The House Republican reconciliation bill, currently at the Senate, would, if passed and signed by President Trump, reduce federal spending on the Supplemental Nutrition Assistance Program (SNAP) by $300 billion through 2034.

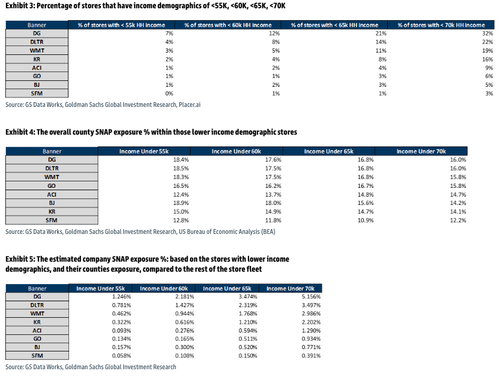

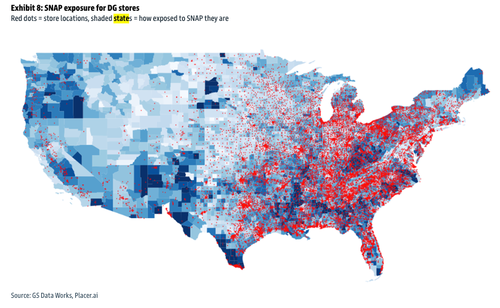

Goldman Sachs' retail desk found that SNAP dependency across major retail chains is very alarming and clear, with Dollar General (DG) and Dollar Tree (DLTR) most exposed if SNAP reductions are seen.

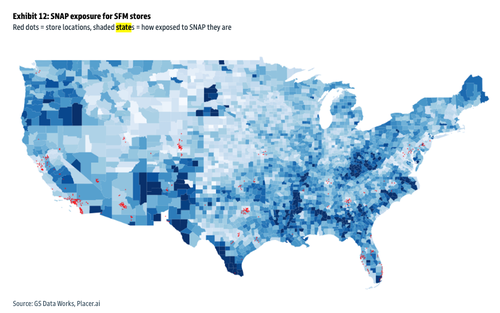

SNAP-linked exposure to sub-$70K income households hits 5.2% at DG, 3.5% at DLTR—compared to just .4% at Sprouts (SFM). Even Walmart (WMT) isn't safe, with a 3% exposure to SNAP.

"Based on household income profiles and average county exposures, we found that DG and DLTR have the highest exposure to SNAP consumers relative to the other companies, with BJ and SFM having the smallest exposure," Goldman analysts, led by Kate McShane, wrote in a note on Tuesday.

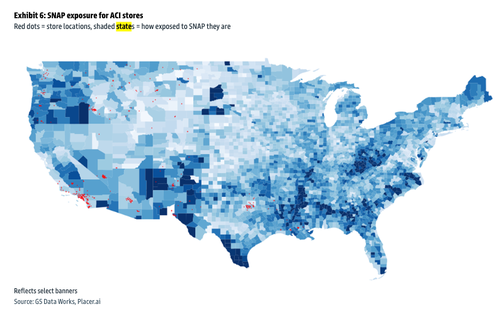

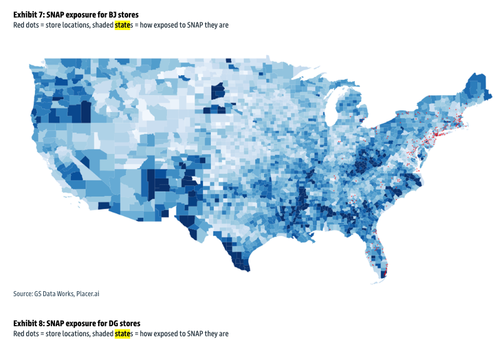

McShane noted that many of these SNAP-dependent stores are located in red states:

"We found that most stores from DG, WMT, KR, and DLTR tended to be located in Republican counties, BJ and GO were mainly located in Democratic counties, while SFM and ACI were closely split between the two parties."

SNAP Exposure by Retailer

"If the SNAP federal funding is cut, it would be up to the states' discretion to determine how much funding they will provide to make up for the shortfall," the analyst said.

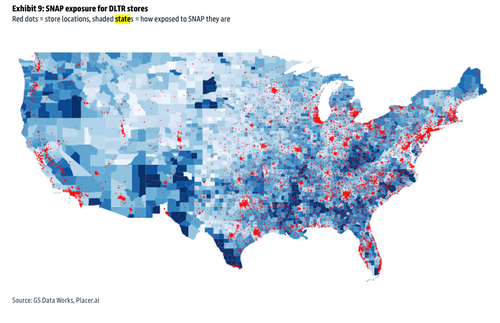

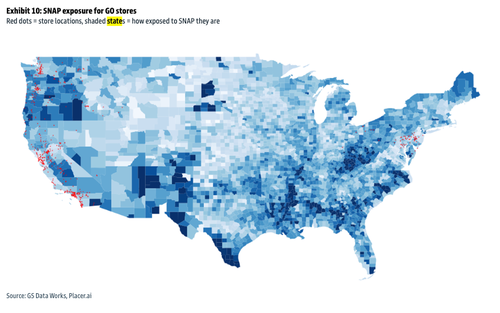

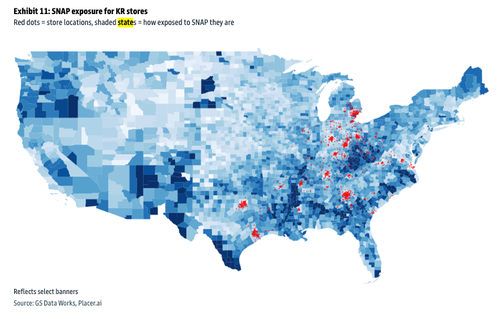

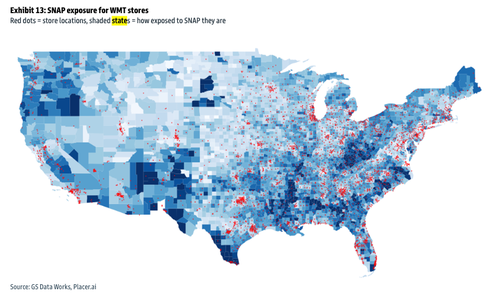

The detailed maps below display the store locations of each retailer, marked with red dots, while shaded states indicate the level of exposure to SNAP.

SNAP exposure for ACI stores

SNAP exposure for BJ stores

SNAP exposure for DG stores

SNAP exposure for DLTR stores

SNAP exposure for GO stores

SNAP exposure for KR stores

SNAP exposure for SFM stores

SNAP exposure for WMT stores

McShane maintains Buy ratings for ACI, KR, DG, DLTR, WMT, BJ, and SFM. However, if the proposed SNAP reduction is passed, future earnings seasons may reveal which retailer offers the best value for cash-strapped consumers, with Walmart currently leading the charge.

Loading...