Authored by Lance Roberts via RealInvestmentAdvice.com,

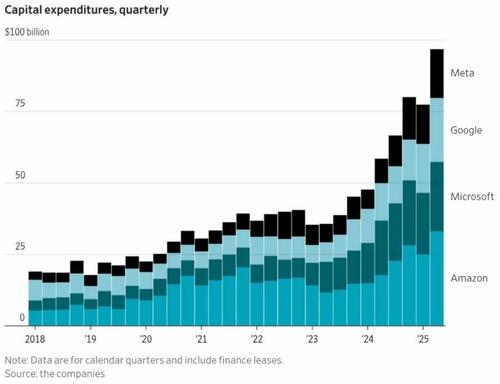

The U.S. economy’s recent growth has a distinctive engine: large‑scale capital expenditures (capex) tied to artificial intelligence (AI). Firms such as Microsoft, Alphabet (Google), Meta Platforms, and Amazon have announced massive investments in data centers, servers, networking equipment, and AI infrastructure.

As noted by Investing.com:

“Artificial intelligence is consuming capital faster than investors can recalibrate. Bank of America now sees global hyperscale spending rising 67% in 2025 and another 31% in 2026, with total outlays climbing to $611 billion. That is a $145 billion increase in just one month’s estimates.

The surge shows how cloud giants are doubling down. Google raised its 2025 capital budget to $92 billion, Microsoft plans even faster growth into fiscal 2026, and Meta now expects spending of about $100 billion in 2026. Amazon’s data center capacity is on track to double by 2027. None show intent to slow down, even as capex intensity approaches 30% of sales, roughly triple historic norms.

That level of investment is extraordinary. At its peak, the 5G telecom buildout consumed about 70% of operating cash flow, AI infrastructure is now approaching the same strain.

While we can certainly discuss the magnitude of those investments and the risks associated with repeating another “Dot.com” overbuild, the point I want to address with you today is how those capital expenditures are masking broader economic weakness.

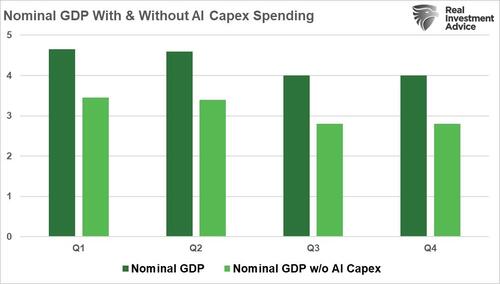

For example, a recent estimate places U.S. AI‑related capex for fiscal 2025 at about 1.2% of GDP. (The chart below uses the Atlanta Fed GDP Now estimate for Q3 of 4% nominal GDP growth and assumes the same in Q4.) If we subtract out the AI-related Capex spending, growth is significantly weaker than advertised.

In raw terms, the global AI investment by key players already exceeds hundreds of billions of dollars. Analysts forecast global AI spend at around US $360 billion in 2025 with growth into 2026 and beyond. For instance, data center capex is projected to grow at a 21% CAGR to reach US$1.2 trillion globally by 2029. Such figures highlight real spending momentum, and that momentum has helped the U.S. economy avoid a steeper decline in growth. But this growth is highly concentrated. Only a handful of large tech firms comprise the bulk of the capex. Therefore, the headline numbers require deeper interpretation. Investors must recognize that, while the impact on economic growth is real, spending will eventually slow down.

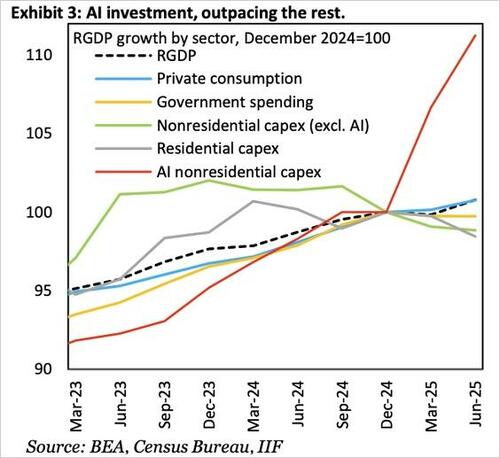

Still, the rise of AI-driven investment is significant for the economy and for investors alike. It signals a shift in the composition of growth from consumption and broad business investment toward heavy‑asset, tech‑centric investment. Recognizing how that shift works is critical for understanding risks and opportunities.

