Late last week, the Joint Committee on Taxation (JCT) released its preliminary score of the House Ways and Means Committee mark-up of the large budget reconciliation bill working its way through Congress, also known as Trump's "Big, Beautiful Bill" (BBB). And while the BBB is inching to passing through Congress - despite holdouts still remaining especially over the size of the SALT deduction - here is a snapshot of what is in the Bill, and how it will affect the US in the coming decade.

We start with a look at the fiscal policy focus of the BBB: Republicans' slim majority and their use of the budget reconciliation process are key influences on the composition of the fiscal policy-related legislation. That said, extending the expiring provisions of the TCJA should have sufficient support within the party for enactment. Additional tax cuts, such as a domestic manufacturing credit and not taxing tips, will be facilitated by the political viability of sufficient “pay-fors”. This will likely include watered-down versions of proposed IRA tax credit phase-outs and cuts to social spending programs.

So how does one quantify the impact of the BBB: as a reminder, the Ways and Means Committee is responsible for writing the main tax code portion of the bill. Relative to the CBO’s January 2025 baseline, the JCT estimated the mark up to increase deficits by $3.8trn over the next 10 years, with most of the deficit increase ($2.2trn) occurring over the next five years. Indeed, breaking the bill down even further, of the $1.9trn of total savings identified in the mark up, the majority ($1.2trn) is realized over the back half of the 10-year budget window.

It is also notable that $915bn of savings stem from capping individual deductions for state and local taxes – a figure that will come down in the final legislation given the pushback from many Republicans in high tax states. As a reminder, under current law, upon expiry of the Tax Cuts and Jobs Act, the cap on state on local deductions would go away leading to lower tax revenues (all else equal).

In addition, ~$560bn of savings are generated through terminations or earlier phasing out of clean energy-related tax credits and another $116bn from “remedies against unfair foreign taxes” – both measures highly dependent on projections with very wide error bands and/or yet to be defined enforcement mechanisms.

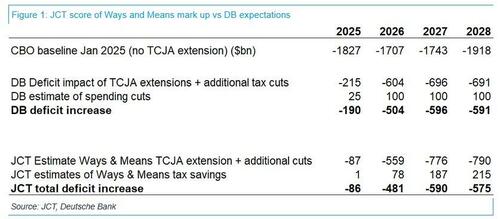

As DB's Brett Ryan - who previously had made his own deficit claculations as a result of the "Big, Beautiful Bill"- writes, while the specific components of the additional tax cuts on top of the TCJA extension differed from what he had previously outlined, the JCT score of the Ways and Means mark-up was largely in line with the top-line deficit assumptions provided by Deutsche Bank. However, one key difference was 2025, where Ryan had assumed more of the additional tax cuts on top of the TCJA extension would be made retroactive to 2025. The first table below shows DB's prior estimates for deficit increases from tax and spending measures – excluding tariff revenue assumptions – compared to the latest JCT score of the Ways and Means mark up.

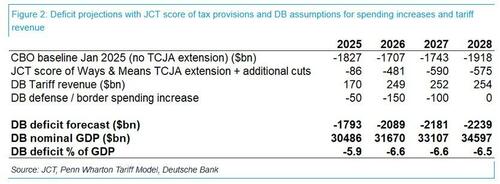

To be sure, the JCT scoring of the Ways and Means Committee mark-up does not capture key elements of the fiscal outlook – namely, estimates of tariff revenues and potential spending increases. Recall that the Ways and Means Committee is responsible for the tax writing portion of the bill and JCT only scores revenue-related measures. Indeed, CBO scoring will likely provide a more complete picture on tariff revenue and spending as the legislative process moves forward. DB anticipates $300bn of increased spending on border and defense to be front loaded over the next couple of years as well as tariff revenues of around ~250bn per year.

