Muddy Waters Capital CEO Carson Block joined Bloomberg TV overnight to discuss whether it's time to short the hyperscalers and the broader artificial-intelligence trade. The answer he gave is somewhat surprising.

Block, a notorious short-seller, warned against betting against the tech giants: "If you're out there trying to short Nvidia or any of these big tech names, you're not going to be in business very long."

"I would much rather be long than be short in this market," Block told BBG TV, adding, "You have all these AI adjacent companies, AI pretenders, that's where you would want to look to short."

He continued, "However, so long as the leaders such as Nvidia are still going up into the right, that would be a very dangerous trade."

Block noted that the surge in passive trading had "broken the markets in terms of greatly diminishing price discovery."

"It doesn't matter how expensive Nvidia gets," he said. "All of these funds that are buying the S&P 500 index, they will not sell Nvidia until they have net outflows. They will buy it everyday at whatever the price is if they have inflows."

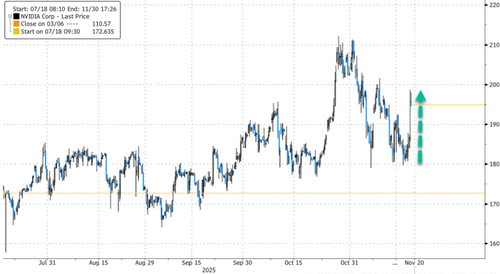

Comments from the seasoned short-seller, who has lived through multiple cycles, come just hours after Nvidia jumped 5% in after-hours trading on Wednesday following strong earnings (read report).

UBS analyst Nana Antiedu told clients earlier, "Nvidia's Upbeat Forecast Should Lift Some AI Bubble Fears."

Antiedu explained further:

Nvidia's after-market strength was sustained, with the stock up 5%, and nothing to nit-pick with a continued upbeat tone on the call with GB300 surpassing GB200, robust accelerator demand and Rubin on track for the second half of 2026. CEO Jensen Huang downplayed any AI bubble fears saying "we see something very different" and reiterated the $500 bn revenue visibility target by the end of 2026. He cited this number will grow with more orders (the Anthropic deal as one example). In terms of supply constraints, Nvidia did acknowledge input costs are going up, but they plan to sustain mid-70s gross margins as it appears to be doing a good job managing the supply chain planning for a "really big year". Overall, a rather upbeat forecast/outlook, which should sooth some of lingering AI bubble fears and a general sigh of relief for markets broadly.

Last week, "Big Short" investor Michael Burry deregistered Scion Asset Management with the Securities and Exchange Commission after receiving a lot of criticism on X over his latest 13F, which showed that roughly 80% of his put positions were concentrated in high-fliers Palantir and Nvidia.

It's no mystery why Burry wants to hide his trades in secrecy - it only takes one X post to go viral, like this one...

The trillion-dollar question ...

... is whether Nvidia earnings revive another up leg in everything AI and crypto into the holidays.

Loading recommendations...