Nintendo's first sales forecast for its highly anticipated Switch 2 console came in at 15 million units for the fiscal year ending March—falling short of Bloomberg's analyst consensus of 16.8 million. The miss may reflect growing trade uncertainty and mounting macroeconomic headwinds souring consumer sentiments. The console is slated for release in June.

Goldman gaming analysts Minami Munakata and Haruki Kubota said Nintendo executives typically provide "conservative" estimates before any new console launch.

Here's Munakata and Kubota's first take on the weaker-than-expected sales forecast for Switch 2:

FY3/26 guidance calls for operating profits of ¥320 bn (+13.3% yoy), assuming shipments of 15 mn units for Switch 2 hardware and 45 mn units for software. This is well below GSe (¥483.6 bn) and the Bloomberg consensus (¥449.3 bn).

However, we would note that Nintendo's guidance has tended to be conservative at the time of new hardware launches, with upward revisions then following over the course of the fiscal year (as was the case when the Switch was launched).

Management also said that its 15 mn volume assumption for the Switch 2 is a level it is targeting for year one, and that there are no supply constraints. Given strong demand, with around 2.2 mn customers registering for the Switch 2 ballot sale in Japan alone via the My Nintendo Store website, we think there is ample upside potential to guidance.

The analysts continued:

It explained that while the Switch 2 has a higher selling price than the Switch, which could present a hurdle to early adoption, the Switch 2 offers platform continuity, including backward compatibility with existing game software, which could support penetration. The company also plans to offer bundled software. Management underlined that the 15 mn unit assumption does not reflect any supply constraints. Our conversations with investors have indicated expectations for shipments of 17-18 mn units, which we consider achievable given that Nintendo has confirmed no major supply constraints and that demand appears strong based on ballot sale registrations.

Separately, Pelham Smithers, managing director at Japan equity research firm Pelham Smithers Associates, noted, "You will have a good portion who will think management is being cautious, knowing that there's little upside in being too bullish at this stage. However, you'll also have a portion that will be concerned that Nintendo may look to keep the Switch 2 in short supply through this fiscal year."

Bloomberg Intelligence analyst Nathan Naidu commented on the positive pre-order trends:

Nintendo's softer-than-expected fiscal 2026 sales and profit guidance vs. consensus is in line with an historically conservative stance, which tariffs probably justify. Positive pre-order trends in Japan, the US and other key markets suggest the company might achieve the 15 million-unit sales goal earlier for its Switch 2 video-game console. The 45 million software-unit goal also seems beatable, with the strong lineup of third-party games — including Cyberpunk 2077 — and in-house ones helping activate or entice upgrades among Nintendo's 366 million users.

Two weeks ago, we commented on the numerous reports from major retailers about the Switch 2 selling out...

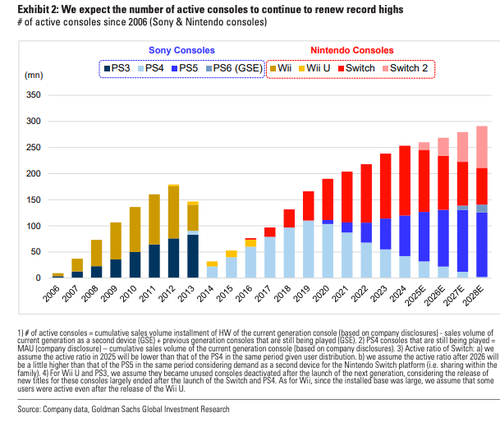

Recall that the Goldman analysts are Nintendo bulls who have previously stated that Switch 2 (the successor to the Nintendo Switch) will "unlock dormant hardware and dormant users" and send "the number of active consoles to continue to renew record highs."

Maybe Goldman and other analysts are correct—management could simply be offering conservative estimates ahead of the highly anticipated Switch 2 launch in June.

Loading...