In a 2020 Lunch with the FT interview, Jim Chanos said financial markets were in “the golden age of fraud”.

On Thursday he said this phenomenon had “done nothing but gallop even higher” since he made the remark.

And now, as we have been highlighting recently, the dominoes may have started falling...

Beneath the surface of what’s been a remarkably resilient US economy, a series of small shocks in the world of consumer credit have combined to rock companies that service financially-vulnerable Americans, raising major questions about the true strength of the supposedly omniscient consumer's health.

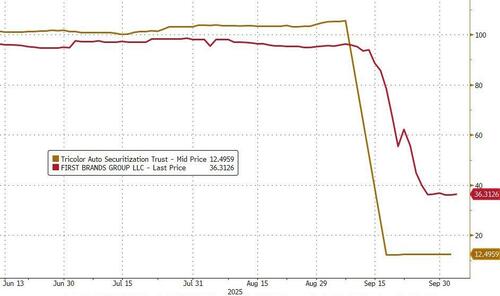

Following the collapse of Tricolor Holdings (a subprime auto lender), and weak second-quarter results from CarMax; we have seen car parts supplier First Brands Group...

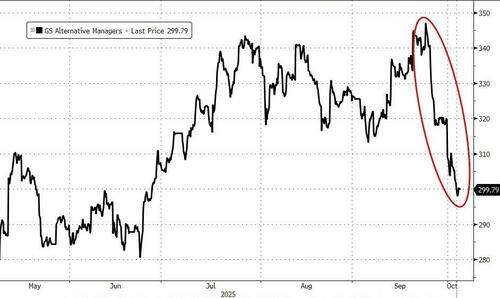

...wrongfooting investors further with payments company Klarna and buy-now, pay-later firm Sezzle also suffering declines alongside the 'Alts' market and private credit...

And as alternative asset managers tumble, The FT reports that 67 year old Chanos likened the near $2tn private credit apparatus fuelling Wall Street’s lending boom to the packaging up of subprime mortgages that preceded the 2008 financial crisis, due to the “layers of people in between the source of the money and the use of the money”.

“With the advent of private credit . . . institutions [are] putting money into this magical machine that gives you equity rates of return for senior debt exposure,” he said, adding that these high yields for seemingly safe investments “should be the first red flag”.

In the case of Tricolor and First Brands, questions (though no official allegations) have been raised about the substantial use of off-balance sheet financing and the possibility of rehypothecation of invoices (pledging collateral multiples times).

Chanos said:

“We rarely get to see how the sausage is made.”

Indeed, but one cut and the guts come spilling out

“The opaqueness is part of the process,” Chanos said.

“That’s a feature not a bug.”

The 'opaqueness' surprised many, as we detailed previously,

Nevertheless, while traders can't pin down the driver of the weakness in 'Alts', The FT concludes that several large banks have also been caught up in the collapse, including JPMorgan Chase and Fifth Third, which are exposed to losses on hundreds of millions of dollars' worth of auto loans.

A second investor who has since sold their position in packaged-up Tricolor loans said they had no idea how potential financial irregularities went unnoticed by JPMorgan Chase, one of the banks that underwrote debt offerings.

“That’s the shocking part of it,” the investor said. “JPMorgan is one of the most sophisticated lenders in the entire world. How the hell could they have missed this?”

JPMorgan declined to comment.

Loading recommendations...