Authored by Ryan McMaken via The Mises Institute,

Weakness in the US economy continues to hide behind surging debt levels and government spending. As noted last month by Daniel Lacalle,

[A] large part of the growth in GDP came from bloated government spending financed with more debt and inventory revaluation, adding 0.8 and 1.4 percentage points to GDP growth. ...

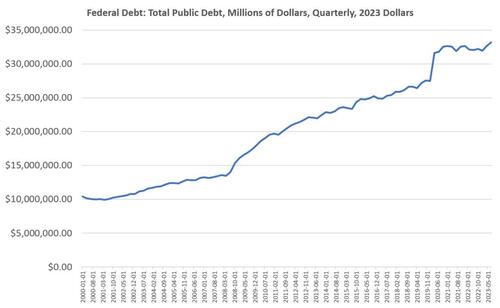

The increase in gross domestic product between the third quarter of 2022 and the same period of 2023 was a mere $414.3 billion, according to the Bureau of Economic Analysis, while the increase in public debt was $1.3 trillion ($32.3 to $33.6 trillion, according to the Treasury).

The United States is now in the worst year of growth, excluding public debt accumulation since the thirties.

This trend is continuing at least into the first quarter of the new fiscal year, as it is apparent that total public debt isn't slowing down.

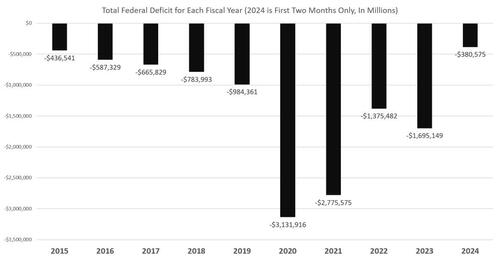

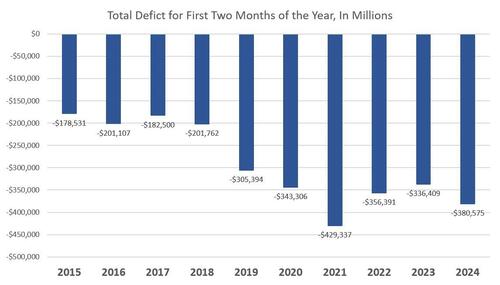

According to the latest monthly statement from the Treasury Department, the total budget deficit for the 2024 fiscal year (which began October 1) has already risen above $380 billion. The new total, which includes the months of October and November, puts the US on track for a total annual deficit of more than $2 trillion by the end of the fiscal year. That would be an increase of more than 25 percent over 2023 fiscal year, which was itself a 23 percent increase over 2022.

A 2024 annual deficit of $2 trillion would make 2024's deficit the third-largest deficit ever, behind only 2020 and 2021 during which federal spending in covid-related social benefits were seemingly unlimited.

Comparing the same two-month period over the previous decade, the totals also suggest deficit spending in 2024 will lag only the covid years of 2020 and 2021. During the first two months of fiscal year 2021, the deficit came in at more than $429 billion.

The American debt train is not slowing down. After reaching $33.1 trillion at the end of the third quarter this year, the total federal debt will reach $34 trillion by the end of this month. The US will add more than $7 trillion to its debt since 2020. To put this in perspective, we can note that the total revenue for the US the 2023 fiscal year was $4.4 trillion. (Total debt in FY 2023 topped 38 percent of all federal receipts.)

Many Americans have become numb to these sorts of debt numbers because it has long felt like free money. From the early 2000's to 2022, real interest rates were essentially zero which means the federal government could borrow money at rock-bottom rates. Since interest rates consistently trended downward in that period, maturing debt could always just be paid with new debt at even lower interest rates.

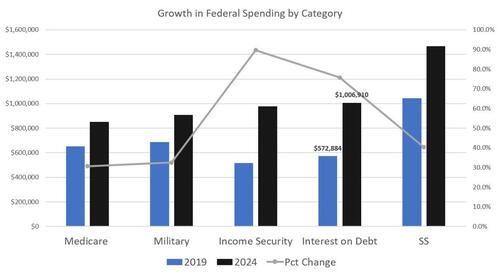

That, however, came to an end in 2022. Since then, the interest paid on new federal debt has grown significantly, and the total amount of interest paid on the debt each year will double from 2019 to 2024. For example, the yield on 10-year Treasurys surged throughout 2022 and most of 2023, nearly reaching five percent in October 2023. On the other hand, for most of the decade from 2012 to 2022, the yield on the 10-year was between two and three percent. The 10-year yield has fallen since October, dropping below 4 percent. But that still puts it more than double of what has come to be regarded as "normal" over most of the past decade.

This has amplified the true cost of the rising national debt. Since 2019, the total national debt has increased by 25 percent, but interest paid on the debt has increased by 75 percent. More specifically, interest on the debt came in at nearly $573 billion in 2019, but it will top $1 trillion in 2024.

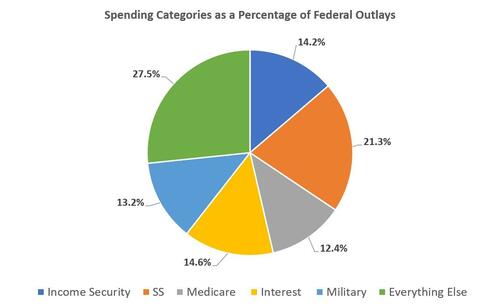

This rate of increase has far surpassed every other major spending category except "income security" which includes much of the trillions of the covid-related panic spending of recent years. In contrast, Social Security increased 40 percent, and Medicare increased 30 percent.

If the current trend in interest and debt continues, Congress is going to have to make some very unpopular spending decisions. Interest payments are now a larger portion of federal spending than military spending and Medicare. If debt continues to mount at the current rate, the requirements of debt service will eat up more and more of the federal budget requiring cuts for other areas of the budget to ensure bond holders get paid.

It's easy to imagine a full one-fifth of the budget going to paying for bonds in the not-too-distant future. That means that for every 100 dollars in taxes the US government steals from the taxpayer—mostly via income and payroll taxes—20 percent of it will go to pay interest which produces no benefit for ordinary people. Interest payments are just payments on old debts for lost wars, failed schools, retired government employees, and countless other grifts.

And then there is the threat of a mounting debt spiral as the central bank prints dollars in an attempt to pay debts while avoiding the fiscal austerity needed to avoid disaster.

The only possible silver lining here is that as it becomes more obvious that interest payments are fleecing today's wage earners, it will make more political sense to simply repudiate the debt. As Murray Rothbard noted, the idea that the government has some sort of moral obligation to pay its debts has always been nonsense. Interest payments have always been paid for by tax dollars, and are thus nothing more than a forced wealth transfer from taxpayers to bond holders. Yet, bond holders voluntarily took on the risk of holding US debt. So, if the US defaults, well that's tough luck and a risk investors adopted willingly. Taxpayers, on the other hand, are an involuntary party to the agreement. The moral thing to do in this case is to free taxpayers from the obligation.