In the fourth quarter of 2024, Ford posted a net income of $1.8 billion, or 45 cents per share, a strong turnaround from last year' s net loss of $526 million, or 13 cents per share. Excluding one-time charges, adjusted earnings per share came in at 39 cents. Here's the full Q4 results:

It is now clear that Farley faces mounting challenges, including overhauling the company’s EV strategy to curb losses and cutting high warranty repair expenses. The automaker lost a record $5.1 billion on EVs last year and expects that deficit to widen to as much as $5.5 billion in 2024.

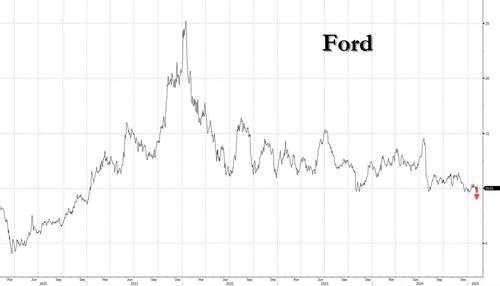

While Farley is pushing for more affordable, longer-range models, those won’t hit the market until 2027. Meanwhile, the pressure on Ford shares continues, with the stock falling nearly 19% last year, in contrast to General Motors’ 48% surge.

Farley has emphasized the need to close Ford’s $7 billion to $8 billion cost disadvantage against competitors, largely driven by warranty costs. He has tied executive bonuses to improving quality and efficiency, with the company targeting $1 billion in cost cuts this year. “In 2025, we expect to make significantly more progress on our two biggest areas of opportunity – quality and cost,” Farley said. “We control those key profit drivers, and I am confident that we are on the right path.”

Ford’s 2025 guidance reflects headwinds, including a 2% decline in industry-wide pricing and slower sales, but does not factor in potential new tariffs under a Trump administration:

- Adjusted EBIT: $7 billion to $8.5 billion, estimate $8.57 billion

- Ford Pro EBIT: $7.5 billion to $8 billion

- Ford Blue EBIT: $3.5 billion to $4 billion

- Ford Model e EBIT loss: $5 billion to $5.5 billion

- Ford Credit EBT: about $2 billion

- Adjusted free cash flow: $3.5 billion to $4.5 billion

- Capital expenditure: $8 billion to $9 billion, estimate $8.66 billion

Incoming CFO Sherry House said: “There is no question that 25% tariffs on Mexico and Canada would have a major impact on our industry. That said, we believe the Trump administration intends to support the American auto industry.”

Tariff concerns are also weighing on the industry. “I know tariffs are on everyone’s mind,” House added.

Trump has also pledged to eliminate federal incentives for electric vehicles, including the $7,500 tax credit that dealers consider critical for sales.

In kneejerk reaction to the disappointing guidance, Ford shares tumbled 5% after hours...

... sliding back below $10 and the lowest level in fouf years.