Risks are two-sided at this point. On the one hand, tariff revenues could be higher than currently penciled in, which assumes a ~15% tariff rate and only 2% import growth on average going forward. Conversely, the JCT score of the Ways and Means mark-up can be best thought of as a floor in terms of deficit increases over the 10-year budget window. The final legislative product is likely to show even less savings once the House and Senate “reconcile” their differences.

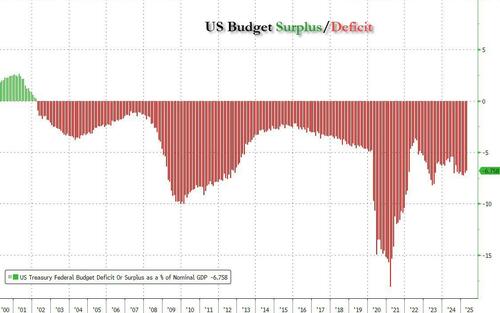

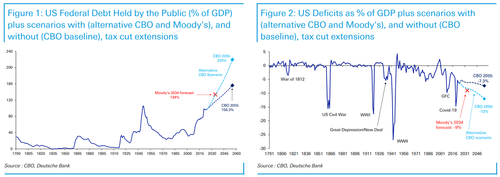

In short, as DB concludes, "there appears to be no serious effort at reining in historically-elevated deficits which remain on track to exceed over 6% of GDP in the coming years."

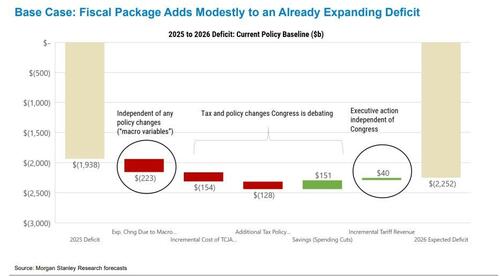

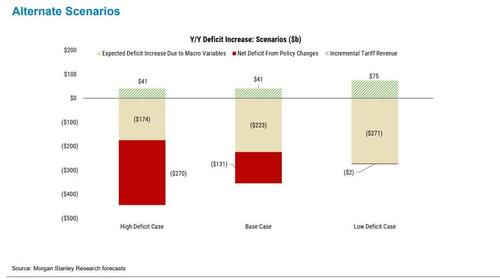

Extending on this, Morgan Stanley writes that the bank's base case is that a politically viable fiscal package will be composed of tax cut extensions with incremental tax cuts mostly offset by “pay-fors”. As such, the key driver of projected deficit expansion in 2026 is slowing economic growth and cost growth embedded in current policy, and this fiscal package would add modestly to that baseline. Accounting for potential tariff revenue as a mitigant, the bank expects a 2026 deficit of 7.1% of GDP (vs. 6.7% in 2025), an increase of ~$310 billion year on year...

... however, the bank also lays out a low and high deficit case, where the former leads to a $400BN increase in the deficit, while the latter "only" $200BN.

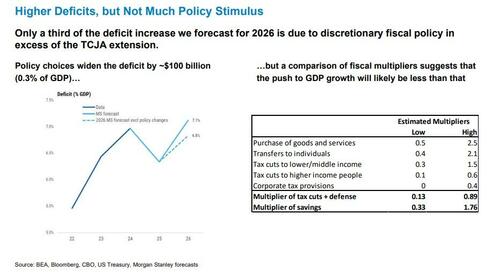

Taking a look at the bigger picture, keep in mind that the bulk of the BBB is just extending on the tax cuts from Trump 1.0, which is why if the bill does not pass, it would be equivalent to a huge tax hike, one which would lead to a lower budget deficit, but lead to an immediate recession as it would translate into a massive fiscal headwind. As such, while the BBB does lead to higher deficits, if largely due to secondary drivers such as the record $1.2 trillion in gross interest expense and economic slowdown, the Big Beautiful Bill will not result in much policy stimulus in 2026. Meanwhile, as Morgan Stanley notes, even assuming continuation of current policy, deficits should increase as the economy slows. And speaking of growth slowing down, MS expects this to happen due to a rise in uncertainty, trade policy, and restrictive immigration, but really it is a modest normalization of the runaway spending of the last two years of the Biden admin. In any case, softer economic growth means lower revenues and a higher deficit. In fact, only a third of the deficit increase for 2026 is due to discretionary fiscal policy in excess of TCJA extension.

