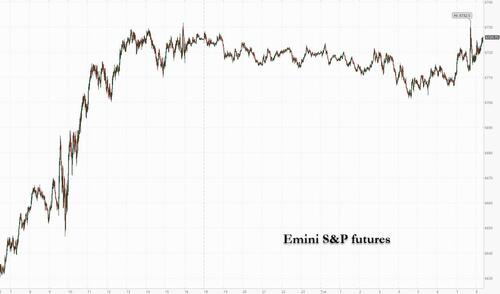

US futures are flat, having rebounded from session lows, even as Nvidia shares fell 3.8% in premarket trading as investors assess the threat of increased competition after a report that Meta Platforms is in talks to spend billions on Google’s TPU-based AI chips (see "The Google TPU: The Chip Made For The AI Inference Era"); Alphabet shares climb 3.2% in premarket. As of 8:15am ET, S&P 500 futures are unchanged after posting the biggest daily gain since Oct 13, while Nasdaq 100 contracts drop 0.1%. The prospect of a market shake-up rippled across other tech companies. AMD slipped more than 3%, while Japan's SoftBank Group shares tumbled 10% on concern that Alphabet’s Gemini model could boost competition for OpenAI, a key SoftBank investment. Treasuries are steady, with US 10-year yields down 1bp to 4.01%. The Bloomberg Dollar Spot Index is down 0.1% while the yen leads gains against the greenback, rising 0.4%. The pound adds 0.2% ahead of the budget on Wednesday. WTI crude futures fall 0.3% to $58.70 a barrel. Spot gold is flat near $4,134/oz. Bitcoin falls 2% to near $87,000. Today's econ data includes ADP weekly employment estimate (8:15am), September retail sales and PPI (8:30am), September FHFA house price index, 3Q house price purchase index and September S&P Cotality home prices (9am), August business inventories, November Richmond Fed manufacturing index, November consumer confidence, and October pending home sales (10am) and November Dallas Fed services activity (10:30am).

In premarket trading, Mag 7 are mixed: Alphabet (GOOGL) rises 4% as the search giant inches closer to a market value of $4 trillion. Nvidia (NVDA) drops 3.6% on a report that Meta Platforms is in talks to spend billions on Google’s AI chips, suggesting the internet search leader is making headway in efforts to rival the industry’s bestselling AI accelerator (Tesla -0.1%, Amazon +0.3%, Meta +0.6%, Microsoft -0.8%, Apple -0.7%)

- Alibaba Group ADRs (BABA) gains 2% after the company posted better-than-projected growth in its pivotal cloud business, highlighting the enormous demand for computing during China’s AI boom.

- Amentum Holdings (AMTM) rises 11% after the IT services firm posted fiscal fourth-quarter pro forma revenue that grew 10% from the year-earlier period and beat estimates.

- Brinker International (EAT) rises 2% after Citi analyst Jon Tower upgraded the operator of Chili’s and Maggiano’s restaurant chains to buy.

- Burlington Stores (BURL) falls 5% after the off-price retailer’s comparable sales for the third quarter fell short of the consensus estimate. Burlington’s fourth-quarter and full-year forecasts for the metric are also underwhelming compared with the Street projections. .

- Dick’s Sporting Goods Inc. (DKS) drops 8% after posting quarterly results.

- Fluence Energy (FLNC) rises 11% after the energy storage company forecast 2026 total revenue that beat the average analyst estimate, and announced more data center deals in the pipeline.

- Keysight Technologies (KEYS) rises 14% after the measurement instruments company gave a first-quarter forecast that was stronger than expected. It also reported positive fourth-quarter results. .

- Kohl’s Corp. (KSS) climbs 25% after raising its full-year outlook for the second straight quarter, a sign that Chief Executive Officer Michael Bender is helping to stabilize performance at the struggling retailer

- Sandisk (SNDK) climbs 3% after the computer hardware and storage company is selected to replace Interpublic Group of Companies in the S&P 500.

- Select Medical Holdings (SEM) jumps 10% after the operator of health-care facilities said it received a take-private proposal from Executive Chairman Robert A. Ortenzio to acquire all of the company’s outstanding shares.

- Spotify (SPOT) climbs 2% after the Financial Times reported that the company is preparing to raise US subscription prices in the first quarter of next year.

