Tesla shares tumbled nearly 6% on Monday morning, on pace for the seventh straight down session, as the EV-maker once again slashed vehicle prices across major markets—China, Germany, and the US—amid the worsening EV price war.

In China, Tesla dropped Model 3, Y, S, and X vehicle prices by 14,000 yuan, or $1,933, according to Bloomberg. US prices for Model Y, S, and X vehicles were reduced by $2,000. The Model 3 saw no reduction in price in the US.

A base-level Model Y in China now starts at around 250,000 Yuan, or $35,000. In the US, base models of Tesla Y, S, and X begin at $43,000, $73,000, and $78,000, respectively.

Following the price cuts, Evercore's Chris McNally told clients that Tesla's China business "may now be breakeven or even negative" based on earnings before interest and taxes. This isn't good for the company operating in the world's largest EV market.

The continued and worsening EV price war led Chinese electric vehicle manufacturer Li Auto to cut prices by 6% to 7% across its vehicle lineup. The L7 sport utility vehicle now starts at around 301,800 yuan.

On Sunday, Musk wrote on X, "Tesla prices must change frequently in order to match production with demand."

Wall Street soured on the latest round of price cuts, with shares down a little more than 4% around lunchtime.

"The volatility of prices has, however, impacted the appetite of professional buyers such as leasing and rental companies – Sixt and Hertz have elected to reduce their Tesla fleets due, in part, to uncertain used pricing," HSBC analyst Pushkar Tendolkar told clients.

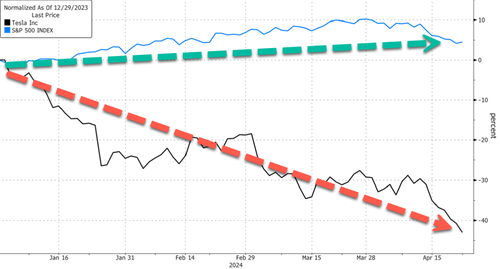

The stock has plunged 43% this year, making it one of the worst performers in the S&P500.

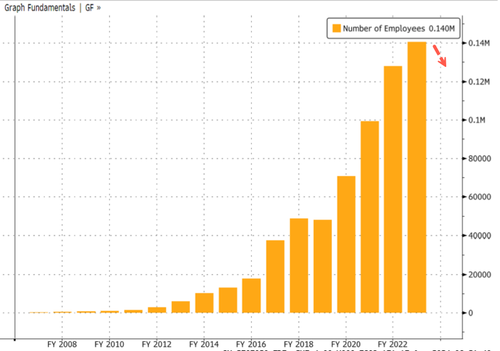

Last week, The Wall Street Journal reported that Tesla was preparing to cut 10% of its global workforce, approximately 14,000 employees. Then, on Monday, Bloomberg reported that the company's newly formed marketing team was laid off.

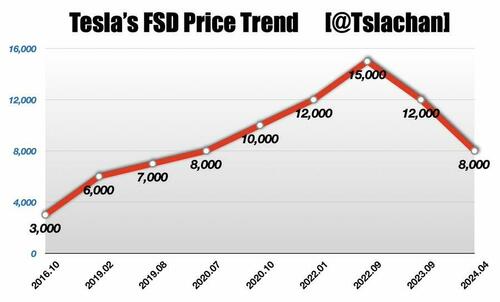

Tesla also slashed the price of its Full Self-Driving software from $12,000 to $8,000 in the US. This followed the most recent halving of the FSD subscription from $200 to $100 per month.

On Tuesday, Tesla is expected to report first-quarter earnings. LSEG data shows that the world's most valuable automaker is likely to post its first revenue drop and lowest gross margin in nearly four years. This comes after the company reported a slide in vehicle deliveries for the first quarter earlier this month.