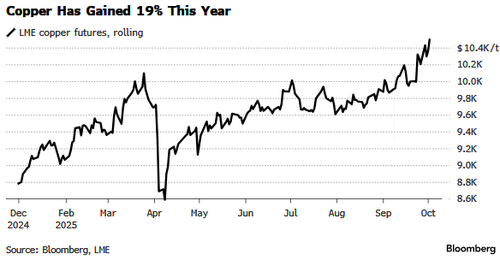

Copper futures on the London Metal Exchange rose above $10,500 a ton - the highest since May 2024 - driven by a mix of investing themes, macro tailwinds, and worsening supply outlook.

Freeport-McMoRan's (FCX) recent force majeure declaration at Indonesia's giant Grasberg mine, the world's second-largest copper source, adds to mounting disruptions already squeezing the market. Add growing demand from AI data centers and grid upgrades, and the shiny industrial metal looks poised for further upside.

Last week, Goldman's commodity specialist James McGeoch called the Grasberg mine incident a "black swan event"... The full note can be read here.

The Grasberg mine incident highlights the copper market's vulnerability to global supply shocks and is just the latest disruption to the industry. It follows Hudbay Minerals' disclosure last month that it was shutting operations at a mill at its Constancia mine site in Peru due to ongoing social unrest.

Supply woes for the industrial metal are colliding with rising demand for "The Next AI Trade" and "Powering Up America" themes, and more recently, Goldman told clients that the power grid is a "vulnerable link in energy security."

In other words, analysts Lina Thomas and Daan Struyven told clients last week, "The need to invest in the power grid – a vulnerable link in the energy supply chain – and the associated metals demand boost are becoming more acute with the rise of AI, geopolitical tensions, and the shift to hybrid warfare."

Both analysts pointed out that with AI and defense putting the power grid at the center of energy security, copper is the new oil.

"Such grid upgrades are metals-intensive: we expect grid and power infrastructure to drive ~60% of global copper demand growth through the end of the decade, adding the equivalent of another US to global demand and underpinning our bullish copper price forecast of $10,750/t by 2027," they said.

With that being said. Copper prices are marching higher.

. . .

Loading recommendations...