- Symbotic (SYM) rises 15% after the company gave first-quarter revenue forecast that beat the average analyst estimate.

- Zoom Communications (ZM) gains 5% after the video communications software company’s third-quarter results beat expectations. It also raised its full-year forecast.

In corporate news, Boeing is gaining ground in a “war against defects” at its 737 jet plant outside Seattle. Media mogul David Geffen is said set to reap more than $500 million in profit from the expected sale of Warner Bros. Discovery. Private equity firm PAG has made a big contrarian bet on China. Spotify is getting ready to increase subscription prices in the US in the first quarter of 2026, the FT reported.

Some caution is returning to markets after indexes posted big gains on Monday. AI competition is heating up, with Nvidia dropping in premarket trading on a report that Meta is in talks to use Google’s AI chips. Escalating geopolitical tensions in Asia and Europe are also dampening the mood. The AI competition concerns and geopolitical tensions put a brake on the two-day bounce-back that was driven by rising Fed cut bets.

A report that Meta Platforms is in talks to use AI chips from Alphabet’s Google spurred investors to rethink bets on related companies, prompting volatile moves for tech stocks in Asia. Alphabet shares were up about 3% premarket. An agreement could see Meta use Google chips, known as TPUs, in data centers in 2027, The Information reported, which could help establish TPUs as an alternative to Nvidia chips.

“Nvidia is the biggest position in my portfolio and I am not worried at all by a 3% dip,” said Fares Hendi, global fund manager at Prevoir Asset Management in Paris. “It’s healthy that in a functioning market economy Google goes into this market, it just shows its vast potential.”

In Japan, shares of tech giant SoftBank tumbled, hitting a 2 1/2-month low and down 40% from their record high just 3 weeks ago, on worries that the latest Gemini AI model from Alphabet may intensify competition for OpenAI — the Japanese conglomerate’s key investment. The stock sank as much as 11% on Tuesday, following a 10.9% dive in the previous session before Japan’s long weekend. The sharp back-to-back declines stand out even for SoftBank Group, whose shares are highly volatile. SoftBank's slump came even as many other AI-related Japanese stocks such as chip testing equipment maker Advantest Corp rose, tracking gains in global chip stocks which had soared during Japan’s long weekend.

“The stocks are hit by concerns that the competition environment of OpenAI will become tougher after Google’s Gemini 3 received strong reviews,” said Tsutomu Yamada, market analyst at Mitsubishi UFJ eSmart Securities Co.

The odds for further easing fluctuated in recent weeks, though climbed steadily after dovish remarks from some policymakers signaling support for the labor market. A lack of economic visibility due to the data blackout, along with widening divisions between Fed doves and hawks, have also kept traders guessing about the central bank’s next move.

“It’s really quite unique in the history of the Fed to have such a confrontation of hawkish and dovish narratives,” said Raphael Thuin, head of capital market strategies at Tikehau Capital. “The lack of visibility on the Fed’s next move could be a big risk this year and for 2026 too.”

Traders are also watching US data ahead of the Thanksgiving holiday, including September retail sales and producer prices due later Tuesday. Though dated by the recent shutdown, the reports may still carry weight given the lack of fresh data before the Federal Reserve’s meeting next month. A number of September data releases are expected at 8:30 a.m. NY time, including retail sales and PPI, followed by consumer confidence and Richmond Fed manufacturing index for November and pending home sales for October at 10 a.m.

In Europe, the Stoxx 600 is down 0.2%; chemicals, travel and consumer product shares are leading declines while miners outperform. Defense stocks rebound after Russia and Ukraine traded airstrikes overnight. Mining and telecom shares also outperform, while autos as well as travel and leisure sectors lag. Here are some of the biggest movers on Tuesday:

- Kingfisher shares rise as much as 6.9% after the home-improvement retailer raised its full-year earnings guidance and reported third-quarter sales that were slightly ahead of estimates.

- ABN Amro shares advance as much as 5.1%, the best performer in the banks sector, after the Dutch lender said it is planning to cut almost 20% of its workforce in a bid to boost profitability.

- Cranswick shares climb as much as 4.9% as analysts welcomed the meat supplier’s strong performance in the first half and said there is still upside to expectations for the second, despite guidance being reiterated today.

