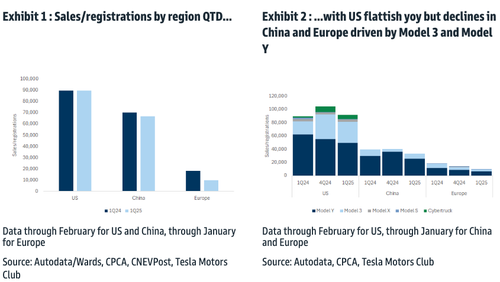

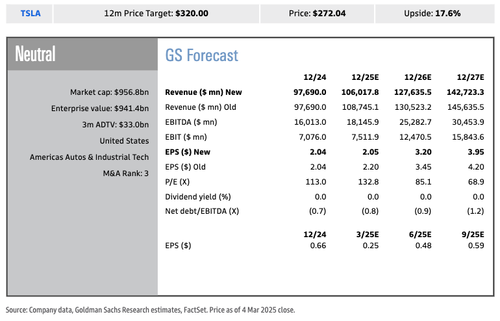

On Tuesday, Goldman Sachs analysts Mark Delaney, Will Bryant, and others provided clients with new commentary on Tesla, in which they revised their 1Q25 delivery estimate down due to softening in key markets, including China, Europe, and the US:

Deliveries tracking softer in 1Q, we believe in part on the Model Y transition and partly due to weaker demand Tesla delivery data for January and February in key regions has been soft, which we believe is partly due to the Model Y changeover and partly due to somewhat weaker underlying demand than we had expected (as we think growth has also been slower than we had previously estimated for Model 3 and Cybertruck per delivery data, consumer surveys, incentives that Tesla has been utilizing, and the competitive landscape). We expect shipments to be stronger in the month of March driven by the refreshed Model Y ramp. Overall, we now expect deliveries of 375K in 1Q25, down from our prior 399K view and well below Visible Alpha consensus at 426K.

Delaney and Bryant provided more color on the slowdown on a regional basis:

USA - Through February, deliveries are tracking flattish yoy per Wards and Motor Intelligence (with Wards showing a slight decline and Motor Intelligence reporting slight growth) but down meaningfully qoq as 1Q24 was impacted by the Model 3 transition;

Europe - European registration data for January shows a >40% yoy decline, and registration data from daily reporting countries (i.e. UK, Spain, Netherlands, Denmark, Sweden, Norway) indicates a mid to high 20% decline through February (although we note that this daily reporting data does not include Germany, which has been a larger source of weakness for the more complete January data);

China - CPCA data in January and registration data through February indicates a mid single digit decline in China retail sales yoy QTD, but assuming a stronger March as production of the new Model Y ramps, we think China could end up being more flattish yoy for 1Q25 overall.

Sales are slowing.

Since the analysts do not cover Germany and France in the note, Tesla sales in those countries plunged as well:

Tesla registrations in Germany plummeted 76% last month, according to the German Federal Motor Transport Authority. This decline comes as Elon Musk publicly voiced his support for the AfD party.

Tesla registrations in France plunged 44% last month.

These two countries are the largest EV markets in the EU.

The analysts emphasized: "While the Model Y transition is a key driver of the weakness, we also believe that underlying demand is somewhat weaker than we had previously expected."

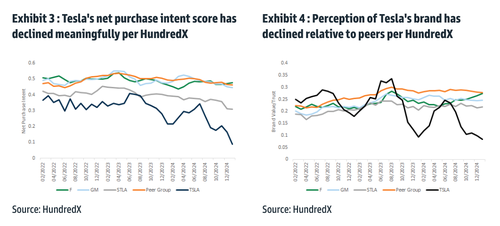

HundredX data (which aggregates survey responses from US consumers) shows Tesla's net purchase intent and net positive perception of the brand have been sliding since the summer of 2023.

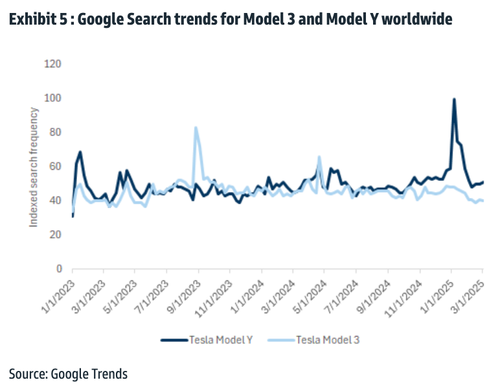

Google Search trends for Tesla Model 3 and Model Y worldwide remain stable.

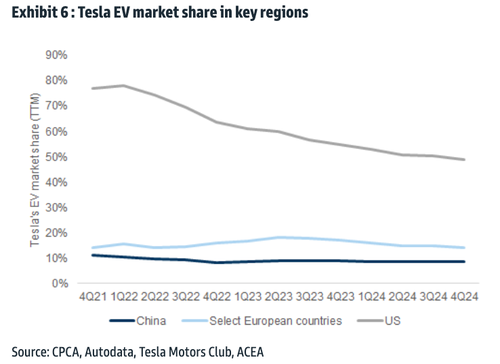

The analysts believe Tesla's market share in China has eroded because of the "strong competitive environment" with domestic brands like Xiaomi and BYD.

In addition to lowering their Q1 2025 delivery estimate, the analysts have also reduced their full-year 2025 forecast.

Here's more:

We lower our 2025 deliveries estimate to 1.91 mn (up 7% yoy) from 1.96 (up 10% yoy), and our 2026/27 estimates to 2.25 mn/2.50 mn from 2.30 mn/2.60 mn reflecting lower assumptions for Tesla's existing models and partly offset by a more positive view of shipments from Tesla's upcoming new model launches (which could benefit from new form factors and lower prices). Our estimates are below VisibleAlpha consensus at 1.98 mn/2.37 mn/2.68 mn respectively. Separately, we lower our energy gross margin assumptions, reflecting higher tariffs on imports from China that are already in effect (given the battery sourcing for Megapacks) and the competitive landscape. However, our estimates do not include tariffs on imports from Mexico or Canada, which are evolving and could still be adjusted per media reports.

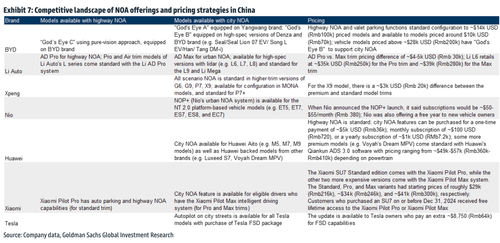

On FSD, the analyst said Tesla is facing a tough competitive environment in China:

As for shares, the analysts remain "Neutral" rated on the stock, lowering their 12-month price target to $320 from $345.

The analysts do note: "We expect Tesla's earnings growth to improve over the longer-term due in part to increased software revenue with FSD, although we have a more balanced view of Tesla's monetization potential than we believe the company is targeting."

Loading...