Former President Donald Trump on Wednesday vowed to never allow the use of a Central Bank Digital Currency (CBDC), as it would "give the government absolute control over your money."

"This would be a dangerous threat to freedom – and I will stop it from coming to America. We are also going to put in place strong protections to stop banks and regulators from trying to de-bank you for your political beliefs. That will never happen while I am your president," Trump told a crowd in Portsmouth, New Hampshire - as first reported by The National Pulse.

Trump's comments come hours after Rep. Jim Jordan (R-OH) revealed that federal agencies have been flagging financial transactions using politically sensitive words such as "MAGA" and "Trump" in yet another egregious example of the establishment targeting political rivals.

As we've reported for years, CBDCs - touted by globalists such as French Central Bank deputy governor Denis Beau as "the catalyst for improving cross-border payments by enabling the build-up of a new international monetary system" - are in fact the ultimate tools of oppression.

Even Fed Governors know 'this way lies danger':

"In thinking about the implications of CBDC and privacy, we must also consider the central role that money plays in our daily lives, and the risk that a CBDC would provide not only a window into, but potentially an impediment to, the freedom Americans enjoy in choosing how money and resources are used and invested," Federal Reserve Governor Michelle Bowman told a Harvard Law School Program on International Financial Systems last year.

Central bank digital currencies are part of a broader "war on cash."

A cashless society is sold on the promise of providing a safe, convenient, and more secure alternative to physical cash. We’re also told it will help stop dangerous criminals who like the intractability of cash.

But there is a darker side – the promise of control.

The elimination of cash creates the potential for the government to track and control consumer spending. Digital economies would also make it even easier for central banks to engage in manipulative monetary policies such as negative interest rates.

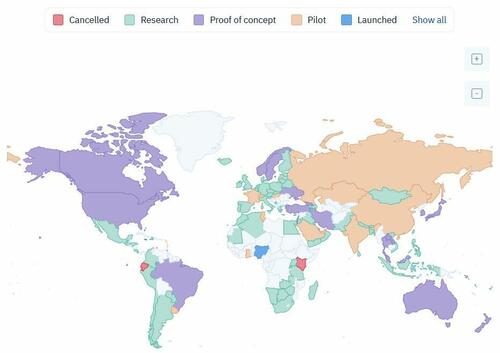

But they seem to be an inevitability, as according to data from the Atlantic Council CBDC Tracker, 130 countries - representing over 98% of global gross domestic product - are exploring or developing CBDCs, marking an outsized increase from just a few years ago.

They're even starting to experiment with them for international settlement... In November, Zurich issued a CHF 100 million ($113m) digital bond via the SIX Digital Exchange - the most distinctive aspect of which is that it settles using a wholesale central bank digital currency (wholesale CBDC) issued by the Swiss National Bank (SNB).

Last April, Democratic Presidential candidate Robert F. Kennedy Jr. (who is now working to create a new political party to qualify for the ballot in various states), vehemently opposed the Fed's announcement of a "FedNow" CBDC, calling it a "slippery slope to financial slavery and political tyranny."

"While cash transactions are anonymous, a #CBDC will allow the government to surveil all our private financial affairs. The central bank will have the power to enforce dollar limits on our transactions restricting where you can send money, where you can spend it, and when money expires," he wrote on X. "A CBDC tied to digital ID and social credit score will allow the government to freeze your assets or limit your spending to approved vendors if you fail to comply with arbitrary diktats, i.e. vaccine mandates."

In July, Kennedy promised to back the US Dollar with Bitcoin if he's elected president.

Also in July, Florida Governor Ron DeSantis (R) vowed to kill FedCoin on "day one" of his presidency, telling Tucker Carlson at the Family Leadership Summit in Iowa, "If I am the president, on day one, we will nix central bank digital currency. Done. Dead. Not happening in this country," adding "They want to get rid of cash. They want no cryptocurrency. They want [CBDCs] to be the sole form of legal tender. It will allow them to prohibit 'undesirable purchases' like fuel and ammunition."

More recently, several states opposed to CBDC have launched bills which would prohibit classifying digital currency as money.

If successful, Utah, South Carolina, South Dakota and Tennessee would become the first states to exclude CBDC as a medium exchange - potentially creating significant roadblocks to CBDC in the United States.

Finally, for those still unsure, we don’t need to look as far as China to understand the implications here in the West. As Laura Dodsworth wrote in October of the dystopian nature of CBDCs, via The Brownstone Institute:

In 2019, Mastercard and Doconomy launched a credit card with a carbon footprint calculator that can switch off your spending when you reach your carbon max. This functionality is voluntary, but it could be an automatic aspect of a CBDC.

Tom Mutton, a director at the Bank of England, said that the Government would be required to make the final decision on whether a UK CBDC should be programmable. Sir Jon Cunliffe, a deputy Governor at the Bank, said:

"You could think of giving your children pocket money, but programming the money so that it couldn’t be used for sweets. There is a whole range of things that money could do, programmable money, which we cannot do with the current technology."

As this quote reveals, CBDCs won’t just alter our relationship with money but with government. Governments around the world have shown increasingly authoritarian tendencies during the management of the Covid pandemic, and more recently to discourage driving in cities. Behavioural science has been leveraged to manipulate, incentivise and coerce us into behaving as model citizens. Do we want to negotiate with Daddy State to be allowed to spend our ‘pocket money’ as we wish?

An account-based CBDC would give the government enormous power over your money as your identity is connected to the money. A 2020 Bank of England discussion paper gave examples of programmability, for example that smart cars could automatically pay for fuel directly at the dispensing pump, with automated taxation and charitable donations at point of sale.

That all sounds very convenient. But politicians pushing Net Zero goals on an unwilling population could choose to go a step further. If you insist on keeping your private car, despite the inconvenient 20 MPH speed limits, the ULEZ and congestion charges, and the Low Traffic Neighbourhood barriers, they could simply dictate a maximum fuel spend in a given time period. Just ten of your Britcoins on petrol this month, Sir, no more driving for you.

Interestingly, we have not heard from the Biden administration with regard their support (or lack thereof) of CDBCs. Given their recent authoritarian over-steps, it shouldn't be too hard to guess which side of the 'more centralized power and control' vs 'freedom and personal sovereignty' fence they might come down on.