- Marston’s shares rise as much as 15% to the highest level since June 2022, after the pub operator reported results ahead of analysts’ estimates on Tuesday and said Christmas bookings are strong.

- Beazley shares fall as much as 13%, the most in more than five years, after the insurer’s third-quarter sales come in below analysts’ expectations.

- Fortum shares drop as much as 7%, the most since April, after the Finnish utility company gave an update to its long-term targets that didn’t include any mention of data center-related deals, disappointing analysts.

- Intertek shares fall as much as 5.5%, the most in more than three months, as the testing specialist’s organic growth between July and October misses forecasts.

- Carnival shares fall as much as 5.5% after Barclays analyst Brandt Montour wrote on Monday the cruise operator was striking a more “cautious” tone.

- Compass Group shares drop as much as 3.7% to their lowest level since April after the catering and support service company reported results that were slightly above consensus but lacked major catalysts.

- Thyssenkrupp Nucera shares slump as much as 11% after the green hydrogen electrolysis technology company gave guidance for 2026 which was significantly below expectations.

Asian stocks rose, as investors repositioned their bets in artificial intelligence after a report that Meta Platforms Inc. is in talks to use chips from Alphabet Inc.’s Google. The MSCI Asia Pacific Index rose as much as 0.8%, to the highest since Nov. 21. South Korea’s benchmark trimmed an earlier advance of as much as 2.6%, as Samsung Electronics and SK Hynix — both memory suppliers to Nvidia — pared gains. In Japan, a 10% decline in SoftBank Group — a key partner to OpenAI — weighed on the Topix, which closed lower. Optimism over Alphabet’s TPU AI chip expansion boosted shares of its Asian suppliers, as investors sought to take position in potential new winners in the AI sector. The move could threaten Nvidia Corp.’s dominance, with analysts expecting a more volatile trading ahead as traders recalibrate for the shifting competitive landscape. Trade relations will stay at the forefront going into next year, with US President Donald Trump agreeing to visit Beijing in April. Investors will also keep an eye on China-Japan relations as the row over Taiwan heats up.

In FX, the Bloomberg Dollar Spot Index is down 0.1%. The yen is leading gains against the greenback, rising 0.4%. The pound adds 0.2% ahead of the budget on Wednesday.

In rates, treasuries are steady, with US 10-year yields dip 1bps to 4.01%. Money markets are pricing in about a 75% chance of a Fed rate cut in December.

In commodities, oil fell sharply after ABC News reported that Ukraine agreed with the US on the terms of a potential peace deal with Russia, with only some minor detail to be sorted out, although subsequent reports from WaPo indicated that Russia will once again balk on the proposed deal. Spot gold is flat near $4,134/oz. Bitcoin falls 2% to near $87,000.

To the day ahead now, US data releases include retail sales and PPI inflation for September, along with the Conference Board’s consumer confidence for November. Otherwise from central banks, we’ll hear from the ECB’s Villeroy, Makhlouf, Sleijpen and Cipollone.

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.3%

- Russell 2000 mini little changed

- Stoxx Europe 600 little changed

- DAX -0.2%, CAC 40 little changed

- 10-year Treasury yield little changed at 4.03%

- VIX +0.2 points at 20.67

- Bloomberg Dollar Index -0.2% at 1224.89

- euro +0.2% at $1.154

- WTI crude -0.2% at $58.7/barrel

Top Overnight news

- The US and Ukraine have drafted a new 19 pt peace deal but left the most politically sensitive elements to be decided by the countries’ presidents, according to Ukraine’s first deputy foreign minister. FT

- Allies of Federal Reserve Chair Jerome Powell have laid the groundwork for him to push a rate cut through a divided committee at next month’s meeting even though it could draw multiple dissents. The unusual level of division inside the Fed means that, to an even greater degree than usual, the final call rests with Powell. WSJ

- Donald Trump’s health care plan is in limbo after pushback from Republicans who were caught off guard by the president’s forthcoming proposal. Trump had been expected to unveil a new policy framework Monday afternoon, said two people familiar with the plan and granted anonymity to describe deliberations around it. Politico; US House Speaker Johnson reportedly cautioned the White House that most House Republicans are not in favour of extending enhanced ACA subsidies: WSJ

- White House said Trump signed an executive order related to AI research, while the order will boost AI-accelerated innovation and directs the building of AI platforms to harness federal scientific data sets.

