Shares of Novo Nordisk in Copenhagen plunged the most in nearly four months after top-line results from a two-year analysis of the evoke and evoke+ Phase 3 trials, a pill version of Ozempic, showed the treatment failed to slow progression in early-stage symptomatic Alzheimer's disease.

The studies, which enrolled 3,808 adults over two years, found improvements in Alzheimer's-related biomarkers but no meaningful impact on cognitive decline, as measured by the Clinical Dementia Rating (CDR-SB) score.

"While treatment with semaglutide resulted in improvement of Alzheimer's disease-related biomarkers in both trials, this did not translate into a delay of disease progression," Novo wrote in a press release.

Novo chief scientific officer Martin Holst Lange commented on the results:

"Based on the significant unmet need in Alzheimer's disease as well as a number of indicative data points, we felt we had a responsibility to explore semaglutide's potential, despite a low likelihood of success. We are proud to have conducted two well-controlled phase 3 trials in Alzheimer's disease that meet the highest standards of research and rigorous methodology.

"We sincerely thank all participants and their caregivers for their meaningful contributions. While semaglutide did not demonstrate efficacy in slowing the progression of Alzheimer's disease, the extensive body of evidence supporting semaglutide continues to provide benefits for individuals with type 2 diabetes, obesity, and related comorbidities."

Goldman analyst James Quigley, arguably one of Novo's biggest super bulls, offered a first take on today's results:

This morning (November 24th), Novo announced that the EVOKE/EVOKE+ trials of semaglutide in Alzheimer's disease did not hit the primary endpoint, as no efficacy difference was seen between the treatment and placebo arms, leading to the 1-year extension study to be discontinued. Topline results will be presented at the CTAD conference on December 3rd, and Novo noted that semaglutide behaved as expected on all other known characteristics (safety, tolerability etc). Our expectations into the trial were low, as we forecast 5% probability of c.$4bn in peak sales for semaglutide in Alzheimer's disease and while the DCF impact on our model is limited (<1% decline on taking EVOKE out of the model), our scenario analysis suggested c.4% downside to the shares in this scenario. Our investor conversations suggested that downside risk could be >4%, given potential concerns over 2026 growth. However, we note that these concerns should largely be included in the stock given the recent step down on commentary around FY26 headwinds, and while the stock is trading down c.8% at the time of writing we believe the stock could underperform by LSD-MSD based on the trial failure.

EVOKE/ EVOKE+ misses on lack of efficacy. Oral semaglutide treatment for patients with Alzheimer's disease did not show superiority in reducing disease progression vs placebo in the EVOKE/EVOKE+ trials. In the press release, Novo confirmed that the final year of the trials will be suspended given the efficacy shown by semaglutide during the trials.

Sensitivity analysis suggests c.4% downside in the event of a trial failure and no directional benefit (Exhibit 1). As we had previously highlighted, while the impact on our DCF is negligible, our scenario analysis (based on consensus estimates) implies a c.4% downside risk in this scenario. Investor feedback following our original note suggested that there could be additional downside risk, beyond just removing Alzheimer's, particularly given concerns over the 2026 growth outlook; however, we would argue that consensus has already started to move down (Visible Alpha now estimates c.2% CER growth vs. 6/7% previously.

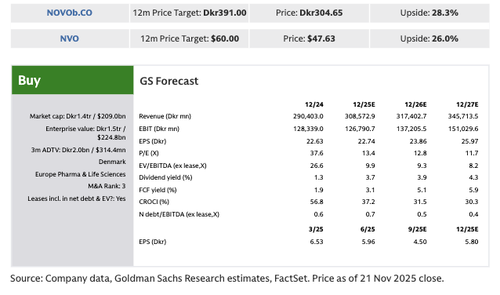

Quigley remains buy-rated on Novo with a 12-month price target of DKK 393 per share.

The dismal results sent Novo shares tumbling nearly 10% in Copenhagen by afternoon trading, the steepest intraday drop since the 23% crash on July 29. The stock is now down 55% year-to-date, hitting levels last seen in mid-2021. Novo ADR shares are down 9%.

Worst year on record.

Related:

"It was a lottery ticket that could have had great value," said Per Hansen, investment economist at Nordnet AB, who Bloomberg quoted. "Investors hadn't assigned it any real value. Still, the hope was there."

Loading recommendations...