China auto industry was already on the rocks.

Recall, in late May we reported that a historic price war had broken out in China, one where the world's largest maker of EVs, BYD, had just cut prices by 34% in a desperate attempt to capture market share and put its competitors out of business (while unleashing a deflationary global shockwave that would crush EV makers around the globe).

Just a few days later, Wei Jianjun, Chairman of Great Wall Motor - one of China's largest car makers - said China's auto industry was going through its own "Evergrande" moment as a result of the unprecedented price war (for those who missed that particular episode, Evergrande is effectively China's Lehman, because while the largest financial asset in the US is capital markets in China it is real estate, and the 2021 collapse of Evergrande has left China's property market shocked and still unable to recover).

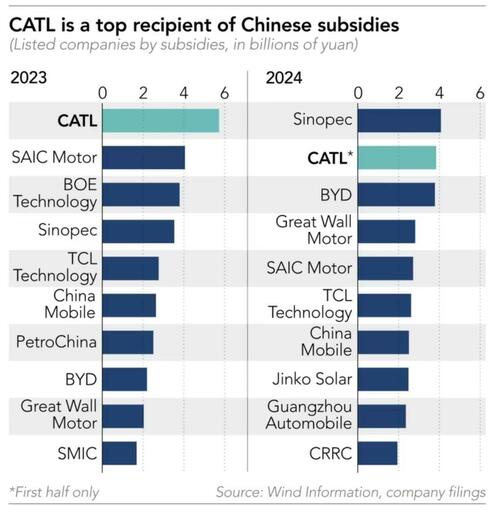

And also roughly at the same time, we reported that China's Contemporary Amperex Technology Co., Limited (or CATL), the world's largest EV battery maker (and thus directly dependent on the viability and growth of the global EV industry), was receiving more in Chinese subsidies in 6 months than Chinese auto giants BYD, Great Wall and SAIC combined.

All in order to maintain the illusion that China's EV industry was firing on all cylinders, to use a bad metaphor, and more importantly, to give the impression that China's economy was booming at a time when all eyes were on it as a result of the trade war with America (because woe to the loser).

The problem, as every Potemkin village comes to realize sooner or later, is that one can only pretend for so long and eventually the stimulus money runs out. And in the case of China, the stimmies have almost run out.

According to Reuters, at least six cities and municipalities across China have suspended trade-in subsidies for car buyers in June, which could grind to a halt most if not all new car sales in the world's second-biggest economy.

Notices from governments in Zhengzhou and Luoyang blamed the subsidy pause on the first round of funding allocated by Beijing for the program running out, while Shenyang and Chongqing said the suspension was due to adjustments to improve capital efficiency. The northwestern region of Xinjiang issued a similar suspension.

Translation: Beijing was pushing the communist economy into overdrive with the help of billions in stimmies to create the impression in April and May that all is well and that Trump's trade war isn't hurting China. But now, the money has run out.

As Reuters reports, China's government has leaned on subsidies for big-ticket items, including cars, home appliances and some electronics to get people spending as consumer sentiment in the country remains sluggish amid a prolonged property slump and concerns over wage growth and unemployment.

Naturally, the programmes - also known as free money - have been embraced with some enthusiasm, and as of May 31, there were more than 4 million applications submitted this year for car-specific trade-in subsidies, according to the country's Ministry of Commerce. Not surprisingly then that boosted by the torrential stimulus, Chinese retail sales data for May released earlier this week surprised on the upside... but economists quickly realized that subsidies were the main reason for the higher-than-expected 6.4% growth.

There is yet hope that the stimmies running out won't crater ground zero of China's deflationary exports, the EV industry: and that is even more stimmies! While there was no official announcement about when more funds from the central government will be released for programmes, China's National Development and Reform Commission and Ministry of Finance have said the subsidies would continue throughout 2025, leading analysts to expect new funds for the third quarter to be made available from July. Good luck.

Of course, like with virtually every other thing in planned, centralized-economies, the stimulus may be boosting one thing while at the same time it is crushing something else. Sure enough, the subsidy program has been met with controversy, ironically, by the auto sector itself. China's auto industry, the world's largest, has attracted criticism from regulators over a deepening price war that has sapped the sector's profitability.

Official media in China's Henan province, where Zhengzhou is the capital, last week reported that China's central government had taken note of some loopholes in the subsidy schemes and would look to make adjustments.

One of the major issues identified by Chinese media and regulators is so-called “zero-mileage used cars”, which refers to the practice of selling brand new cars as heavily discounted second-hand vehicles to get rid of inventory. In other words pretending to sell new cars as used cars, while unleashing catastrophic price cuts across the sector which lead to collapsing margins and failed companies.

The report in Henan government-owned newspaper Dahe Daily added that sales of “zero-mileage used cars” were one of the key factors leading to subsidies being used up ahead of expectations, necessitating the suspensions. Some businesses were disguising new or nearly new cars as used cars that they could trade in to obtain the subsidies, the newspaper said.

The People's Daily, a national newspaper that often signals the positions of China's top leaders on a variety of issues, also called for a crackdown on the zero-mileage used cars, weeks after Great Wall Motor's Chairman Wei Jianjun publicly condemned the practice.

China's industry ministry in early June summoned automakers to a meeting where it called for the sector to halt its price wars, Reuters reported last week. Since this is China, until one or more collapse, nobody will lift a finger to change anything.