Europe's wind energy and renewable companies were pressured after President Trump signed an executive order on Monday to halt US offshore wind lease sales in federal waters temporarily. Adding to the industry-wide gloom, Danish offshore wind developer Orsted revealed impairment charges that exceeded Wall Street analyst expectations.

Shares of Orsted plunged as much as 18% in Copenhagen - the most since November 2023 - after the company revealed an impairment charge worth 12.1 billion Danish kroner ($1.68 billion) at its troubled US unit.

"The impairments announced today, and especially the continued construction challenges, are very disappointing," CEO Mads Nipper wrote in a statement.

Nipper continued, "We remain committed to the US market in the long term with its potential for renewables to meet the growing electricity demand and create thousands of industrial jobs across the US. We continue to navigate the complexities and uncertainties we face in a nascent offshore industry in the new US market."

Orsted pointed to the "interest rate increase, seabed leases, and the execution of Sunrise Wind" project, which will, in aggregate, result in the $1.68 billion impairment charge in the fourth quarter of 2024. The Sunrise Wind project is located off the coast of Montauk, New York.

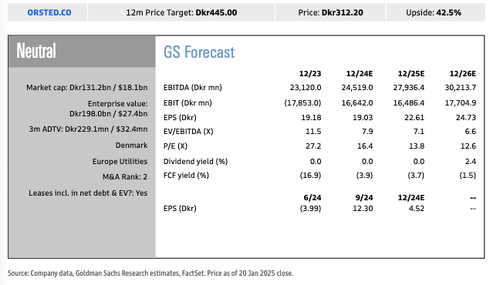

Goldman's Alberto Gandolfi, Mafalda Pombeiro, and Dhwani Khenwar called Orsted's announcement a "surprise" and warned "potentially more to come":

In a surprise announcement, Orsted has pre-announced 2024 results; crucially, the company has disclosed impairments for DKK 12 bn (DKK 29/share), related to: (i) higher interest rates in the US (DKK 4.3 bn), (ii) US seabeds (DKK 3.5 bn), and (iii) further delays in the construction of Sunrise, now expected in the second half of 2027 (DKK 4.3 bn). Despite "in line" 2024 EBITDA (DKK 24.8 bn ex gains), we believe these impairments are a negative for the share price. From here, we also flag that the risk of not receiving any ITC bonus, coupled with potential introduction of import-tariffs on offshore activities, could lead to incremental impairments.

The analysts maintained a "Neutral" rating on Orsted with a 12-month price target of 445 Danish kroner.

Storm clouds continued to gather for the Danish company after Trump's executive order on Monday, which suspended new offshore wind lease sales in federal waters and halted the issuance of approvals, permits, and loans for both onshore and offshore wind projects.

Trump's announcement weighed on renewable shares, sending iShares Global Clean Energy ETF (ICLN) slightly lower in premarket trading. ICLN shares have slid for 3.5 months on the anticipation that Trump will dial back green energy spending. Shares are now trading near 2020 lows.

Across Wall Street, analysts expressed grave concern following Orsted's impairment announcement, compounded by Trump's executive order, which signals elevated risks across the US offshore wind and renewable energy industries (courtesy of Bloomberg):

Citi (neutral)

- Jenny Ping says pre-released impairment numbers were larger than previously indicated

- Expects Sunrise Wind delays/cost escalation impairment of DKK4.3b to particularly negatively impact shares

- Orsted's further impairments come at a time when the sector is facing political risk, and are unlikely to bolster confidence

RBC (sector perform)

- Management's assertion that it remains committed to the US and continues to see value in US projects is unlikely to reassure the market, writes analyst Alexander Wheeler

- Co. continues to experience significant challenges in its US business and the execution of US projects

Jefferies (hold)

- Ahmed Farman notes impairment of DKK12.1b is 9% of Orsted's market capitalization at last close, though some of this is already partly priced in, especially on the interest-rate impairment

- Sunrise Wind impairment is particularly disappointing as it further exemplifies the execution risks within US offshore wind

Barclays (equal weight)

- The scale and nature of the remaining impairments is larger than expected, analyst Dominic Nash writes in a note

- Says this is at least Orsted's third major profit warning/impairment update since January 2023

- Sees higher risks for US offshore wind given Trump's policies against the industry, including the risk of no further US offshore wind development over the medium term and the values of seabed leases potentially going to zero

Trump on Monday: "We're not going to do the wind thing."

A lot of bad news for the green energy bubble in the era of Trump 2.0.