- Nvidia shares dropped premarket on a report that Meta is in talks to spend billions on Google’s AI chips. Alphabet shares rose premarket, with the company’s AI ascent poised to shake up the rankings of the world’s most valuable companies (NVDA -345bps premkt, GOOG +393 bps premkt). BBG

- China instructed its airlines to reduce the number of flights to Japan through March 2026, people familiar said. Japan’s PM Sanae Takaichi said Trump briefed her on his call yesterday with Xi Jinping. BBG

- SoftBank shares tumbled on worries that the latest Gemini AI model from Alphabet may intensify competition for OpenAI — the Japanese conglomerate’s key investment. BBG

- European car sales rose for a fourth month in October, driven by increases in Spain and Germany. The UK and Italy stagnated. BBG

- Mutual funds have increased their equity market exposure in recent months in a struggle to keep up with benchmarks. Only 29% of large-cap mutual funds are outperforming their benchmarks YTD, compared to an average of 37% since 2007. In response, funds have reduced their cash allocations to 1.2% of assets, a record low. Goldman

- San Francisco Fed President Mary Daly said she supports lowering interest rates at the central bank’s meeting next month because she sees a sudden deterioration in the job market as both more likely and harder to manage than an inflation flare-up. WSJ

- Fed's Kashkari (2026 voter) said there are real use cases for AI, but not for crypto, and noted people are feeling hardship due to inflation.

- US Q3 GDP initial estimate is to be released on December 23rd, while US PCE and Personal Income report (Sep) was rescheduled for December 5th: BEA.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher as the region took impetus from the tech-led rally on Wall St, where sentiment was bolstered as dovish comments from Fed officials boosted December rate cut bets. ASX 200 finished higher but lagged for most the session as strength in mining names was negated by underperformance in the top-weighted financial industry and losses in defensives. Nikkei 225 initially rallied on return from the extended weekend and briefly reclaimed the 49,000 level, before momentarily wiping out its entire spoils. Hang Seng and Shanghai Comp were underpinned by continued warming US-China relations following a call between US President Trump and Chinese President Xi, which Trump described as a very good call and noted that they discussed many topics, including Ukraine/Russia, fentanyl, soybeans and other farm products. The PBoC also conducted a CNY 1tln MLF operation that resulted in a net liquidity injection of CNY 100bln.

Top Asian News

- PBoC conducted a CNY 1tln Medium-term Lending Facility operation for a CNY 100bln net liquidity injection.

- Japanese PM Takaichi said she spoke with US President Trump on the phone after a phone call was proposed by the US side, and that Trump explained recent US-China relations following his call with Chinese President Xi. Furthermore, Trump told her that they are very close friends and that she could call him any time, while Takaichi believes they were able to confirm close cooperation between Japan and the US.

- Japanese Finance Minister Katayama said Japan has established a Japanese equivalent of the US Department of Government Efficiency to abolish ineffective subsidies.

- Japanese Chief Cabinet Secretary Kihara said the government is to hold a cabinet meeting on the supplementary budget this Friday.

- Japanese PM Takaichi says the government is to spend JPY 1tln on SME wage hike support; asking cooperation for base pay gains above inflation.

European bourses (STOXX 600 -0.1%) opened mixed, but have dipped off best levels in recent trade, to display a mostly negative picture in Europe. Nothing really behind the latest dip in sentiment, but did come alongside some pre-market pressure in NVIDIA as traders continue to digest Meta/Google related newsflow (detailed in the third bullet). European sectors are mixed. Basic Resources is the clear outperformer, continuing the sectoral strength seen in APAC trade, whilst Travel & Leisure is found towards the foot of the pile. For the latter, easyJet did initially see strength after its FY results, but dipped as markets digested rising costs. Also pressuring the sector is Evolution (-2.2%), which is dragged lower by a broker downgrade at Jefferies; analysts cited uncertainty re. potential litigation battle with Playtech.

Top European News

- UK Treasury asked banks to make public and prominent endorsements of the Budget this week, wanting lenders to praise new policies and show how they will boost lending to first-time buyers and small businesses, according to FT.

