Authored by Sean Tsang via The Epoch Times,

Two senators are urging the Pentagon to find out whether investors tied to China hold stakes in SpaceX, one of America’s most important defense contractors and a key provider of military launch services.

In a Feb. 5 letter to Secretary of War Pete Hegseth, Sens. Elizabeth Warren (D-Mass.) and Andy Kim (D-N.J.) said recently unsealed court records and media reports raise concern about whether Chinese money reached SpaceX through intermediaries and offshore entities.

“These [alleged] ties could pose a national security threat, potentially jeopardizing key military, intelligence, and civilian infrastructure,” they wrote.

The senators argue it could trigger U.S. safeguards meant to keep foreign adversaries from gaining leverage over companies that handle sensitive national security work.

Warren and Kim cited media reports describing a market for SpaceX shares that allegedly included Chinese investors, sometimes using middlemen and structures in places such as the Cayman Islands and the British Virgin Islands.

A Delaware court last year backed a fund manager’s decision to remove a Chinese investor from a fund set up to buy SpaceX shares, according to court filings.

Iqbaljit Kahlon, who managed the fund, had admitted Leo Investments, a publicly traded Chinese company, as a limited partner.

SpaceX told Kahlon the fund could not purchase shares if Leo remained involved, prompting him to remove the investor and return its $50 million. The fund was structured as a special-purpose vehicle (SPV), a common way for investors to pool money to buy shares in private companies like SpaceX. SPVs let multiple investors combine capital into a single ownership stake, making it easier to trade smaller slices of stock without the company having to deal with a large number of individual shareholders.

In the letter, the senators said that as SpaceX is privately held, the public can’t see how much of the company is owned by China-linked investors or whether any such holdings are large enough to influence the company.

In April 2025, the U.S. Space Force awarded SpaceX a National Security Space Launch Phase 3 “Lane 2 contract” with an anticipated value of about $5.9 billion, and it projected SpaceX would receive 28 missions—around 60 percent of those Phase 3 Lane 2 missions over fiscal years 2025 through 2029.

Space Force’s “Lane 2” missions are its highest-priority launches, carrying the most demanding, least risk-tolerant national security payloads—often major military and intelligence satellites—into harder-to-reach or higher-energy orbits with complex security and integration requirements.

The senators warned that Chinese investors could “potentially gain access to nonpublic information about the company, including ‘details on its contracts or supply chain,’ giving China access to information and technology that could undermine US national security.”

The Epoch Times reached out to SpaceX and the Department of Defense for comment but did not receive a response by publication time.

Review

The senators said their concerns merit the Pentagon to conduct a Foreign Ownership, Control, or Influence (FOCI) mitigation review.

The Pentagon’s security arm, the Defense Counterintelligence and Security Agency (DCSA), defines a company as operating under FOCI when a foreign interest has the power—directly or indirectly—to shape management or operations in a way that could enable unauthorized access to classified information or harm performance on classified contracts.

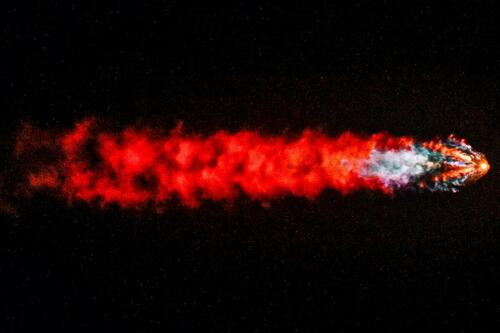

SpaceX launches the Falcon 9 Fram2 Mission from Launch Complex 39A of NASAÕs Kennedy Space Center in Cape Canaveral, Fla., on March 31, 2025. Miguel J. Rodriguez Carrillo/Getty Images

The DCSA says it evaluates factors such as the extent of foreign ownership—including “substantial minority” positions—and the foreign government’s record on espionage and technology transfer.

The senators also asked the War Department to coordinate with the Treasury to consider whether any China-linked investments should be reviewed by the Committee on Foreign Investment in the United States (CFIUS), the interagency panel authorized to review certain foreign investment transactions for national security risk.

They requested a response by Feb. 20, and asked the War Department to answer questions such as: how many SpaceX shares are owned by China-linked and other adversary-linked investors, whether any such investors have access to nonpublic information, and whether SpaceX is subject to FOCI mitigation requirements.

Policy Backdrop

The lawmakers framed the request against the Trump administration’s “America First Investment Policy.”

The policy explicitly calls China a foreign adversary and warns that the country can use both visible and concealed investment routes—sometimes via third-country funds—to pursue sensitive technologies and strategic leverage.

The Chinese investment ties are “at odds with the administration’s policies on foreign investment from countries of concern in strategic industries,” the senators wrote.

They also said that the matter became “even more salient” after SpaceX announced it had acquired xAI, expanding the combined company’s footprint across AI, rockets, and satellite connectivity.

Loading recommendations...