Authored by Vince Quill via CoinTelegraph.com,

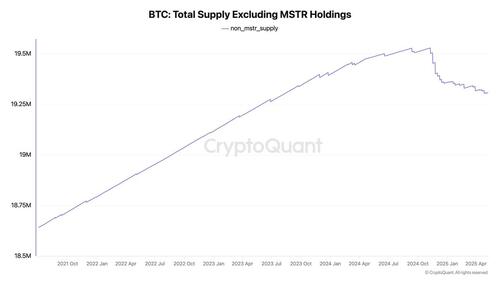

Strategy, a Bitcoin treasury company, is accumulating Bitcoin at a faster rate than total miner output, giving the supply-capped asset a -2.33% annual deflation rate, according to CryptoQuant CEO and market analyst Ki Young Ju.

“Their 555,000 BTC is illiquid with no plans to sell,” the analyst wrote in a May 10 X post.

“Strategy's holdings alone mean a -2.23% annual deflation rate — likely higher with other stable institutional holders,” Ju continued.

Michael Saylor, the co-founder of Strategy, is an outspoken Bitcoin advocate who evangelizes the scarce digital currency to potential investors and has inspired many other companies to adopt a Bitcoin treasury plan.

The total BTC supply is shrinking due to Strategy accumulating Bitcoin. Source: Ki Young Ju

Additionally, Strategy acts as a bridge between Bitcoin and traditional financial (TradFi) markets by funneling funds from TradFi investors into Bitcoin through selling corporate debt and equity, which the company uses to finance more BTC purchases. According to Michael Saylor, over 13,000 institutions hold Strategy stock directly in their portfolios.

Bitcoin investors continue to watch the company and its effect on Bitcoin market dynamics. Strategy leads the charge toward institutional adoption of Bitcoin, further restricting the supply of available coins and raising BTC prices, while dampening volatility.

Adam Livingston, author of "The Bitcoin Age and The Great Harvest," recently said that Strategy is synthetically halving Bitcoin by outpacing miner supply through high demand.

According to the author, the current collective daily miner output is approximately 450 BTC, while Strategy accumulates an average of 2,087 BTC per day, over four times the daily miner production.

Miner reserves are dwindling and are in a long-term decline. Source: CryptoQuant

Other institutions, including hedge funds, pension funds, asset managers, and tech companies, continue buying BTC as a portfolio diversifier or a treasury asset to hedge against fiat currency inflation.

ETF inflows have also helped to stabilize Bitcoin's price by injecting fresh capital from traditional financial markets, smoothing out the volatility of Bitcoin and making downturns less severe.

However, the most august institutional players — sovereign wealth funds — will not ramp up Bitcoin purchases until clear cryptocurrency regulations are established in the United States, according to SkyBridge founder Anthony Scaramucci.

Once a comprehensive regulatory framework emerges in the US, it will trigger large blocks of Bitcoin purchases by sovereign wealth funds, increasing Bitcoin's price, Scaramucci added.

Loading...