Authored by Kane McGukin via Bombthrower.com,

Money has always been strategic, providing the foundation of nations and empires for centuries.

Owning capital and controlling its flow isn’t just about survival; it’s about building something that lasts.

If Bitcoin 2024 was the year of political invasion and intelligence acknowledgement, 2025 was a confirmation.

My key takeaway is that what started as an emergent behavior, Bitcoin, has made its way to center stage in 21st-century capital formation. New age dollars are backed once again with layers of sound money and innovative tech rails (stablecoins) that will extend our ability to build the future in both our digital and physical worlds.

This year’s conference laid out how Bitcoin + Stablecoins will be incorporated into balance sheets, national stockpiles, and act as a financial reserve asset. Backing traditional assets, new financial instruments (bitbonds), and resetting the geopolitical landscape while driving growth in the 21st Century.

“Bitcoin is now becoming one of the largest asset classes in the world. … The US needs to be able to defend Bitcoin or use it as an offensive weapon…” – Fred Theil, Mara

“The Executive Order specifically named Bitcoin… as a strategic asset because of its scarcity… and that was a signal being sent to the American population as well as the global population of other national leaders… The US Government sees Bitcoin as a Strategic asset… Is this a signal of a strategic shift? … I think that’s still an uncertain question, but I think we’re leaning towards the latter.” – Matthew Pines

Strategic reserves aren’t just about oil or Swiss cheese anymore. They’re about Bitcoin and the future of money as statecraft – Matthew Sigel, VanEck

A Historical Perspective of How We Got to Bitcoin

Money began with kings and blacksmiths, then shifted to vaults and shipping lanes as industrialized nations arose. To power this evolution, a global information and logistics network emerged: wires stretched across continents, barges moved gold port to port, and boots on the ground gathered local intelligence. Routed it back through government think tanks and major global bank trading desks. These old-fashioned and manual networks are what FED the dollar money machine, creating an unrivaled capital engine in the US.

By the 1960s and 1980s, a new era began. Derivatives became the norm, and information moved faster, requiring one to have financial trading desks around the globe to capture profitable information and support national security. Bankers ruled supreme. Bitcoin 2025 made it clear there is new capital in town, but this time is no different.

In recent decades, social networks began outperforming diplomats and spies. Capital shifted from hard assets to liquid and digital instruments. This accelerated the tempo of our world. We must rebuild that complex network of global banks, but with the advantage of nodes over buildings. In the new realm, VCs, software developers, and engineers rule supreme.

If one theme echoed throughout this year’s conference, it was this: Monetary information is a weapon, and the dollar network needs an extension. A new innovation to carry its weight around the world faster. That’s why Bitcoin is more than Number Go Up (NGU) technology.

Throughout the conference, if you heard it once, you heard it numerous times. Bitcoin won’t replace the dollar, it will expand and deepen the vast power of the dollar network. Moving forward, BTC will be the basis of capital formation, buying power, and geopolitical edge. Its volatility will be harvested and embedded into the balance sheets of public companies (Bitcoin Treasury Companies).

Stablecoins Were Everywhere

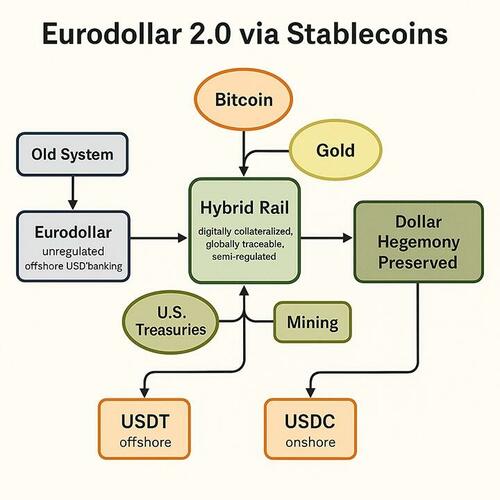

The x.com post/meme above is funny and sums up the stablecoin mania. This was an inevitable route, and there was no loss in the opportunity to weave it into almost every session. Stablecoins will lead the way in transforming our money market and dollar payment networks. They bring them up-to-date with modern technology and making “money” fully digital and usable.

Making money move at the speed with which people live today. Tether’s (USDT) Paolo Ardoino proved this in his session. He effectively showed that we’re moving from an era of tech stacks to an era of monetary tech stacks.

If you want value, it must be backed by truth and sustainability. Not rhetoric, corruption, merry-go-rounding, and nothingness.

