Goldman analysts find that a softening labor market, slowing traffic at major QSR chains, and intensifying competition are raising investor concerns about ready-to-drink (RTD) and specialty coffee demand. Since Gen Z is a key driver of RTD coffee at QSRs, the analysts highlight several "swing factors" to watch that could influence demand from this younger cohort.

"We are observing rising investor concerns about the coffee category's macro and competitive backdrop," a team of analysts led by Christine Cho wrote in a note on Tuesday.

Cho listed some of those key pressure points:

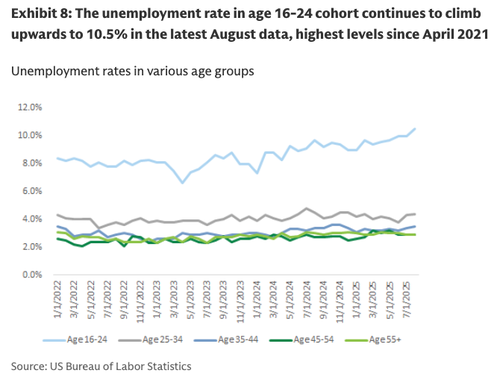

Softening labor-market data, which is notable given that younger consumers have been a key growth engine for coffee and beverages in recent years;

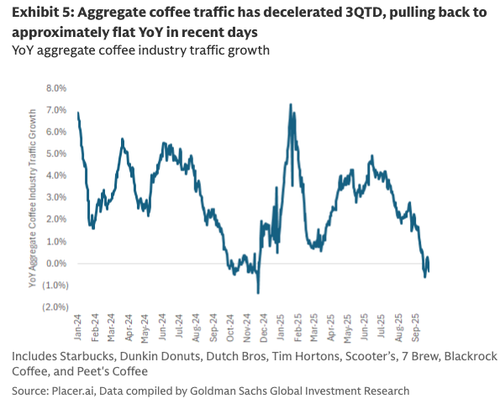

Signs of 3QTD traffic deceleration across the broader coffee market; and

QSR brands' stepped up focus on beverage opportunities (i.e., MCD's new beverage test in hundreds of stores in the US and Taco Bell's plans to open 30 Live Mas Cafes by the end of the year).

Here's more:

We have observed a modest uptick in SBUX's foot traffic trends in the top 3 coffee markets post the fall menu launch on Aug 26 vs. some deceleration in BROS' trends as per our latest Placer data analysis, and while it's early, McDonald's has gained 80 bps share of foot traffic in Colorado from 9/1-9/25/25 since the launch of its beverage tests on Sep 2 (Exhibit 4). We believe there are a number of key swing factors to watch for over the next few months including Gen Z spending intentions, Starbucks' launch of protein beverage / cold foam platform on Sep 29 and whether that influences net purchase intentions. That said, we maintain our Neutral ratings on SBUX and BROS as we await more clarity in these trends.

How will increased coffee/beverage competition impact existing market players?

On July 24, McDonald's announced a CosMc's-inspired beverage test across 500+ restaurants in Colorado, Wisconsin, and surrounding areas as consumers, particularly the Gen Z cohort, prefer cold beverages (link). This reflects a broader shift toward beverages we've seen across the restaurant industry as brands aim to capitalize on shifting coffee preferences (~40% of LSR offerings are now cold), with Taco Bell (Live Mas Cafe) and Chick-fil-A (Daybright) also testing beverage concepts and Wendy's launching cold brew coffee in August. Additionally, Jack in the Box announced the return of bigger cup sizes (25% more ounces) starting October 1 amid the stepped up value narrative across the industry. We think this could translate to intensifying competition in the coffee market especially for Dutch Bros, given that the brand has differentiated itself through its unique iced beverages and preference among younger consumers.

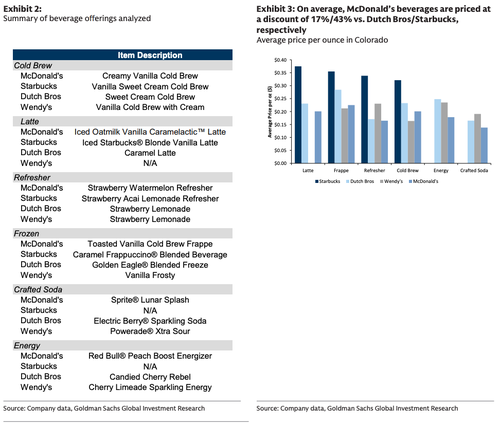

McDonald's beverages per ounce are priced at a discount of high teens/low 40% on average vs. Dutch Bros/Starbucks, respectively, based on our analysis of menu pricing for an array of offerings across 11 cities in Colorado as a way to assess which brands offer strong value in an increasingly competitive environment (Exhibit 3). Notably, Starbucks did not have any comparable offerings for two of the six categories analyzed, as the company aims to reduce operational complexity through a simplified menu, and offered the most expensive option across the remaining four categories.

For cash-strapped consumers, McDonald's offers the best RTD prices (at least in Colorado).

Coffee demand remains dismal.

Given that Gen Z significantly drives coffee demand, analysts point to rising youth unemployment as a potential factor behind the slump in sales.

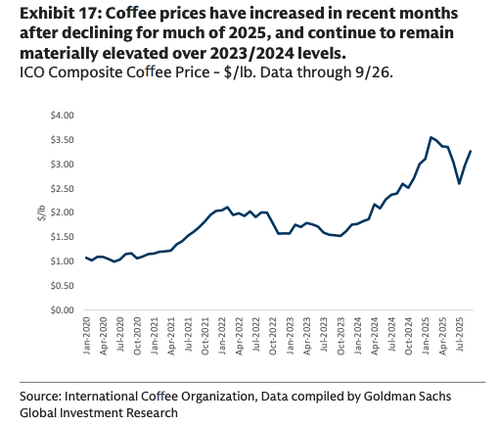

And soaring coffee bean prices don't help with price affordability.

The takeaway is that the coffee market is facing mounting macroeconomic headwinds and intensifying competition, just as unemployment among Gen Zers ticks higher. A soft labor market, slowing traffic, and aggressive QSR beverage rollouts (McDonald's, Taco Bell, Chick-fil-A, Wendy's) are eroding demand momentum. Starbucks still commands premium pricing but risks losing share to cheaper, value-oriented rivals like McDonald's.

ZeroHedge Pro Subs can access the full note, with all the charts and deeper analysis, in the usual spot.

Loading recommendations...