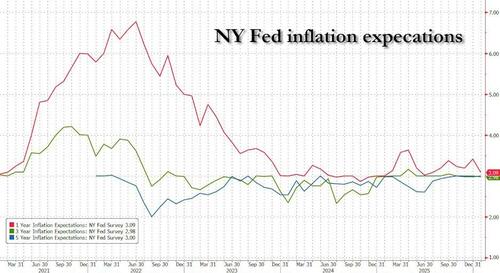

Despite the ongoing partisan panic over 'Trump-driven inflation' or whatever narrative-du-jour the mainstream media chooses, inflation expectations tracked by the NY Fed survey of Consumer Expectations dropped to six-month lows. inflation expectations tracked by the NY Fed survey of Consumer Expectations

Median inflation expectations in January declined by 0.3 percentage point at the one-year-ahead horizon to 3.1% and remained steady at the three-year and five-year-ahead horizons at 3.0%.

Additionally, median inflation uncertainty - or the uncertainty expressed regarding future inflation outcomes - decreased at the one-year and three-year-ahead horizons and increased at the five-year-ahead horizon.

Over the next year consumers expect gasoline prices to rise 2.8%; food prices to rise 5.74%; medical costs to rise 9.8%; the price of a college education to rise 9.03%; rent prices to rise 6.82%

Optimism over the labor market improved modestly with median one-year-ahead earnings growth expectations increased by 0.2 percentage point to 2.7% in January, driven by those with household income under $50,000. Additionally, respondents saw a higher probabilioty of finding a job within 3 months...

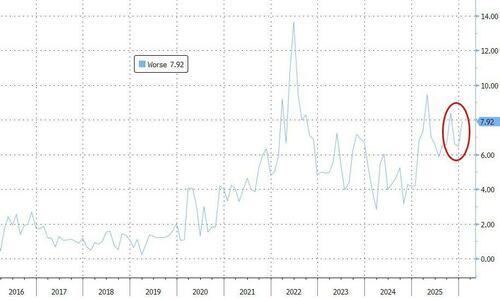

However, perceptions about households’ current financial situations deteriorated with a larger share of respondents reporting that their households were worse off compared to a year ago.

The median expected growth in household income decreased by 0.1 percentage point to 2.9% in January, equaling its trailing 12-month average.

Year-ahead expectations about households’ financial situations also deteriorated with a smaller share of respondents reporting that their households expect to be better off a year from now and a larger share reporting they expect to be worse off.

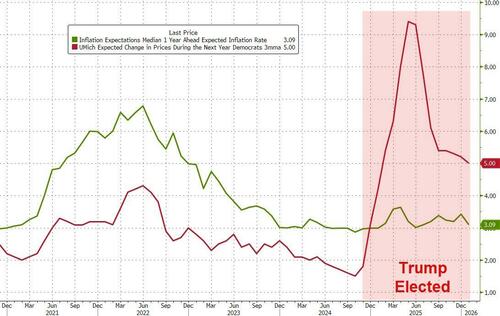

Finally, some food for thought... Going back to where we started above, why was it that for the entire term of President Biden, Democrats surveyed by UMich saw future inflation expectations dramatically below that of the NYFed's survey respondents...

...and yet the moment President Trump was elected, a sudden surge of hyperinflation angst smashed them in the head?

Net-net, the NYFed survey shows little to no anxiety over inflation, a rebound in job market optimism, but concerns remain over household financial conditions, particularly with regard to medical costs.

Loading recommendations...