- French PM Lecornu has scheduled a debate on Wednesday, 10th December on defense and resources, via Politico citing sources. A second debate will be held on December 15th.

- French Socialist (PS) Leader Faure says he sees the budget as possible

FX

- DXY resides towards the bottom end of a 100.01-100.26 range this morning, which is just inside Friday's 99.99-100.40 range. Upside is capped as rate cut bets were boosted following dovish rhetoric from Fed officials. From a more macro lens, attention is also on the Ukraine peace plan, which the Washington Post reported was now a 19-point plan, down from 28, with talks expected to continue. Elsewhere, it was announced that US President Trump and Chinese President Xi held a phone call that was said to be productive, in which leaders discussed many topics, including trade. The US schedule is heavy: weekly ADP average jobs data for the four weeks to 8th November are set for release (last week, the average rate of additions improved to -2.5k). US September PPI is seen rising 0.3% M/M (prev. -0.1%).

- EUR/USD is a little firmer today and trades within 1.1512 to 1.1540 range. Really not much to talk about from a European specific standpoint today, aside from German GDP (Q3) which was unrevised. Upside today comes in the context of a softer USD and optimism surrounding peace. Despite the optimism, there is still heightened uncertainty regarding the path to peace - as such the upside in the single currency has been relatively muted.

- JPY stands as the outperformer, recent weakness has spurred expectations of potential BoJ intervention, whilst wages are also on watch as Japanese PM Takaichi said the government is to spend JPY 1tln on SME wage hike support, and asking cooperation for base pay gains above inflation. This alongside the risk tone has helped to strengthen the JPY today. USD/JPY is currently at the bottom of a 156.15-156.98 range, dipping under Monday's 156.37 low, with Friday's trough at 156.20.

- Cable is a little firmer and trades above the 1.3100 mark in a 1.3096 to 1.3140 range; a peak which is roughly 4 pips above its 21-DMA. The Pound is largely moving at the whim of a slightly lower Dollar, but with price action contained into the Autumn Budget on Wednesday.

- AUD and NZD lower on broader risk whilst the latter looks ahead to a widely anticipated rate cut by the RBNZ at tomorrow's meeting (full Newsquawk RBNZ preview available on the Research Suite).

Fixed Income

- USTs are flat/slightly firmer. Initially moved lower soon after the European open, but then gradually edged off worst levels as global sentiment dipped. Nothing really behind the latest slip in the risk tone, but does come as NVIDIA (-3%) continues to sell off in the pre-market. Markets will remain focused on PPI, Retail Sales and ADP Weekly Prelim Estimate later today. USTs are currently trading within a 113-09+ to 113-15 range.

- Bunds are firmer by just over 10 ticks, and essentially following global peers. Currently towards the upper end of a 128.75 to 128.93 range, alongside the souring risk tone. Earlier, German GDP (Q3) which were unrevised, had little impact on German paper. Thereafter, German paper traded choppy into a 2030 Bobl Auction, which drew a better-than-prior b/c. No real move to the benchmark.

- Gilts opened flat, and then gained alongside peers. Currently towards the upper end of a 92.18 to 92.44 range, next level to the upside would be 92.46 which marks the 19th November peak. A relatively strong 2031 auction, which drew a b/c a touch above 3x, had little impact on Gilts.

- Netherlands sells EUR 1.445bln vs exp. EUR 1.0-2.0bln 3.50% 2056 DSL; Average yield 3.469%.

- UK sells GBP 4.5bln 4.125% 2031 Gilt: b/c 3.01x, average yield 4.088%, tail 0.6bps.

- Italy sells EUR 2bln vs exp. EUR 1.5-2bln 2.10% 2027 BTP Short Term & EUR 2.5bln vs exp. EUR 2-2.5bln 1.10% 2031, 2.40% 2039 BTPei.

Commodities

- WTI and Brent have pulled back from Monday's bid higher despite the absence of any clear drivers. After peaking at USD 59.06/bbl and USD 62.92/bbl respectively in the latter part of Monday's session, benchmarks have gradually pulled back and have formed a trough at USD 58.32/bbl and USD 62.14/bbl. This comes as the risk tone started on the back foot at the start of the European session. Currently, benchmarks have bounced off their session lows as the global risk tone improves.

