Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), has invested $2 billion in cryptocurrency-based prediction market Polymarket.

According to a Tuesday Polymarket X post, the ICE invested $2 billion in the prediction market. The deal values Polymarket at a $9 billion post-money valuation.

As CoinTelegraph reports, ICE’s NYSE is the world’s largest stock exchange by market capitalization, exceeding $25 trillion as of July 2024. Its interest is the latest move that fuses the United States’ traditional financial landscape with the cryptocurrency industry.

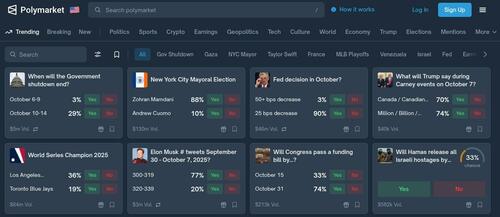

Polymarket is a crypto-powered prediction market where people buy and sell “shares” in real-world event outcomes (elections, sports, crypto prices), with market prices reflecting the crowd’s implied probabilities. Trades typically settle in stablecoins, and markets are resolved against predefined, verifiable sources, with access for US users restricted due to regulatory reasons.

Polymarket’s homepage. Source: Polymarket

CEO Shayne Coplan wrote on X: Markets on everything.

We’re proud to announce that $ICE, the owner of @NYSE and the largest exchange company in the world, is making a strategic investment of $2 billion into Polymarket, valuing us at $9 billion post-money.

Our partnership with ICE marks a major step in bringing prediction markets into the financial mainstream. But in addition to that, it’s a monumental step forward for DeFi. ICE is the one remaining founder-led exchange company, and Jeff is all-in on utilizing his assets, including NYSE, to usher in a new financial era of tokenization. We’re humbled to be working together on this endeavor. ICE will also begin distributing Polymarket data to thousands of financial institutions around the world. There is so much to build when you combine the force of ICE’s institutional scale and credibility with Polymarket’s consumer + cultural savvy and distribution.

The past two years have been surreal. Going from a write off to creating a category, watching our vision become a reality. The Polymarket origin story is funny because it's a rare case of the dream being identical to how things played out. If I learned one thing, it’s that bold ideas are everywhere, hidden in plain sight. It just takes someone crazy enough to spend their life willing it into existence. That’s entrepreneurship: willing things into existence.

I remember reading Robin Hanson’s literature on prediction markets and thinking - man, this is too good of an idea to just exist in whitepapers. There were a million reasons why it shouldn’t work, countless arguments of why not to do it, and the odds were against us, but we had to try.

At the onset of the pandemic, I quite literally had nothing to lose: 21, running out of money, 2.5 years since I dropped out and nothing to show for it. But I knew we were entering an era where ways to find truth would matter more than ever, and Polymarket could play a critical role in that. After all, nothing is more valuable than the truth. It’s still a work in progress, but we’re honored to have made the impact we have thus far.

I’d also like to give a special thank you to all of our users, builders, and community members who have been with us since 2020. Your support will not be forgotten.

Last but not least, I am deeply grateful for all of the support and hard work of my brilliant team. I’m getting to live my wildest dreams, seemingly against all odds, and I don’t take it for granted.

The best is yet to come…

Que Sera Sera

The news also follows recent reports that Polymarket is reportedly preparing a US launch that could value the company as high as $10 billion. In early September, the US Commodity Futures Trading Commission (CFTC) issued a no-action letter to QCX granting Polymarket relief from certain federal reporting and record-keeping requirements.

That stance marks a notable shift from prior years. In mid-November 2024, the United States Federal Bureau of Investigation (FBI) went as far as to raid the home of Polymarket CEO Shayne Coplan, seizing his phone and electronics. The CFTC also issued a cease-and-desist order against Polymarket in early 2022.

This followed Polymarket’s July acquisition of the US-licensed derivatives exchange and clearinghouse QCEX for $112 million in preparation for its re-entry into the US market. In recent times, the prediction market has undergone significant leadership changes.

In late August, Polymarket added Donald Trump Jr., the son of US President Donald Trump, to its advisory board after receiving a strategic investment from self-described politically aligned vehicle 1789 Capital. The financial details are unclear, but according to some estimates, the investment was worth “double-digit millions of dollars."

Loading recommendations...