As part of America's Industrial Policy transformation, Thetrump administration is pressing companies across nearly 30 industries to strike deals that advance national and economic security goals, Reuters reported.

Officials are offering tariff relief, revenue guarantees, and even government equity stakes in exchange for concessions. The rapid pace of negotiations is aimed at securing political wins for President Donald Trump before the 2026 midterm elections, the sources said. Stocks like USA Rare Earth (USAR), Lithium Corporation (LTUM), Centrus (LEU) and other appear to be moving higher mid-day Thursday on the news and speculation of which companies could be targeted.

Commerce Secretary Howard Lutnick has emerged as the administration’s lead dealmaker, overseeing government stakes in Intel and Nippon Steel’s purchase of U.S. Steel. “If we're going to give you the money, we want a piece of the action,” Lutnick said in August. He is building out a Wall Street-heavy team under a new U.S. Investment Accelerator, seeded in part with $550 billion from Japan as part of its trade commitments.

The International Development Finance Corporation, originally tasked with overseas projects, is also central to the strategy. A June proposal before Congress would expand its mandate and increase its firepower to $250 billion, creating an equity fund to support critical supply chains, energy, minerals, and infrastructure.

Reuters reports that the administration’s outreach spans semiconductors, AI, shipbuilding, critical minerals, energy, and pharmaceuticals. On Tuesday, Trump announced a White House deal with Pfizer to cut drug prices in exchange for tariff relief, declaring: “The United States is done subsidizing healthcare of the rest of the world.”

Companies are learning the optics are as important as the agreements. Eli Lilly was pressed by the administration after announcing new U.S. plants without including Trump. “As an American company, Lilly is committed to expanding manufacturing capacity in the U.S.,” a spokesperson said. Pfizer and AstraZeneca declined comment.

Some executives view the strategy as a chance to tap government support, while others fear strings attached. One minerals executive said industry peers worry about being told: “We need 10% of your company.” Lawyers caution that deals could unravel if the next administration reverses course.

Just today speculation about who may be next under the Trump admin's spotlight sent microcap US Lithium miner Lithium Corp soaring as much as 500%.

Supporters - and even some critics - say the approach is pragmatic, aiming to de-risk vital sectors, ensure taxpayer returns, and bring jobs back to the U.S. “They want to see projects that are credible and where there are viable partnerships,” said Mark Jensen, CEO of ReElement Technologies, after meeting officials on rare earth supply chains.

In his latest report, JPM's Michael Cembalest, hardly a fan of the Trump admin, discussed how the recent purchases of stakes in companies like Intel is actually a good idea, to wt:

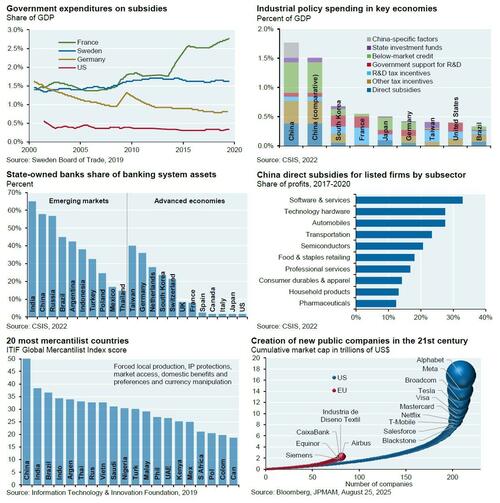

Bottom line: it’s a really mercantile world out there. While the US has a stellar track record in creating new companies compared to Europe (see bubble chart), the rest of the world often provides a lot more in the way of tax, loan, grant and other subsidies to its manufacturing industries than the US4F5. In China, the world’s most mercantile country, such subsidies can reach 15%-35% of industry profits. Providing a Federal government lifeline to Intel may have been the least bad option in the world illustrated below

More in the full JPM note available to pro subs.

Loading recommendations...