Underneath the most popular stablecoin USDT sits: sound money assets (Bitcoin and Gold), paper yield-bearing monetary assets (US Treasuries), private company profits, Bitcoin mining and AI datacenter infrastructure, independent media tools, privacy chat tools, and more. Tether has built the future of what a monetary tech stack likely looks like. A combination of all forms of assets we might want in our society today.

“There are many senior folks in the Trump administration directly around the stablecoin space, and this was the same philosophy that really gave rise to the growth of US-based, world-dominant multinational corporations. It was not just the love of Pepsi and Coke as products. It was that they served as instruments of US statecraft, and there was a deep financial overlap between the profits of the large multinational corporations and the reach and acquisitions of the American Empire. … I think that there is a kind of belief that Stablecoins and the Bitcoin market can effectively do for the dollar what multinational corporations did in the 20th Century for the reach of the Empire.” – Mike Benz

As we’ve seen across centuries, intelligence is once again being embedded and synchronized. As power has shifted to technology networks, we’re seeing the importance these leaders are now playing in government.

Much like we saw with old Wall Street revolving doors that allowed leaders to bounce back and forth between Goldman, JP Morgan, Black Rock, The Federal Reserve, and other government institutions. We’re now seeing the same with technology companies, too.

Given the posturing around Bitcoin and AI, it would not be a shock for Bitcoin and stablecoin companies to be the next vector. After all, the power of a monetary network is in the information and profit its operators control.

As capital competition intensifies, it is clear that economic dominance and even warfare have moved from the battlefields to bandwidth.

All of this, Bitcoin’s integration, the rise of stablecoins, and the evolution of monetary tech stacks point to a deeper truth: our current financial system isn’t just adapting, it’s straining while monetary architecture is quickly becoming the next battleground.

This strain comes from a design flaw baked into the system itself: its dependency on endless growth. Its dependency on debt-backed growth.

The Problem of Scale and Constant Growth

“Basically, the way the system is constructed. … it relies on constant growth. It’s like a shark that can’t stop swimming, otherwise it drowns, ironically.” – Lyn Alden

What Lyn describes here with the shark analogy is the premise of Geoffrey West’s book Scale – The Universal Laws of Growth, Innovation, Sustainability, and the Pace of Life in Organisms, Cities, Economies, and Companies.

Eventually, superexponential growth systems (like financial systems) reach finite time singularity where the energy and growth required to maintain pace become catastrophically unsustainable.

The only way to avoid the inevitable collapse is through innovation. Ironically, Bitcoin is an innovation for both our financial system and our information system. Both are on unsustainable resource burn paths just to maintain themselves. For the financial system, it’s a debt issue. For the internet, it’s an energy and volume of content/information/value issue.

These dilemmas, though not Triffin’s, make the points highlighted by Vice President JD Vance even more important.

For starters, unfortunately, he made it clear that Bitcoin is now political; continued voice and action are required. As he posed, Bitcoin and AI together should be considered the two most important tools for our future.

As a reminder, empires and stability are built on one’s ability to collect, process, and profit from information. Both work nicely in these capacities. So, the undue interest does make sense.

As a reminder, those who reign are the ones who best showcase the ability to monetize the value in networks.

What nation-states, public entities, and those in statecraft seem to grasp is we’ve shifted from a world of “he who holds the gold makes the rules” to a world of “he who holds the data gets the value”.

It now appears to be an arms race to see who can amass critical capital. Because in times of geopolitical instability, strategic resources are what give control. They are what lead to historical transitions. Once again, we find ourselves in the midst of a paradigm shift, with Bitcoin at the center.

Money, information, and supply chains are the battlegrounds of the moment that will define the lanes of the future.

“We have to start thinking about the long-term strategic implications of Bitcoin. Where Bitcoin is going is as a strategically important asset for the United States over the next decades.” – JD Vance

And yet, while the Bitcoin Conference conversations touched on geopolitics, network theory, and systemic fragility, there was also something personal about this year’s conference.

One moment that captured this shift in narrative was from none other than Jack Mallers.

Mr. Mallers is Aging… A Conference Farewell

Lastly, a Bitcoin Conference would not be complete without a passionate ending from Jack Mallers.

However, this year was a bit of a flip of the script. Rather than promoting HODLing or stacking sats forever, Mallers promoted spending bitcoin and even taking loans against them… debt… because the reality is, as you become an adult, there are things in life Bitcoin can’t buy. There are real moments, real bills quoted and accepted only in USD. This realization helps us understand the simple line Jack quoted:

“Money is a means, it’s not an end.” – Jack Mallers

Money is a savings technology > Spending is for memories and life.

Jack Mallers Bitcoin 2025 Keynote Speech: The HODLers Dilemma

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto and The CBDC Survival Guide when it drops. Subscribe to Kane McGukin’s Substack here.

Loading...