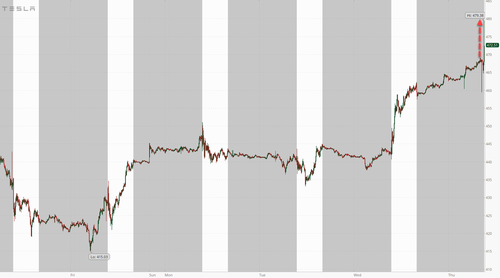

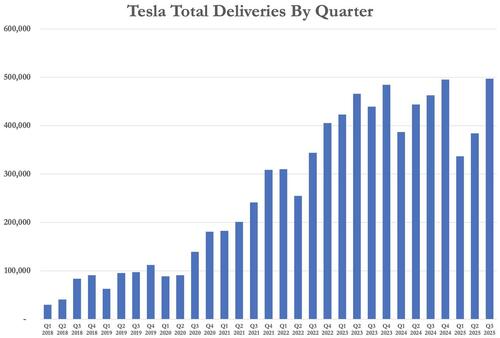

Tesla shares jumped 3.5%, rising to a fresh 2025 high and pushing Elon's wealth above $500 billion, after the company reported stronger-than-expected third-quarter delivery figures. Deliveries came in at 497,099 vehicles, a 7.4% increase from a year earlier and smashing Bloomberg consensus estimates of 439,612. The numbers also beat the recently-boosted guidance from Goldman and UBS.

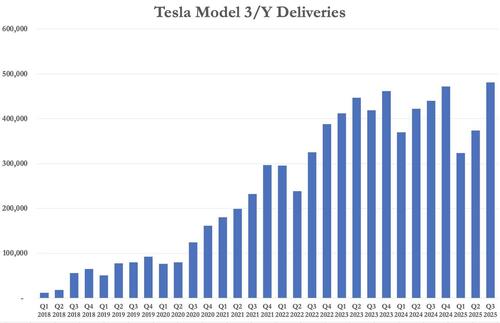

The bulk of the growth came from the company’s mass-market lineup: Model 3/Y deliveries reached 481,166, up 9.4% year-over-year and surpassing expectations of 424,828. Deliveries of Tesla’s other models totaled 15,933, representing a 53% jump from the previous quarter but slightly below estimates of 17,184.

On the production side, Tesla built 447,450 vehicles, down 4.8% from a year earlier and just under the consensus of 450,313. Model 3/Y production totaled 435,826, a 1.8% decline but still ahead of forecasts. Production of other models slipped to 11,624, down 13% from the prior quarter.

The strong delivery numbers likely reflect the pull-forward effect ahead of changes in US tax credits. Federal incentives that provided buyers with up to $7,500 for new EVs and $4,000 for used EVs expired on September 30 under new legislation passed by Congress. Tesla and its rivals had been factoring these credits into competitive lease and purchase offers, boosting demand in the final weeks of the quarter.

As we noted a week ago, Goldman recently raised raised both its delivery estimates and price targets into today's report. UBS analysts also lifted their delivery forecast. "We believe our new forecast is more in line with buy-side expectations in the 470-475k range," UBS analyst Joseph Spak told clients about a week ago.

Spak also predicted the stock wouldn't move much as a result of a beat. He continued, "Despite a print that may be inline with buyside expectations, we tend to find the stock does react to beat/misses vs. the headline number."

UBS said in their note that a push to take advantage of the tax credit would help delivery numbers: "Strong deliveries in the US as Tesla pushes, and consumers take advantage of, the $7,500 IRA EV tax credit before its expiry at the end of September 2025. We believe 3Q25 could be the highest quarterly US deliveries since mid-2023 and potentially the highest ever. We believe demand is very likely being pulled forward so we'd expect a q/q drop in 4Q25, even if the new "lower cost" Model Y is introduced."

He also said improved European and China sales, combined with strong delivery growth in Turkey and South Korea, could also help.

While deliveries beat expectations, investors will be closely watching upcoming earnings results for more clarity on margins, particularly given the production decline and the impact of incentive-driven sales.

Loading recommendations...