As official US macro 'hard' data starts to creep out from Washington, we get more private 'soft' survey data this morning (for preliminary November period) and it is 'mixed' for want of a better word.

This mixed bag comes in the face of 'strong' hard data...

Source: Bloomberg

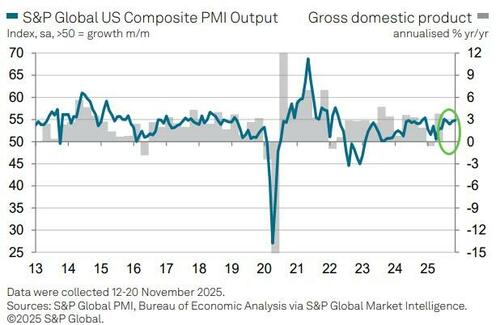

The headline S&P Global US PMI® Composite Output Index rose for a second successive month in November, up from 54.6 in October to 54.8, according to the 'flash' reading (based on about 85% of usual survey responses).

The latest reading is the highest since July, signaling an acceleration of growth over the fourth quarter so far.

Output has now grown continually for 34 months.

“The flash PMI data point to a relatively buoyant US economy in November, signalling annualised GDP growth of about 2.5% so far in the fourth quarter.," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"The upturn also looks encouragingly broad-based for now, with output rising across both manufacturing and the vast services economy."

Rate-cuts and optimism:

“A marked uplift in business confidence about prospects in the year ahead adds to the good news.

Hopes for further interest rate cuts and the ending of the government shutdown have boosted optimism alongside a broader undercurrent of improved economic optimism and reduced concerns over the political environment."

Jobs vs Inflation:

“Furthermore, although jobs continued to be created in November, the rate of hiring continues to be constrained by worries over costs, in turn linked to tariffs.

Both input costs and selling prices rose at increased rates in November, which will be of concern to the inflation hawks.”

However, Williamson notes that manufacturers reported a worrying combination of slower new orders growth and a record rise in finished goods stock noting that "this accumulation of unsold inventory hints at slower factory production expansion in the coming months unless demand revives, which could in turn feed through to lower growth in many service industries."

Loading recommendations...