Authored by David Stockman via InternationalMan.com,

Talk about hiding in plain sight.

Here is possibly the most important graph ever about the flagging state of the US economy and the utter failure of Washington’s constant efforts during the last two decades to “stimulate” improved outcomes.

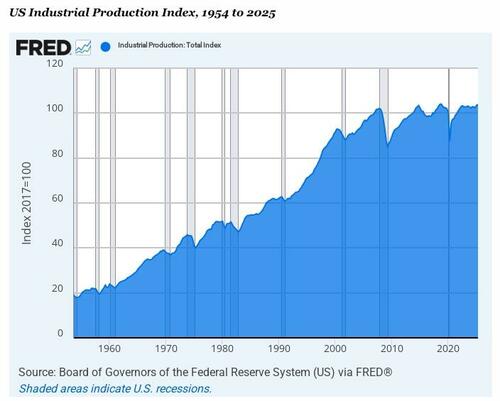

To wit, the US industrial production index—which measures the sum of manufacturing, energy, mining, and utility output—marched straight uphill at a 3.3% annual rate between 1954 and 2007.

Yet since then it has essentially plateaued, rising by just 0.10% per annum during the past 17 years.

That’s right. The growth rate of America’s industrial foundation has plunged by 97% since the pre-crisis peak in Q4 2007. And yet June’s industrial production index, which was up a small tad, gets headlined as a sign of economic strength. In fact, the longer-term chart below screams the very opposite.

After all, there is no logic that says an economy can remain healthy and prosperous that is increasingly based on educating a shrinking number of kids, feeding an expanding national waistline at fast food joints, and changing adult diapers among the soaring share of the population composed of octogenarians. At the end of the day, you actually have to make things in order for the population to pay for taking in each other’s laundry.

As it has happened, however, during the 48 months since June 2021 the industrial production index has been negative or flat nearly half the time on a month-over-month basis. For all practical purposes, the US industrial economy is just playing “mother may I”, advancing one step forward and the next step backwards month after month. And if that’s “strong” or even a sign of anything except decaying performance, we’d suggest the English language has lost all meaning.

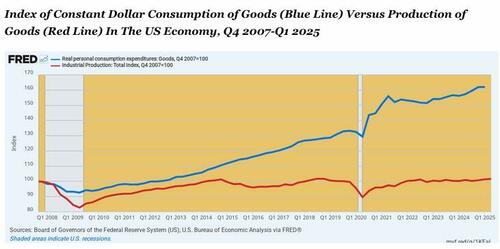

As it happens, the disconnect becomes even more dramatic when you compare the production of goods since Q4 2007 with the constant dollar value of goods consumption (PCE) during the same period.

That is to say, cumulative real consumption of goods (durable and non-durable) rose by 62% but domestic industrial output was up by only 1.4%!

Obviously, the yawning gap got filled by imports. On the margin, therefore, the growth of goods consumption during the last 17 years was based on imports financed by massive current account deficits.

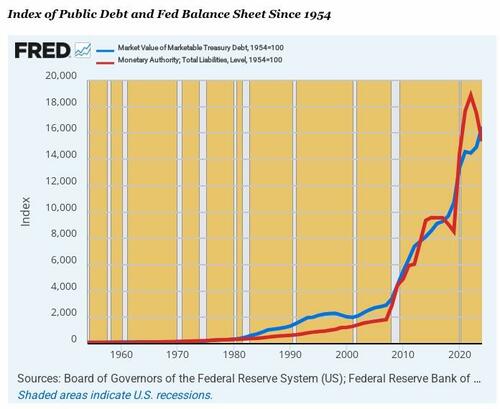

Needless to say, the above disconnect was not due to a want of trying by means of Washington-based stimmies. The index lines for Federal Debt and the Fed’s balance sheet since 1954 show the opposite pattern to that embedded in the industrial index chart above. That is to say, growth was slow to moderate between 1954 and 2007, but then took off like a bat out of hell thereafter.

Thus, between 1954 and 2007, US Treasury debt outstanding grew by 6.5% per annum, while the Fed’s balance sheet expanded by 5.6% per year. During the last 17 years, by contrast, the public debt rose by 10.7% per year, and the Fed’s balance sheet grew by 13.3% per year.

To reprise, industrial production growth has essentially ground to a halt at 0.1% per year since 2007, notwithstanding a 13.3% per annum expansion of Fed credit. Self-evidently, all that high-powered central bank money was going somewhere, but clearly it was not into the production of goods on Main Street.

There is no mystery, however, as to where it actually went. Since Q4 2007, the NASDAQ 100 index has risen by 86-fold. In turn, the net worth of the top 1% of US households has soared from $18.9 trillion to $49.4 trillion.

Stated differently, industrial production went nowhere, even as the net worth of the top 1.35 million US households soared by nearly $31 trillion.

And yet and yet. Bubble vision today was replete with Wall Street experts rebuking the Donald in the name of the Fed’s purportedly sacrosanct “independence” for his impending plan to fire Jay Powell.

Then again, the Latin phrase “cui bono” immediately comes to mind. The answer to “who benefits” from the Fed’s so-called “independence” is surely not Main Street America.

The fact is, the Fed is neither a democratically accountable arm of the state nor an agency of the free market. It was, is, and may always be a tool of the traders and gamblers who inhabit the canyons of Wall Street.

To be sure, the Donald’s comprehension of monetary policy is about as wrong-headed as it gets, but his imminent frontal attack on the rogue institution domiciled in the Eccles Building may well be the only way to upend its destructive reign.

* * *

The data doesn’t lie—and neither do the consequences. As Washington’s debt-fueled “stimulus” regime enriches Wall Street while hollowing out Main Street, the illusion of prosperity continues to mask an industrial and monetary decay that cannot go on forever. The cracks are widening, and the next phase may bring seismic changes most Americans are unprepared for. That’s why we’ve put together a free special report: “Guide to Surviving and Thriving During an Economic Collapse.” If you want to understand what’s coming—and how to protect yourself, your assets, and your freedom—don’t wait until the crisis hits full force. Click here to claim your free copy now. You owe it to yourself to be informed—and ready.

Loading recommendations...