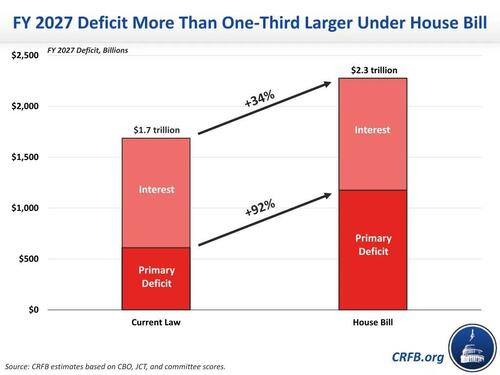

Finally, we look at the latest in-depth analysis from the Committee for a Responsible Federal Budget, which estimates the BBB would add $3.3 trillion to the debt including interest or $5.2 trillion if its temporary provisions are made permanent. In part because new borrowing is front-loaded and offsets are back-loaded, the bill would add massively to near-term deficits.

Unlike Morgan Stanley, the CRFB estimates the House bill would boost the FY 2027 deficit – the deficit in the first year the policies would be fully in effect – substantially more, by nearly $600 billion, or 1.8% of GDP. That’s the net effect of roughly $770 billion of new borrowing and only $180 billion of offsets.

The deficits boost represents a one-third increase in total projected deficits from $1.7 to $2.3 trillion – and a near doubling of the primary (non-interest) deficit.

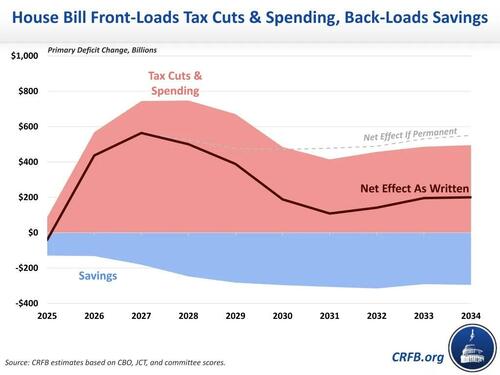

What is (perhaps not so) unique about the bill is that spending and tax cuts are front-loaded, while offsets are back-loaded, which means about 55% of the gross deficit increases – $2.8 trillion – would take place in the first half of the budget window. Meanwhile only 40% of the offsets – $970 billion – would accumulate over that period. As a result, 70% of the non-interest borrowing would occur in the first five years.

The tax cut and spending increase provisions are front-loaded due to the use of “arbitrary expirations” designed to limit reported costs. A number of provisions – including the enhanced Child Tax Credit and standard deduction, no tax on tips and overtime, 100 percent bonus depreciation for equipment, and new ‘MAGA accounts’ – are scheduled to expire in 2028 or 2029. The bill also relies on one-time appropriations for defense and immigration, which must be obligated by 2029. And finally, the bill includes a large number of retroactive provisions that provide a one-time windfall for activities already undertaken.

Meanwhile, many of the offsets don’t begin or ramp up until late in the budget window. Medicaid work requirements, for example, save $300 billion through 2034 but do not take effect until 2028. In addition, while some of the Inflation Reduction Act (IRA) energy credits are repealed at the end of 2025, the most expensive ones only begin phasing out in a few years with some restrictions taking effect sooner. And the Supplemental Nutrition Assistance Program (SNAP) state matching fund requirements do not start until 2028.

As a result of this mismatch and the sheer size of the bill’s deficit increases, the House bill would add to the deficit in every single year – with the possible exception of 2025 – even after the temporary provisions expire. But the largest deficit increases will take place very early in the budget window.

