Walmart shares are moving lower in premarket trading despite solid third-quarter results, suggesting that price-sensitive consumers are flocking to its stores nationwide. The shift toward value mirrors what off-brand retailer TJ Maxx reported on Wednesday. It caps a pivotal week for retailers (as described by Goldman's Scott Feiler), with Home Depot and Target both highlighting sagging demand and stressed household budgets earlier in the week.

What's key to understand is that consumers are continuing to trade down to Walmart in the third quarter. The retailer's core U.S. stores saw same-store sales rise 4.5%, beating the Bloomberg Consensus estimate of 4.03%. Store visits were down during the quarter, but basket sizes grew.

Third-Quarter Results (All vs. BBG Estimates)

U.S. comp sales ex-gas: +4.4% (est. +4.0%).

- Walmart U.S. stores: +4.5% (est. +4.03%).

- Sam’s Club: +3.8% (miss vs. est. +4.77%).

Adjusted EPS: $0.62, beat (est. $0.60).

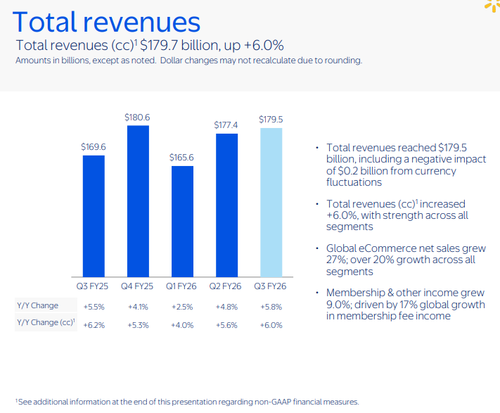

Revenue: $179.5B, +5.8% YoY (est. $177.57B).

Adjusted operating income: $7.2B (est. $7.03B).

Sam's Club e-commerce: +22% (est. +15.7%).

More in-depth on Total Revenues via WMT Presentation

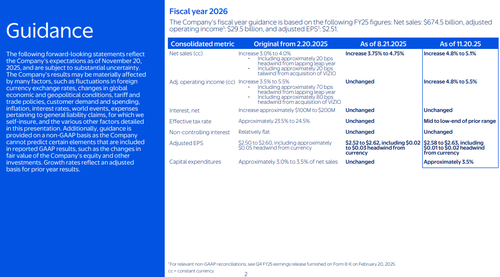

Full-year guidance was raised again. Management now expects 4.8% to 5.1% sales growth for the fiscal year, reflecting elevated confidence in traffic across Walmart stores, Walmart.com, and Sam's Club.

Full-Year Guidance Raised

Adjusted EPS: Now $2.58–$2.63 (prior: $2.52–$2.62; consensus: $2.61).

Net sales (constant currency): Now +4.8% to +5.1% (prior: +3.75% to +4.75%).

Adjusted operating income (ex-FX): +4.8% to +5.5%.

Effective tax rate: Tracking toward mid-to-low end of 23.5%–24.5%.

Capex: ~3.5% of net sales (slightly higher than prior range).

More color on guidance via WMT Presentation

In recent weeks, Walmart and the White House have promoted the retailer's Thanksgiving meal deal bundle, which serves up to 10 people and is being offered at 2019 prices. Trump's repeated spotlighting of the deal only underscores the high demand Walmart is likely to see heading into the holiday season next week.

"The team delivered another strong quarter across the business," Doug McMillon, Walmart's chief executive, said in a statement. Last week, the retailer announced McMillon would retire at the end of January and be replaced by John Furner, head of Walmart's U.S. business.

Walmart shares fell about 2% in premarket trading in New York. Shares are up 11% year to date.

Bloomberg analyst Heather Burke provided color on WMT's price action post earnings:

Walmart shares are falling about 2% in pre- market trading even though the retailer increased its sales outlook for the full year. The CFO said consumer spending has been largely consistent, though there's "some slight moderation" within lower-income households. Middle- and higher-income shoppers aren't pulling back.

There's no obvious catalyst though investors may be getting concerned about the impact of tariffs after the CFO said that there are higher costs flowing through in coming months. Prices in this latest report rose 1%, suggesting the retailer has been absorbing some costs.

This week, Home Depot and Target set the trend for consumer earnings, reporting dismal results. Then, off-price retail chain TJ Maxx reported solid earnings, only suggesting consumers are trading down as low- and middle-income consumers are getting financially squeezed.

Goldman has flagged imploding sentiment, UBS has revealed the tale of two consumer worlds, and consumer behavior and spending trends show a pullback in discretionary spending, from restaurants to big-box retailers.

The strain has become large enough that the Trump administration rolled out "Operation Affordability" last week, an attempt to ease pressure ahead of the midterm election cycle.

Read Feiler's note on retailer earnings expected later today and Friday.

* * *

View WMT's earnings presentation

Loading recommendations...