The week's first coupon auction just priced, and it was quite solid, taking advantage of the broader risk off mood.

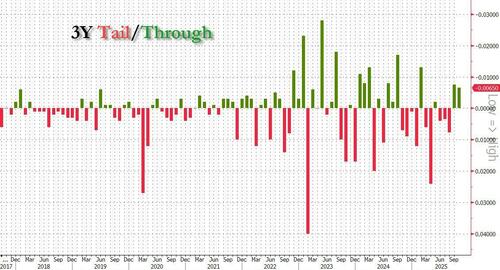

At 1pm ET, the Treasury sold $58BN in 3Y paper, at a high yield of 3.576%, up from 3.485% last month but not that far off the lowest high yield in the past three years. The auction stopped 0.8bps through the 3.584% When Issued, the biggest stop since February.

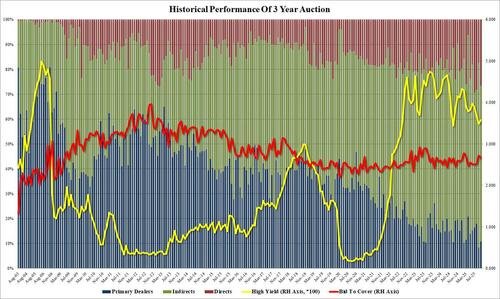

The bid to cover was 2.663, down modestly from 2.726 last month but above the six auction average of 2.550.

The internals were a tad soft, with Indirects taking 62.7%, down from 74.2% in Sept and also below the 64.1% six-auction average.

And with Directs jumping to 26.6% from 17.4%, that left just 10.7% to Dealers, just shy of the lowest on record.

Overall, this was a softish auction which despite the pullback in foreign buyers, did not have a problem stopping through amid the broader risk off that has seen yields slide for much of the session and hit a LOD just after the auction priced.

Loading recommendations...