Readers have been well informed about the bifurcated consumer landscape, where financial conditions look relatively stable for upper-middle-class and wealthy households. But for anyone earning less than $100,000 a year, financial misery persists, with many pressures lingering after four years of the disastrous Biden-Harris regime era.

Last week at the Barclays 11th Annual Eat, Sleep, Play, Shop Conference in New York City, fast-food chain Wendy's Co.'s top executives participated in a fireside chat. They offered a clearer view of the consumer environment backed by Wendy's own proprietary data, only to reveal yet more evidence of the "K-shaped" economy.

Ken Cook, the interim chief executive officer and chief financial officer, Suzie Thuerk, the chief administrative officer and head of financial planning and analysis, and Aaron Broholm, the head of investor relations at Wendy's, offered no update on formal guidance. However, they emphasized the persistent weakness among customers earning less than $75,000 per year.

Here are the main takeaways from the fireside chat:

Low-income Weakness a Persistent Theme: Wendy's continues to see consumer pressure, particularly at the low end of the income spectrum. The company has invested in more rigorous data analysis that will allow for greater segmentation of its consumer base, but for now the view is comprised of sub-$75k and $75k+ household incomes. While the beginning of 2025 was very noisy with weather-related issues, Wendy's has observed a persistent decline in lower income traffic since March. Specifically, low-income traffic has been down in the high single-digit to low double-digit range, while higher-income traffic is up y-y. This is consistent with what other peers in the quick-service segment have publicly acknowledged.

As for the underlying issue with low-income consumers, Wendy's believes the restaurant industry is battling the cumulative impact of Food Away From Home inflation over the past few years post pandemic, though interestingly, today the gap between FAFH & FAH inflation has narrowed to "a couple of points." Notably, Wendy's has not taken as much price as the competition, which sets the brand up "fairly well" for a rebound, as consumers are still willing to pay for quality and experience. As for the most discernible area of weakness within its business, Wendy's noted the breakfast daypart is the first area of pullback when consumers shift to FAH. This is not surprising given a host of readily available (and affordable) substitutes.

This granular view of consumer behavior confirms what readers have long known: the existence of a K-shaped economy. It's worth noting that Wendy's customer base is primarily young adults aged 18 to 34, with household incomes between $40,000 and $75,000.

Related:

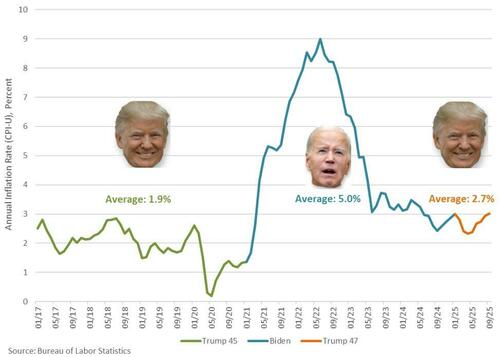

Let's not forget who created the worst inflation crisis that doomed a generation of young people ...

Affordability will be front and center in the midterm election cycle. The Trump administration has already begun Operation Affordability.

Loading recommendations...