- Spot XAU trades choppy following Monday's bid above USD 4100/oz on dovish Fed rhetoric. After peaking at USD 4156/oz in the early hours of the APAC session, XAU pulled back to a trough at USD 4110/oz before a slight rebound as the risk tone soars following downside in NVIDIA (NVDA) shares.

- 3M LME Copper gapped higher and drove from USD 10.80k/t to a peak of USD 10.89k/t at the start of the APAC session as it followed on from Monday's positive risk tone and the Trump-Xi meeting. As the European session got underway, the red metal has pared back some of its initial gains as the risk tone starts to weaken, but remains near USD 10.85k/t.

- An announcement on North Sea energy licenses is expected on Wednesday, to coincide with the Budget, via Politico citing sources; official cited says there is likely to be a "pragmatic" shift on policy.

- India's Russian oil imports set to drop as sanctions hit according to Reuters citing sources. Sanctions to cause sharp December drop in Russian oil imports and refiners seek options on tighter Western curbs, bank scrutiny. US, EU sanctions pressure India's refiners to cut Russia buys.

- Hong Kong net gold exports to China (Oct) 8.02MT vs prev. 22.047MT; total gold export to China 30.08MT vs prev. 36.275MT.

- Caspian Pipeline Consortium says Black Sea terminal temporarily suspended oil loadings amid drone attacks.

Geopolitics: Middle East

- Taliban spokesman Mujahid said aerial raids took place in the provinces of Kunar and Paktika, which injured four civilians, while it was announced that nine children were killed after Pakistani forces bombed the home of a local resident in the Khost province.

Geopolitics: Ukraine

- US is holding secret Russia-Ukraine peace talks in Abu Dhabi with US Army Secretary Dan Driscoll meeting delegations from Kyiv and Moscow in a push for a deal to end Russia's invasion, according to FT.

- A barrage of Russian missiles struck Kyiv overnight, in what the Ukrainian Energy Minister described as a "massive" attack on energy infrastructure, while the Kyiv Mayor said that some areas were experiencing disruptions to power and water.

- Regional Governor said three people were killed and 10 injured in a Ukrainian attack on Russia's Rostov region.

- Russia's Kremlin says that adjustments are being made to the published text of the Ukraine peace plan. Adds that it is impossible to discuss security system without participation of Europeans and at some stage this will be necessary and that Russia hasn't received adjusted US plans for Ukraine via RIA.

Geopolitics: Other

- Taiwan's Premier said Taiwan is a fully sovereign and independent country and that for Taiwan's 23mln people, a ‘return’ to China is not an option, while he added that maintaining the status quo in the Taiwan Strait is a development the whole world is watching closely. Furthermore, he said they must strengthen self-defence capabilities and must stand together with like-minded democratic countries. In relevant news, Taiwan's Defence Ministry said a Chinese balloon was detected in the Taiwan Strait on Monday.

- Japanese Chief Cabinet Secretary Kihara said Japan's UN ambassador sent a letter to UN Secretary-General Guterres explaining Japan's stance on China's demand to withdraw PM Takaichi's remarks on Taiwan, while Kihara added that China’s claims that contradict the facts cannot be accepted, and Japan must firmly refute and communicate its position. It was separately reported that Japan's top foreign ministry official held talks with China's ambassador, according to Kyodo

- China asks airlines to extend flight cuts to Japan till March 2026, via Bloomberg citing sources.

- Drone reported on Romanian territory, according to CGTN. Alerts for residents in several counties to hide were lifted. Currently, no drone signals are being detects by radars in Romanian airspace. Too early to say how many drones breached the airspace (CGTN)

