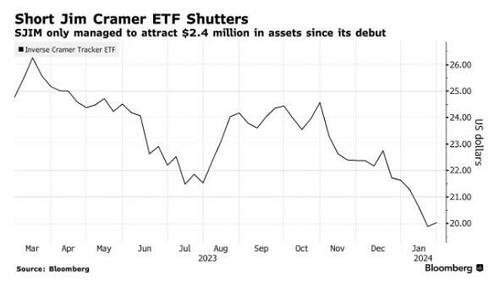

While the anti-Cathie Wood ETF, SARK, was launched at just the right time and experienced significant gains in its short lifespan (still up more than 250% since inception), Tuttle Capital Management’s Jim Cramer ETFs have both shuttered.

This means that the Inverse Cramer Tracker ETF (SJIM) and the Long Cramer Tracker ETF (LJIM) have both shut down, per Bloomberg. Sadly, if investors want to lose money on Jim Cramer now, they're going to have to do it the old fashioned way: tuning into CNBC and following along with his stock picks live.

In a press release out in summer of last year, Matthew Tuttle, brain child behind both ETFs, stated last summer when the long ETF shut down: “We started LJIM in order to facilitate a conversation with Jim Cramer around his stock picks as the other side to the Short Cramer ETF. Unfortunately, Mr. Cramer and CNBC have been unwilling to engage in dialogue and instead have chosen to ignore the funds, therefore there is no reason to keep the long side going. Going forward we will just focus on the short side.”

But it wasn't just the long side people didn't want to have anything to do with: it was everything Cramer, it seems.

And so, upon shutdown of the short ETF, Tuttle commented: “Retail investors are more focused on volatile products, and the interest in a long/short portfolio never fully materialized.”

He said he started the ETF to “point out the danger of following TV stockpickers, Jim Cramer specifically.”

Jane Edmondson, head of thematic strategy at TMX VettaFi, commented to Bloomberg last week: “There are a lot of ‘fad’ thematics, not tied to sound economic principles. Sadly, most of them are destined to fail.”

When the ETFs first hit the market, Cramer expressed on Twitter his openness to people taking opposite positions to his, cautioning that such bets would be against some of the most prosperous U.S. companies, notably Apple Inc. and Alphabet Inc.

In a March 2023 interview with Bloomberg's Trillions podcast, Tuttle revealed that he and two associates track Cramer's TV segments and online presence to construct their actively managed investment portfolios, which have a 1.2% fee.

A CNBC representative told Bloomberg that Cramer advocates for long-term investment strategies, emphasizing a mix of index funds and individual stocks.