Authored by Chris Macintosh via InternationalMan.com,

While we are all having our attention directed towards the war with Iran, we should always be looking at the “why.” Keeping in mind the absolutely true adage that all wars are bankers’ wars, I noted this from ZeroHedge.

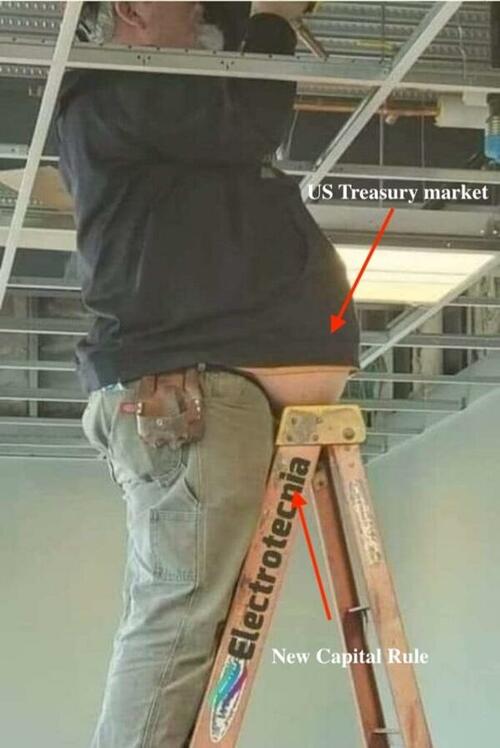

So while we’re being directed towards the Middle East, I note the easing of the capital rule on banks. This — together with the war — are absolutely totally part of the same equation, despite the fact that not one in a 100 folks will ever know it or realize it, and for that very reason it will progress. Here is the problem…

The US government has quietly initiated a stealth liquidity backdoor for banks by easing capital requirements on Treasury trades. This means:

Banks no longer need to reserve as much capital when holding or trading US government debt, making banks dodgier than they already are.

They can now soak up more Treasury issuance without showing increased risk on their balance sheets, making banks dodgier than they already are.

This injects artificial demand into the Treasury market and helps paper over collapsing organic demand while making banks dodgier than they already are.

This is not a mere policy shift. It’s a quiet declaration of structural stress.

What this really means is that the Treasury market, the backbone of the current financial system, is now so fragile and overburdened with issuance that it can no longer function without regulatory distortion.

The US government is now issuing a whopping $1–2 trillion in new debt every quarter.

Foreign buyers like China and Japan are net sellers.

Domestic demand for treasuries is not keeping up.

Yields are becoming increasingly unhinged from real risk.

I’d always thought they’d tap the boomers’ capital sitting in pension funds, mandating percentages to be allocated to “safety” or some such hogwash, but this is a new one that I admit I did not see coming — they’re turning banks into forced buyers by changing the rules. Sneaky buggers!

It won’t be called yield curve control, but this is exactly what it is… and it stinks of desperation.

So where does the Iran distraction come in? Exactly here:

War is a cover for liquidity expansion. War equals narrative control. War is a moral justification for massive capital deployment. And war means optical deferral of systemic accountability (they screwed up biggie, but can’t admit to it, because by doing so we’d get a revolution). Far better to send the peasants into a meat grinder (worked in Ukraine).

The Iran “surprise” hype machine serves a dual purpose:

Emotionally spike public attention away from the fact that the US is suffering from domestic insolvency.

Creates a narrative for justifying increased military spending and debt expansion, all under the guise of national security. The deep state truly is in control.

They’re not trying to hide the debt anymore. They’re trying to normalize the next phase of collapse by staging urgency elsewhere.

The United States is entering a phase where the legitimacy of the dollar system depends entirely on manufacturing belief. And when belief wanes, control mechanisms shift from fiscal logic to memetic warfare.

This is why capital rules are being gutted in silence, all the while state media channels scream about “world-changing surprises” (Trump’s Big Beautiful Bill) and existential threats (Russia bad, Iran bad, yadda, yadda, yadda). It is simply another step in the process of a failing empire.

* * *

As the fog of war thickens and financial smoke screens grow more elaborate, understanding the real drivers behind the chaos is no longer optional — it’s essential. Beneath the surface of the headlines lies a deliberate engineering of collapse, disguised as policy, wrapped in distraction.

If this article resonated with you — if you sense, deep down, that something far more profound is unraveling beneath the theater of geopolitics — then it’s time to dig deeper.

We’ve prepared a special PDF report, Clash of the Systems: Thoughts on Investing at a Unique Point in Time, to help you see what’s coming and how to position yourself accordingly. It outlines the seismic shifts underway in the global order — and where smart capital goes when empires fall.

Click here to download the report now.

Understand the collapse. Prepare for the transition. Position yourself before the dust settles.

Loading...