US Event Calendar

- 8:30 am: Sep Retail Sales Advance MoM, est. 0.4%, prior 0.6%

- 8:30 am: Sep Retail Sales Ex Auto MoM, est. 0.3%

- 8:30 am: Sep Retail Sales Ex Auto and Gas, est. 0.3%

- 8:30 am: Sep PPI Final Demand MoM, est. 0.3%, prior -0.1%

- 8:30 am: Sep PPI Ex Food and Energy MoM, est. 0.2%, prior -0.1%

- 8:30 am: Sep PPI Final Demand YoY, est. 2.6%, prior 2.6%

- 8:30 am: Sep PPI Ex Food and Energy YoY, est. 2.7%, prior 2.8%

- 9:00 am: Sep FHFA House Price Index MoM, est. 0.2%, prior 0.4%

- 9:00 am: 3Q House Price Purchase Index QoQ, prior 0%

- 9:00 am: Sep S&P Cotality CS 20-City YoY NSA, est. 1.4%, prior 1.58%

- 9:00 am: Sep S&P Cotality CS U.S. HPI YoY NSA, prior 1.51%

- 10:00 am: Aug Business Inventories, est. 0%, prior 0.2%

- 10:00 am: Nov Richmond Fed Manufact. Index, est. -5, prior -4

- 10:00 am: Nov Conf. Board Consumer Confidence, est. 93.3, prior 94.6

- 10:00 am: Oct Pending Home Sales MoM, est. 0.2%, prior 0%

DB's Jim Reid concludes the overnight wrap

Yesterday we published our 2026 World Outlook, with this year’s edition called “Anything but dull”. You can read the full report here. Following another year of huge surprises, the title reflects how we expect 2026 to see no let-up in volatility, even as our economists and strategists remain broadly positive. We’ve seen a huge wave of AI investments that offer the prospect of meaningful productivity gains over time but the debate will rage on beyond 2026 as to how tech companies will monetise this and it’s unlikely that debate will be concluded next year so there’s plenty of opportunity for wild sentiment swings. However our US equity strategist Binky Chadha has an S&P 500 target of 8,000 for year-end 2026. While many of us will have our doubts, Binky’s strong track record over the last decade or so means it’s hard to ignore.

In terms of the global growth picture, our economists expect that the overall pace will echo 2024 and 2025, but the source of that growth will shift. So, the US will re-accelerate as trade uncertainty fades and tax cuts support household incomes. Germany should have a meaningful rebound thanks to the fiscal stimulus. But China’s growth is set to moderate as “anti-involution” reforms reshape supply-side behaviour. Then on inflation, it’s likely to keep normalising, but not fully back to pre-pandemic norms. So that’ll keep the major central banks cautious, with the Fed only delivering two more cuts before pausing, while the ECB is expected to stay on hold until a hike in mid-2027.

On rates, our team expects the 10yr Treasury moving up to 4.5% by end-2026, with 10yr bund yields reaching 3.10%. And for FX, our team expects further dollar weakness, with EUR/USD at 1.25 by year-end 2026. See the report for sections on all the major asset classes and economies for 2026 and beyond.

In terms of the here and now, markets continued to rebound yesterday, with the S&P 500 (+1.55%) posting its best day in six weeks. In fact, the 2-day gain for the S&P now stands at +2.54%, which is its biggest bounce since the US and China slashed tariffs by 115 points back in May. In large part, that was thanks to growing anticipation of another Fed rate cut in two weeks’ time. But there was also support from a rebound in tech optimism as well as headlines pointing to progress on the Ukraine peace talks. So collectively, that backdrop meant we saw higher equities, tighter credit spreads, and a rally for most sovereign bonds too.

When it comes to those peace talks, there were several stories of note over the last 24 hours. First, President Trump suggested yesterday that progress was being made with the talks, saying in a post that “something good just may be happening.” Then later on, Chinese state media said that President Xi had a phone call with President Trump, which added to the sense that something could be moving behind the scenes. Separately, the FT and Washington Post reported that the US and Ukraine have slimmed down the 28-point plan to 19 points. The slimmed down plan apparently leaves out some of the most “sensitive questions”, notably territory, to be discussed by Trump and Ukraine’s President Zelenskiy directly. In terms of the market reaction, the clearest impact was among Ukraine’s dollar bonds, where the 10yr yield (-59.1bps) fell to its lowest since August, at 14.25%. However, European defence stocks that had benefited from the prospect of higher military spending struggled, with Rheinmetall down -5.03%, whilst the STOXX Aerospace & Defense index fell -2.31%. In some ways an unsatisfactory deal might actually increase the need for Europe to speed up defence spending so one to watch.

