Billionaire investor Warren Buffett's Berkshire Hathaway has been offloading tens of millions of shares of Bank of America in the last several weeks. Since we first detailed the selling on Tuesday, Buffett's firm has dumped millions more.

Let's begin with the note on Tuesday titled "Buffett Disposes 71 Million BofA Shares As Berkshire's Cash Stockpile Rises."

By the end of the week, new data from Bloomberg shows Berkshire sold a further 19.2 million BofA shares.

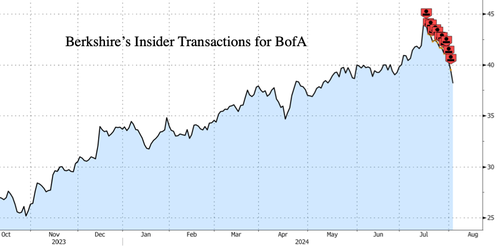

Since the selling first began in mid-July, Berkshire has unloaded 90 million BofA shares, mostly above the $40 handle.

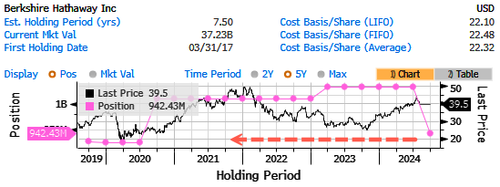

As of Thursday, Buffett's Berkshire remained BofA's largest shareholder, owning approximately 942.429 million shares.

The size of Berkshire's BofA stake has been reduced to where it was in early 2020.

Berkshire's rising stockpiles merely reflect the firm's inability to find deals in today's overvalued and weak economic environment. On Friday, economic data in the US showed troubling signs of a worsening employment landscape and rising recession risks.

In May, Buffett told investors at Berkshire's annual meeting that "it's a fair assumption" the firm's cash stockpile would top $200 billion in the near term. The rising stockpile comes as the trusty ole' 'Buffett' Indicator (US Equity market Cap/US GDP) has warned for quite some time about overvalued stocks.

The exact reason for Berkshire's BofA dump has yet to be disclosed. But raising cash could be a sign that Buffett and his team understand deals are ahead. This means valuations in overall markets must go lower.