Warren Buffett’s company, Berkshire Hathaway, has about $325 billion in cash, accounting for over a quarter of its portfolio - the highest percentage in over 30 years.

The question begging an answer is, what is worrying Warren Buffett?

We believe the answer is valuations.

We have shared numerous charts over the last few months showing how valuations are on par or even higher than those of 1999 and 1929.

Warren Buffett’s preferred market valuation metric is the ratio of the total stock market cap to GDP. The ratio stands at 230%, 2% below the level when the market peaked in 2021 and well above 175% in 1999.

The foundation of this calculation is that earnings, thus ultimately asset values, are the result of economic activity. Therefore, a rising ratio potentially signals investors are expecting too much future earnings growth.

We turn to our friends at Kalish Concepts and their recent paper- Market Cap To GDP- The Importance of Basic Arithmetic.

The article shows that not all stocks are overpriced. In their words:

This is a problem that is being driven almost entirely by the 50 largest stocks in the market

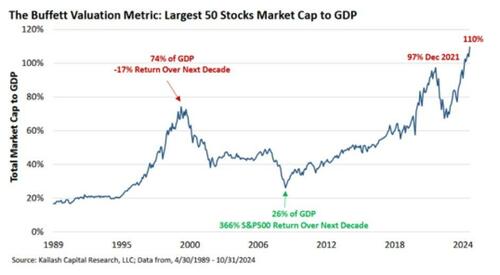

Their first graph below shows the ratio of the market cap of just the largest 50 stocks to GDP.

The ratio is well above 1999 and a good amount higher than late 2021.

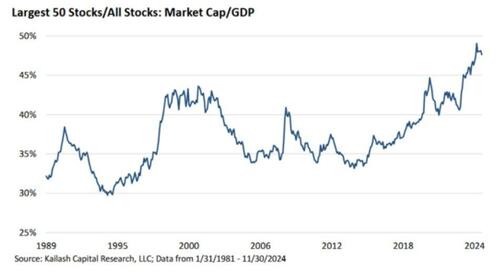

The second graph provides a slightly different context.

Per Kalish:

The line merely divides the 50 biggest stocks market cap to GDP by the overall market cap to GDP.

This shows what percentage of the total market’s valuation is being driven by the 50 largest stocks.

Out of 5,166 stocks, America’s 50 largest companies now account for nearly half the market’s total valuation – a record.

The good news, per Kalish, is that there are plenty of stocks without high valuations offering a potential port in the proverbial storm when large-cap valuations correct. The biggest question, however, is when.