The impact of tariffs aside, this additional acceleration in near-term borrowing could stoke inflation and push up interest rates well above current levels. And it may continue in the future if Congress extends expiring provisions and perhaps cancel some of the offsets.

But what is most amazing, is that even this massive increase in the US deficit in the coming years is still a remarkable slowdown to the debt and deficit avalanche observed during the Biden administration, where like the president himself the economy was kept on life support thanks to a cocktail of debt, debt and more debt, as we first explained in the summer of 2023.

This is how Bank of America's Michael Hartnett explained the "policy math" as one where monetary and fiscal policy stimulus in 2024 was best in USA, but in 2025 it’s better in the Rest-of-World:

- US Fed funds rate: 2024 = down 100bps, 2025 = unchanged.

- US government spending: past 12 months spending up huge $750bn (to $7.1tn), next 12 months spend down $50bn according to FY26 budget proposal.

- US tariffs: past 12 months import duties raised $85bn, next 12 months = $400-600bn (assuming 10-15% tariff rate), tariff taxation that falls on either foreign exporters, domestic importers, or domestic consumers.

- US tax cuts: next 12 months potentially start delivering $90bn per year in new tax cuts (rather than tax cut extensions); per CRFB current cost of “big, beautiful bill” next 10 years sees $0.2tn TCJA expansion of tax cuts + $0.7tn new tax cuts.

- US policy stimulus crudely flipping from meaty 100bps cuts & $750bn fiscal stimulus to >$250bn fiscal contraction (spending cuts & tariff hikes before tax cuts) & zero rate cuts…big reason why US economy slows in 2025

- Meanwhile, China is in big fiscal stimulus mood, and NATO military expenditures: defense spending in Europe set to rise $100bn per annum; per US proposal all other 31 NATO countries to raise military spend to 5% of GDP by 2032= $700bn extra defense spending by NATO ex. US (currently US accounts for $0.9tn or 69% of the NATO military budget covering 32 members

The final straw, of course, was last Friday's Moody's downgrade of the US Aaa rating - the final one - which took place on purpose just as the debate over the BBB hit a fever pitch. And speaking of Moody's, earlier today we explained that the rating agency assumes the 2017 tax cuts are extended (unlike the last CBO semi-annual estimates), pushing debt and deficits much higher. The key Moody’s projections are:

- Interest + mandatory spending will hit 78% of total federal outlays by 2035 (from 73% in 2024)

- Deficits will rise from 6.4% to 9% of GDP by 2035

- Debt/GDP will hit 134% by 2035 (vs. 98% today)

And, as we also discussed earlier today in what America's Debt Doomsday looks like, both U.S. debt and deficits are about to truly take off. As shown in the chart below, while the baseline CBO projections don’t include the tax cut extension, one of their alternative scenarios of including it pushes debt/GDP above 200% of GDP over the decades ahead. The chart hardly needs any further commentary.

For anyone "shocked" by this development, don't be: back in February we warned readers, while praising the efforts of Elon Musk and DOGE, that while superficially cutting and streamlining government spending here and there will help, it will do nothing at all in the grand scheme of things to truly slash unsustainable government spending, which is dictated by Congress...

... and when it comes to the debt trajectory set there, nothing will ever stop this train, or as we put it in February:

What Musk is doing in trying to streamline the govt is admirable but ultimately it will be Congress that decides the endgame.

And there things are as status quo as always.

Three months later, a rather dejected Elon Musk observed the same thing when he said that the $2 trillion DOGE savings goal relies on the government, and that the "Doge team has done incredible work, but the magnitude of the savings is proportionate to the support we get from Congress and from the executive branch of the government in general."

And saving money is, unfortunately, the very last thing on the uniparty's mind.

More in the full notes from the CRFB, Deutsche Bank, Bank of America, Morgan Stanley, all available to pro subscribers.

Loading...