What the Boom Masks – Underlying Weakness in the Economy

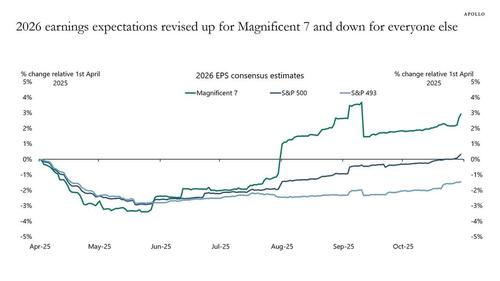

Although the surge in AI investment is impressive, it masks several structural weaknesses in the broader U.S. economy. First, the AI‑capex boom is concentrated among a small number of firms and sectors rather than being broadly diffused across all industries or geographies. The bulk of spending is going into servers, data‑centers, and networks. While those assets are capital‑intensive, they are not labor‑intensive in the way large manufacturing or services growth might be. As noted above, while analysts estimate that AI-capex may be 1.2% of GDP in 2025 under a standard multiplier, the real economic benefits in productivity or employment outside of the tech sector remain limited so far. We observe that in the dispersion of expected 2026 earnings growth between the largest market-capitalization-weighted stocks in the S&P 500 index and the rest.

In other words, if AI capex spending reached a broad swath of the economy, the earnings expectations for the bottom 493 companies would not be negative. It is also crucial to note that forward earnings estimates are ALWAYS overly optimistic, so the results are likely to be worse in the future.

Second, much of that investment relies on imported equipment, components, and technologies, which means the domestic multiplier of the spending is weaker than the headline number suggests. Although AI-capex is large, much of it is still classified as intermediate goods, which aren’t fully captured in GDP statistics. However, while AI capex spending is robust, spending by the rest of the economy remains muted.

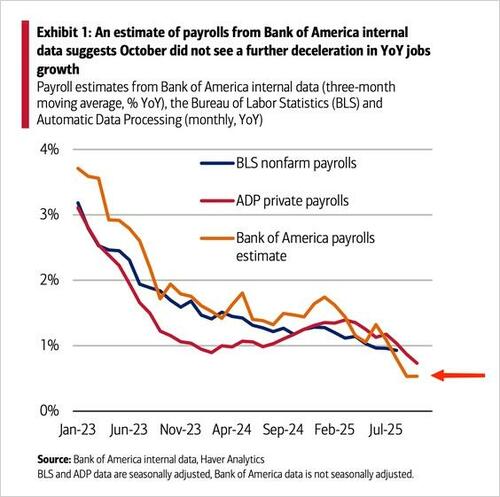

Third, when you look beyond the tech sector, the traditional engine blocks of growth are weaker. Residential investment is under pressure as housing affordability remains an issue. As noted above, since business investment outside the large tech players remains muted, that is weighing on employment growth, which continues to show signs of softening.

Fourth, while AI capital expenditures (capex) are high, the economic payoff has not yet been fully proven. Productivity gains, revenue gains, and sustainable earnings from this wave of infrastructure spend have not been fully realized. One Vanguard analysis notes that to move U.S. growth above trend via AI alone would require approximately US$1 trillion in AI-related spending, which lies ahead, not behind.

Thus, the underlying condition of the economy is more fragile than the capital‑spend numbers imply. The risk is that when the tech‑capex boom slows or fails to deliver a broad spill‑over, the rest of the economy will feel the weakness more sharply.