As all that was going on, markets got further support from the Fed, with growing confidence that they would in fact cut rates in December after all, particularly after the comments from NY Fed President Williams on Friday. So yesterday, Governor Waller said on Fox Business that he was “advocating for a rate cut at the next meeting”. And San Francisco Fed President Daly (non-voter) also supported a December cut in a Wall Street Journal interview, seeing the labour market as “vulnerable enough now that the risk is it'll have a nonlinear change”. The one US data release from yesterday surprised on the downside, with the Dallas Fed’s manufacturing index down to a 5-month low of -10.4 in November (vs. -2.0 expected). So investors dialled up the likelihood of a December rate cut to 77%, up from 63% at the close on Friday and down at 29% last Wednesday. Today we have the shutdown delayed September US retail sales and PPI to give us and the Fed more intelligence, albeit quite backward-looking info now.

The increased Fed cut probabilities backdrop proved supportive across multiple asset classes, with equities picking up on both sides of the Atlantic. So the S&P 500 (+1.55%) rebounded, largely thanks to the best performance for the Magnificent 7 (+3.55%) since May. However, the breadth of gains was fairly narrow, with 49% of S&P 500 constituents lower on the day, led by declines for consumer staples (-1.32%). Cruise operator Carnival (-6.78%) was the weakest performer in the S&P, adding to lingering questions on the strength of the US consumer. Over in Europe, the gains were also more subdued, with the STOXX 600 (+0.14%) only posting a modest gain. Overnight Nvidia fell around -2.7% after a report suggesting that Meta is in talks to buy Google's AI chips for data centres in 2027 and for rent in 2026. Alphabet shares have risen +2.7% overnight after rising +6.31% yesterday with increasingly positive reviews for its Gemini 3 launch. There are lots of questions as to whether it will squeeze OpenAI so maybe the AI story is showing signs of moving on a little from all winners to a winners and losers narrative.

Back to yesterday and for fixed income, sovereign bonds mostly rallied on both sides of the Atlantic. So the 10yr Treasury yield (-3.9bps) fell to 4.03%. Over in Europe, there were slightly smaller declines for 10yr bunds (-1.1bps), OATs (-2.6bps) and BTPs (-1.9bps). However, in Germany, sentiment took a modest dent from the Ifo’s latest business climate indicator, which unexpectedly fell to 88.1 in November (vs. 88.5 expected). And over in the UK, gilts were a relative underperformer ahead of tomorrow’s Budget, with 10yr yields only down -0.8bps on the day. Overnight US yields are back up 1 to 1.5bps across the curve.

The improving tech mood helped drive a rebound for Bitcoin, which rose +4.28% from Friday’s close to $88,763 yesterday. Still, the cryptocurrency remains on track for its worst monthly performance since 2022, having lost nearly -20% since the start of the month. For those interested in the topic, Marion Laboure on my team has written a note on what’s driven the latest decline (link here).

Asian equity markets are mixed this morning with Chinese stocks outperforming in the region after President Donald Trump and Premier Xi Jinping held their first talks since agreeing to a tariff truce last month even though both skipped this weekend’s G-20 summit (details below). As I check my screens, the CSI (+0.97%) is leading gains followed by the Shanghai Composite (+0.89%) while the Hang Seng (+0.56%) is also advancing amid gains in local internet giants with Alibaba Group up over +2% before its quarterly earnings due later today. Japanese stocks are lagging their peers with the Nikkei flat after a long holiday weekend amid persistent concerns over the country’s fiscal health, especially as PM Sanae Takaichi’s government prepares to ramp up spending. 10yr JGB yields are +2.4bps. The KOSPI (+0.31%) is seeing some wild swings, having jumped +2.39% at the open before moving all the way back to negative territory as I started typing. S&P 500 (-0.02%) and NASDAQ 100 (-0.03%) futures are trading flat after the Nvidia/Alphabet/Meta news mentioned above.

Coming back to the Trump-Xi meeting, the two leaders discussed several major issues between their nations, including Taiwan, the Ukraine war, and lackluster Chinese purchases of American soybeans. President Trump’s statement confirmed that he will visit China in April, and that Premier Xi will visit Washington later in 2026.

To the day ahead now, and US data releases include retail sales and PPI inflation for September, along with the Conference Board’s consumer confidence for November. Otherwise from central banks, we’ll hear from the ECB’s Villeroy, Makhlouf, Sleijpen and Cipollone.

Loading recommendations...