Is the 'batshit insane' delusion of AI/ORCL about to break?

As a reminder, a month ago, ORCL stock soared after forecasting extraordinary growth:

"We signed four multi-billion-dollar contracts with three different customers in Q1," said Oracle CEO, Safra Catz.

"This resulted in RPO contract backlog increasing 359% to $455 billion. It was an astonishing quarter—and demand for Oracle Cloud Infrastructure continues to build."

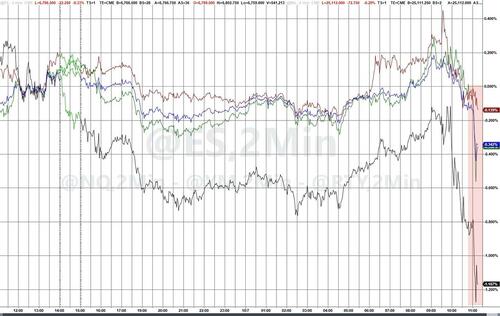

Since then it has been up, up, and away... until today...

The Information reports that internal documents show the fast-growing cloud business has had razor-thin gross profit margins in the past year or so, lower than what many equity analysts have estimated.

In the three months that ended in August, Oracle generated around $900 million from rentals of servers powered by Nvidia chips and recorded a gross profit of $125 million—equal to 14 cents for every $1 of sales, the documents show.

That’s lower than the gross margins of many non-tech retail businesses.

As sales from the business nearly tripled in the past year, the gross profit margin from those sales ranged between less than 10% and slightly over 20%, averaging around 16%, the documents show.

In some cases, Oracle is losing considerable sums on rentals of small quantities of both newer and older versions of Nvidia’s chips, the data show.

In the three months that ended in August, Oracle lost nearly $100 million from rentals of Nvidia’s Blackwell chips, which arrived this year.

That’s partly because there is a period between when Oracle gets its data centers ready for customers and when customers start using and paying for them, the documents show. It’s not clear what causes the gap or how Oracle plans to shorten it.

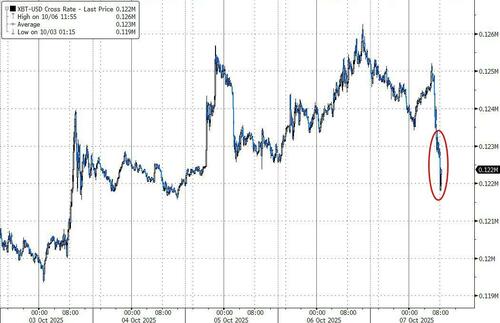

Stocks (broadly) and crypto were both hammered lower on the report.

Is the world's biggest bubble about to burst? Or is this just another opportunity to BTFD?

Loading recommendations...