U.S. natural gas futures surged 17.3% last week, the largest weekly gain since early May. Goldman Sachs analysts offered context for the rally, noting that the market narrative has shifted "from U.S. storage congestion fears to tightening 2026 supply."

A team of Goldman analysts led by Samantha Dart, senior energy strategist, explained that the jump in NatGas prices last week to nearly $3.5/mmBtu was largely due to the roll into the November "winter" contract, which carries stronger heating demand and lower storage congestion risk.

$3.5/mmBtu resistance.

Dart explained that even beyond the rollover effect, two bullish forces supported the rally:

First, while the market seemed to be pricing in concerns that Gulf storage would face a congestion event over the past several weeks, such an event does not seem to have materialized. Henry Hub cash prices have held relatively well in the period, consistent with manageable weekly storage injections (Exhibit 2 and Exhibit 3). The weakest point for cash prices in the period, but which still held above $2.70/mmBtu, was the long Labor Day weekend, when demand softness from the holiday was exacerbated by significantly milder-than-average weather.

Second, U.S. liquefaction demand for gas has increased recently, with Venture Global's Plaquemines' gas pull now approaching its 3.6 Bcf/d capacity, while gas demand at Cheniere's Corpus Christi expansion appears to have also stepped up (Exhibit 4). This has taken total U.S. gas demand for LNG exports to over 16.5 Bcf/d this week, the highest level since early August, and likely to rise sustainably above 17 Bcf/d by mid-Oct, when we expect Cove Point to return from maintenance.

On net, salt storage, which are the highest deliverability facilities in the U.S., has remained at a manageable level, including an atypical withdrawal last week reported today by the EIA. We note this may be offset next week by a combination of increasing production and reduced pipeline exit flows from the Gulf (largely driven by maintenance events), which could temporarily weigh on U.S. gas prices from current levels. However, we believe we are quickly approaching a period when the market's focus will more sustainably shift towards 2026 tightness concerns. This is illustrated by the Cal26 strip settling this week above $4/mmBtu for the first time in two months. We maintain our $4.00/$4.60/mmBtu Nov-Dec25/Cal26 Henry Hub forecasts.

Dart's chartpack:

*pic

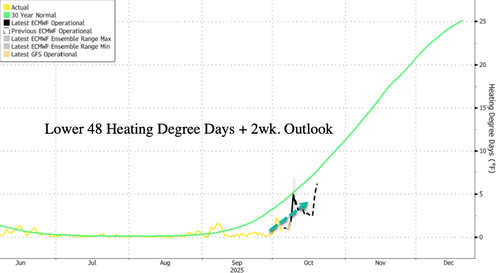

Separately, the heating season is just around the corner, with about 42% of U.S. households (the top source, especially in the Midwest and Northeast)using NatGas for heating.

Here comes the heating season.

. . .

Loading recommendations...