Tesla unveiled a cheaper Model Y today with prices starting at $37,990–$39,990, about 15% below the previous base model, as the company works to reverse slowing sales and lost U.S. tax incentives.

Elon Musk has long promised a mass-market EV, though he scrapped a $25,000 car plan last year. Still, he argued in July: "The desire to buy the car is very high. (It's) just (that) people don't have enough money in the bank account to buy it. So the more affordable we can make the car, the better."

The new pricing on Tesla's website today, reported by Bloomberg and Reuters, followed teaser clips earlier this week posted on X showing headlights and a wheel with the date “10/7.” Tesla reportedly began building this lower-cost version in June but delayed production until after $7,500 tax credits expired. CFO Vaibhav Taneja warned output will ramp up slower than initially expected.

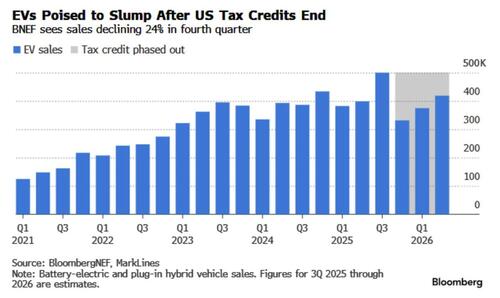

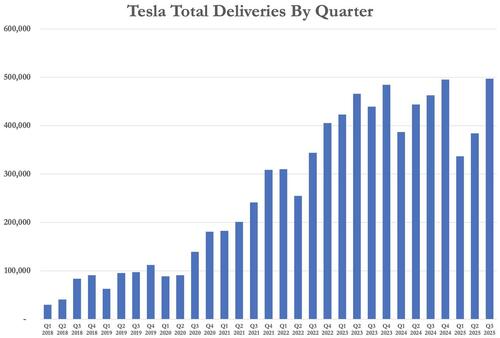

While Tesla just had a record quarter, global sales are down about 6% this year, and analysts expect U.S. EV sales to fall sharply after the credit’s removal. Recall, about a week ago the company reported stronger-than-expected third-quarter delivery figures. Deliveries came in at 497,099 vehicles, a 7.4% increase from a year earlier and smashing Bloomberg consensus estimates of 439,612. The numbers also beat the recently-boosted guidance from Goldman and UBS.

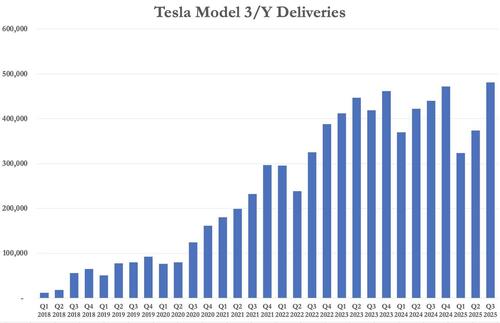

The bulk of the growth came from the company’s mass-market lineup: Model 3/Y deliveries reached 481,166, up 9.4% year-over-year and surpassing expectations of 424,828. Deliveries of Tesla’s other models totaled 15,933, representing a 53% jump from the previous quarter but slightly below estimates of 17,184.

On the production side, Tesla built 447,450 vehicles, down 4.8% from a year earlier and just under the consensus of 450,313. Model 3/Y production totaled 435,826, a 1.8% decline but still ahead of forecasts. Production of other models slipped to 11,624, down 13% from the prior quarter.

The strong delivery numbers likely reflected a pull-forward effect ahead of the loss of the US tax credits. Federal incentives that provided buyers with up to $7,500 for new EVs and $4,000 for used EVs expired on September 30 under new legislation passed by Congress. Tesla and its rivals had been factoring these credits into competitive lease and purchase offers, boosting demand in the final weeks of the quarter.

UBS said in a note that a push to take advantage of the tax credit would help delivery numbers: "Strong deliveries in the US as Tesla pushes, and consumers take advantage of, the $7,500 IRA EV tax credit before its expiry at the end of September 2025. We believe 3Q25 could be the highest quarterly US deliveries since mid-2023 and potentially the highest ever. We believe demand is very likely being pulled forward so we'd expect a q/q drop in 4Q25, even if the new "lower cost" Model Y is introduced."

Now we'll see if a lower cost Model Y can do the same...

Loading recommendations...