After two months of nothing, the avalanche of actual government-supplied macro data begins in earnest with Retail Sales (for September). BofA's omniscient analysts expected a small beat...

But, for once, they were off with headline sales rising just 0.2% MoM (+0.4% MoM exp) but still rising for the 4th straight month...

Source: Bloomberg

On an unadjusted basis, Retail Sales fell significantly MoM (but that appears to be a very seasonal factor)...

Excluding Autos, sales were up 0.3% MoM (in line with expectations) but Ex Autos and Gas it was a disappointment, rising just 0.1% MoM (+0.3% exp).

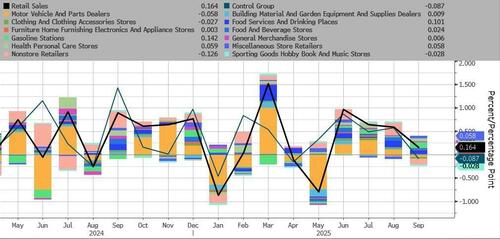

Motor Vehicles and Nonstore Retailers saw sales drop the most while Gasoline Stations and Food Services & Drinking sales rose the most...

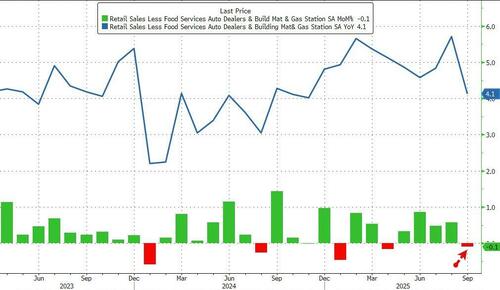

Perhaps worst of all is the 0.1% MoM decline in the Control Group - which is used in the GDP calculation - considerably worse than the +0.3% MoM expectation...

Source: Bloomberg

Control Group Sales are still up 4.1% YoY however.

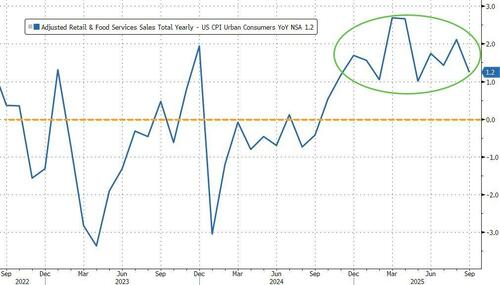

Finally, we note that 'real' retail sales are higher YoY for the 12th straight month...

More bad news to support Fed rate-cuts?

Loading recommendations...