Across global luxury property markets, $1 million doesn’t go as far as it used to.

In Dubai, for instance, a $1 million dollar property in 2020 is worth $2.7 million today. Meanwhile, in Miami, it would be worth $1.9 million. However, in some markets, cracks are beginning to show amid higher rates and frothy valuations spurred by the pandemic.

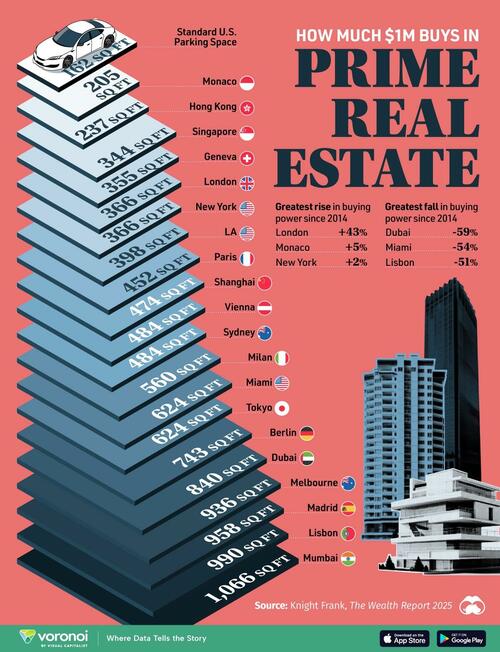

This graphic, via Visual Capitalist's Dorthy Neufeld, shows what $1 million can buy in prime real estate across 20 markets worldwide, based on data from Knight Frank.

Below, we show the square footage that $1 million covers across luxury real estate markets, defined as the top 5% of residential listings as of 2024:

As we can see, $1 million covers just 205 square feet in Monaco, with an average new build costing a staggering $39 million in 2024.

Monaco’s appeal for the ultra-rich largely stems from its tax-haven status as it has no income tax, inheritance tax, or capital gains tax. Additionally, the scarcity of land met with high demand contributes to high property values.

Despite economic challenges, Hong Kong ranks as the second-most expensive luxury market. While many properties of Chinese real estate tycoons have sold at a sharp discount since the collapse of China Evergrande, it still commands top dollar for the most exclusive residences. Overall, buying power has moderately decreased compared to 2014 levels.

On the other hand, buying power has risen notably in London due to a falling pound against the dollar and a property market correction. Over the last decade, it has increased by 43%, the biggest jump across cities analyzed.

In many ways, this bucks the trend of a majority of prime real estate markets globally. In particular, Dubai has seen buying power drop 59% since 2014, followed by Miami (-54%) Lisbon (-51%), and Shanghai (-47%) amid robust demand and rising affluence.

To learn more about this topic from a real estate perspective, check out this graphic on the world’s least affordable housing markets.

Loading...