By Stuart Chirls of FreightWaves

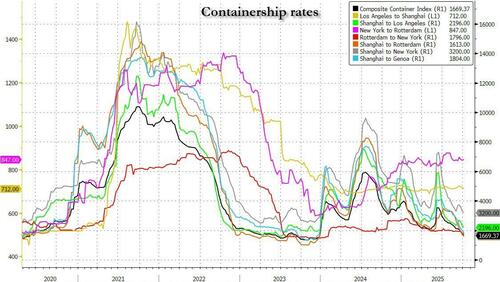

Container rates on the eastbound trans-Pacific continued their plunge as ocean lines increase blank sailings amid weak demand that’s expected to persist through the end of this year.

The SONAR Inbound Ocean TEUs Volume Index for Oct. 1 was down less than 1% from the previous week, but off 14.58% year-on-year.

Demand got a small bump from frontloading ahead of China’s Golden Week holiday, but nothing substantial enough to shore up falling rates.

Forecasts cite consumer concerns over rising prices, tariff concerns and trade shifts for a muted outlook through the end of the year.

The second pause of retaliatory China tariffs announced by the Trump administration in August has so far failed to generate sustained improvement in the busiest Asia-U.S. trade lane. On Tuesday U.S. Trade Representative Jamieson Greer termed a “good status quo” China tariffs of around 55% as the two countries continue to seek a mutually beneficial trade agreement.

But absent a deal or another pause, tariffs on Nov. 14 would boomerang back to around 145% on Chinese goods and 125% for U.S. shipments entering China, which all but shut down trade between the countries earlier this year.

Further complicating matters, China this week said it could levy costly port fees and bar some ships from its ports, in retaliation for punitive U.S. charges on China-linked ships set to take effect Oct. 14.

Asia-U.S. West Coast rates fell 15% to $1,853 per fort foot equivalent unit last week, according to the Freightos Baltic Index, while Asia-U.S. East Coast prices increased 16% to $3,967 per FEU.

The last time West Coast prices were this low was around December 2023, when spot rates dipped to approximately $1,744 per FEU.

Carriers have blanked, or withdrawn, about 13% of scheduled sailings on the trans-Pacific, as of Oct. 5, according to Sea-Intelligence. But that’s less than a year ago, which saw a 15.4% capacity reduction for the West Coast and 11.9% for the East Coast during Golden Week, against just 3.8% and 4.8% reductions planned for 2025.

Loading recommendations...