Tesla shares are plunging heading into the cash open after the automaker reported Q1 deliveries and production that fell far below estimates.

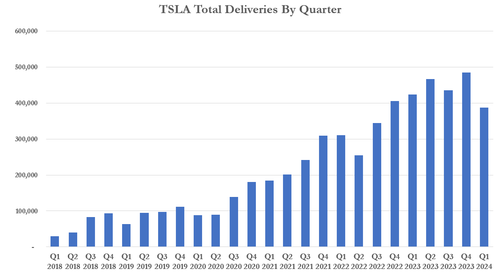

For Q1 2024, Tesla produced over 433,000 vehicles and delivered 387,000. It marks the first annual Q1 delivery decline for the automaker since 2020.

Tesla's exact delivery number for the quarter was 386,810 vehicles, far below Bloomberg estimates of 449.080.

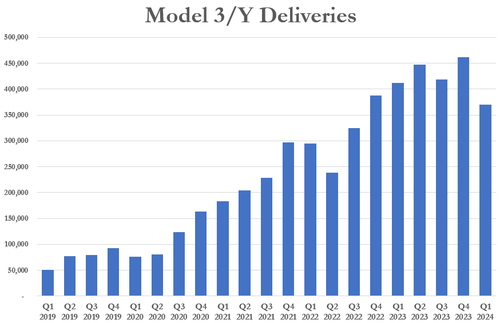

For the quarter, the company produced 412,376 Model 3/Y vehicles against estimates of 439,194. The company produced 20,995 "other models".

Tesla encountered several hurdles in the first quarter, including Houthi militia attacks that disrupted its component supply in the Red Sea, leading to a temporary halt in production at its German factory.

Additionally, environmental activists' sabotage near the same facility further impeded operations.

As we have been noting on Zero Hedge, in China, intense competition from local EV manufacturers like BYD and Xiaomi led to reduced production at Tesla's Shanghai plant after disappointing sales in January and February. The U.S. market at the same time gave mixed reviews to Tesla's new Cybertruck, and discounts and incentives were less successful in boosting sales than previously.

Ahead of the quarter's end, CEO Elon Musk instructed sales and service staff to demonstrate the latest version of the company's premium driver assistance system, marketed as Full Self-Driving, which still requires driver supervision. This period saw Tesla's stock fall 29%, marking its most significant quarterly drop since the end of 2022 and one of its steepest since its 2010 IPO.

Analyst expectations varied, with a FactSet compilation predicting around 457,000 deliveries, and estimates updated in March adjusting this figure to between 414,000 and 469,000. Independent researcher Troy Teslike had anticipated around 409,000 deliveries.

However, a company-compiled consensus shared by Tesla's head of investor relations Martin Viecha, based on 30 analysts' estimates, expected an average of 443,027 deliveries for the quarter.