Therefore, as an investor, the risk of assuming broad-based resilience may be critical to consider when developing your investment thesis.

Implications for Investors

For investors, the mixed nature of this growth wave presents both opportunity and risk. The current opportunity for investors is to invest directly in firms closely tied to AI infrastructure, such as chip manufacturers, data center operators, and cloud services companies, all of which are likely to benefit. Their growth trajectories may outpace the broader economy because they are at the heart of the capital expenditure surge. But these opportunities come with important caveats.

One risk is concentration. If a narrow subset of companies or sectors is driving the growth story, then portfolios that lack diversification towards non‑tech may expose investors to sharper corrections. If the tech-capex wave slows, valuations tied to presumed growth may reverse quickly, especially among firms with aggressive capital expenditures and uncertain near-term returns. For example, analysts at Goldman Sachs warn that the current contributions of AI to GDP are likely understated; however, the actual economic benefit remains modest, and future risks remain high.

Secondly, as we saw during the dot-com bubble, not all companies that jumped into the internet market survived. Those failures also included some of the largest companies at the time, such as Enron, World.com, and Lucent, among others. The current AI cycle will likely be the same; there will be some big long-term winners, but there will also be quite a few companies that are mainly trading on “hope” for future results that are far from guaranteed.

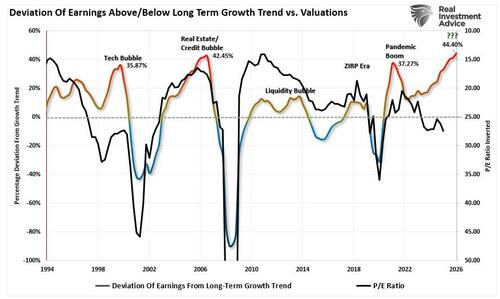

Another investor implication concerns earnings quality. Heavy capital expenditures do not guarantee near-term earnings improvement or productivity gains. Some firms may carry high depreciation, amortization, and idle capacity risk. A report notes that capital spending growth now may generate returns only years down the road. This remains one of our primary concerns, as expectations for future earnings growth are incredibly elevated. This leaves an enormous amount of room for disappointment when combined with already high valuation multiples, making the downside risk not inconsequential.

(The chart shows the current deviation of earnings growth from its long-term exponential growth trend versus the trailing P/E ratio, which is inverted. When the “E” reverses, valuations will skyrocket as they did during the Dot.com bust, the Financial crisis, and the Pandemic shutdown.)

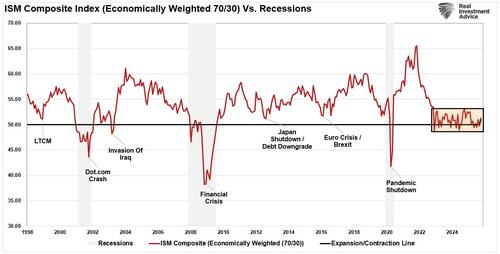

Third, investors should monitor the masking effect. The fact that AI‑capex is propping up headline growth means the rest of the economy remains vulnerable. As shown, the economically weighted ISM index (70% services/30% manufacturing) remains in expansion territory, but just barely. If consumption or non‑tech business investment falters, the broader weakness may surface suddenly. Portfolios built only around tech optimism may lack cushions from areas less tied to the boom.

Fourth, valuations need discipline. As noted above, investors are currently pricing in the most optimistic of future outcomes. That exponentially increases the risk of disappointment at some point in the future. The correction potential rises if growth disappoints, returns are delayed, or macro weakness intensifies. Investors should consider whether the current growth base is sufficiently broad to support the expected outcomes. Are earnings projections realistic? How much is the stock’s valuation already assuming perfect execution?

In short, you must not assume that because one part of the economy is booming, everything else is strong. Please recognize that the growth narrative is narrow; therefore, as investors, we should consider some practical steps to manage future risks.

Loading recommendations...