Via Greg Hunter’s USAWatchdog.com,

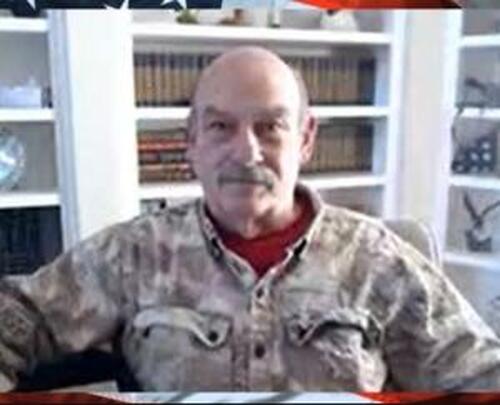

Financial writer and precious metals expert Bill Holter (aka Mr. Gold) has been predicting record high gold and silver prices. We are nowhere finished with record prices for the metals happening every week and sometimes every day.

Mr. Gold now has a new prediction about paper exchanges not being able to deliver physical metal. Holter says, “We exploded through $100 per ounce silver, and we went through $5,000 per ounce on gold, but that’s not the story."

"The story is there are already over 40 million ounces standing for delivery in January.

January is a non-delivery month.

If you go back in past years, you might see delivery in January that might be a million ounces, two million ounces or a small amount.

We are already at 40 million ounces of silver in January with only a few days left in the month.

March is a delivery month.

That’s the month where I am going to be really interested to see what the number is for how much is standing for delivery at the beginning of the month.

If you get 70 million or 80 million ounces of silver standing for delivery at the beginning of the month . . . that would be enough to knock out the inventory in March, which is a primary delivery month for COMEX..”

Holter goes on to say, “They reportedly have 110 million ounces to 120 million ounces registered for delivery..."

" Is any of that incumbered? We just don’t know.

If we get a failure to deliver that completely negates any and all value of a COMEX contract...

If the contract cannot perform, it is worth zero.

A failure to deliver wipes out any credibility of COMEX pricing...

A failure to deliver in silver will immediately spill over into gold.

A failure to deliver in gold will immediately spill over to the credit markets because gold is truly the anti-dollar or the anti-US Treasury.”

Holter says some of the big metal dealers and banks shorting the monetary metals are in financial trouble. Holter says:

“This is all caused by rising metals prices, mainly rising silver prices. . .. Some people may think the rally is over, and it’s not.

We are still early in this price rise.

Any price you hear is going to be laughably too low, and I am going to include that $600 figure for silver that came out several years ago. I think any number you put out there for gold or silver will end up being laughably low.”

Holter contends if you look at all the commitment and debt, there is $200 trillion for the US. Holter says:

“If you take just the $38 trillion in debt for the federal government and you want to back the debt with the 8,000 tons of US gold, you are talking around $200,000 per ounce for gold.”

In closing, Holter predicts, “There will be failure to deliver silver in the first part of March 2026..."

" The currencies will zero out. It is a collapse of the entire financial system...

The real economy runs on credit. Everything you touch, everything you do . . . credit has been involved in its creation.

If credit becomes unattainable, the real economy completely shuts down, and that is where your Mad Max comes in.”

There is much more in the 39-minute interview.

Join Greg Hunter of USAWatchdog as he goes one-on-one with financial writer and precious metals expert Bill Holter/Mr. Gold as the financial system resets for 1.26.26.

Loading recommendations...