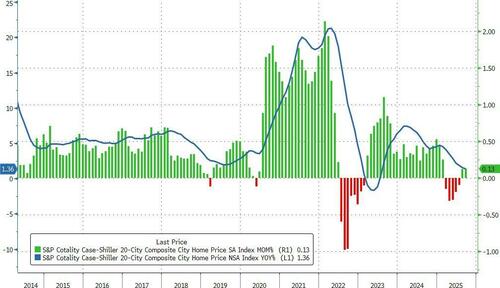

US home prices in the 20 largest cities rose 0.13% MoM in September (very slightly better than the 0.1% rise expected) and up for the second month in a row (after falling for five straight months before). This MoM rise left the average priers up just 1.36% YoY - the lowest since July 2023...

Source: Bloomberg

This (admittedly lagged and smoothed) data fits with the recent trend from Zillow that homes have lost value...

“As of October 2025, 53 percent of homes have lost value over the past year as measured by their Zestimate,” said Zillow.

“This share has climbed from only 16 percent just a year ago. This is on the highest share of homes declining in value since April 2012, when the housing crash was starting to bottom out.”

But of course, the Case Shiller data is actual sales, Zillow is an 'estimate' of value - not a transaction.

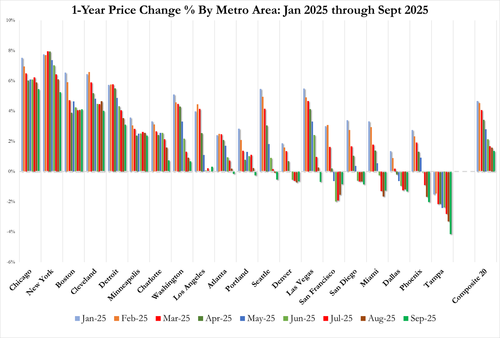

Regional performance reveals a tale of two markets.

Chicago continues to lead with a 5.5% annual gain, followed by New York at 5.2% and Boston at 4.1%. These Northeastern and Midwestern metros have sustained momentum even as broader market conditions soften.

At the opposite extreme, Tampa posted a 4.1% annual decline - the sharpest drop among tracked metros and its 11th consecutive month of negative annual returns. Phoenix (-2.0%), Dallas (-1.3%), and Miami (-1.3%) likewise remained in negative territory, highlighting particular weakness in Sun Belt markets that experienced the most dramatic pandemic-era price surges.

Home Prices are now falling (YoY) in a majority (11/20) of America's largest cities...

“The geographic rotation is striking," said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices.

"Markets that were pandemic darlings—particularly in Florida, Arizona, and Texas—are now experiencing outright price declines.

Meanwhile, traditionally stable metros in the Northeast and Midwest continue to post solid gains, suggesting a reversion to prepandemic patterns where job markets and urban fundamentals drive appreciation rather than migration trends and remote-work dynamics."

For context, this represents the weakest annual price growth since early 2023, when the market was absorbing the initial shock of the Federal Reserve’s aggressive rate-hiking cycle.

“Yet unlike that period, which saw a quick rebound," says Godec, "current conditions suggest more persistent headwinds. With mortgage rates stubbornly elevated and affordability at multi-decade lows, the market appears to be settling into a new equilibrium of minimal price growth—or, in some regions, outright decline.”

Loading recommendations...