Bitcoin just topped $100,000 for the first time since early February...

And Standard Chartered's Geoffrey Kendrick thinks a fresh all-time high for Bitcoin is coming soon (his specific target of USD120k for Q2 looks very achievable).

The dominant story for Bitcoin has changed again.

It was correlation to risk assets (see Bitcoin – another tech stock? note attached, from March).

It then became a way to position for strategic asset reallocation out of US assets (see Bitcoin – We expect a fresh all-time high in Q2, attached).

It is now all about flows.

And flows are coming in many forms:

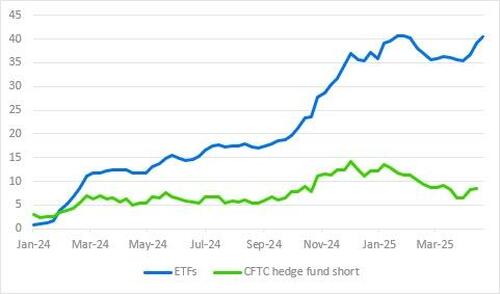

The spot ETFs in the US have seen USD5.3bn of inflows over the past 3 weeks.

Now sometimes a lot of these flows are offset by basis trades where the short is recorded as hedge fund shorts on CFTC.

On my price adjusted calculation that has only increased by USD1.2bn over this period (data as at 29 April).

So net real flow is more than USD4bn.

Strategy (formerly Microstrategy) has also ramped up both current and planned buying.

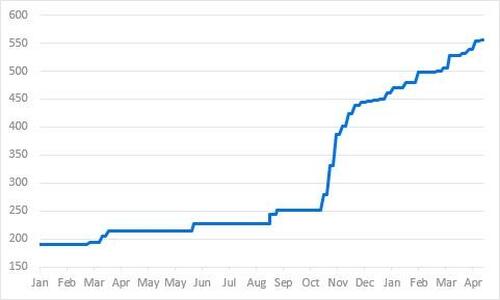

They now hold 555,450 Bitcoins. This is 2.6% of all Bitcoins that will ever exist.

Fig – Strategy (MSTR) holdings of BTC (‘000 BTC)

And their new plan to raise a further USD84bn to buy more Bitcoin would add another 840,000 Bitcoins (at USD100k price). That would take their holdings to more then 6% of all Bitcoins that will ever exist.

Next week we will get the 13Fs for the ETFs and MSTR (see Bitcoin – Changing buyer dynamics, attached, from February 13F season). At the end of December Abu Dhabi’s sovereign wealth fund held a small 4,700 Bitcoin equivalent position in IBIT. I would expect that to have increased and other long-term type buyers to have joined in too. Notably, the Swiss National Bank recently started buying MSTR, joining Norges Pension Fund.

Also this week, New Hampshire became the first US state to pass a Strategic Bitcoin Reserve bill. Other states will follow.

Kendrick ends with even more optimism:

I apologise that my USD120k Q2 target may be too low.

Given where global liquidity is going...

Nothing would surprise us less.

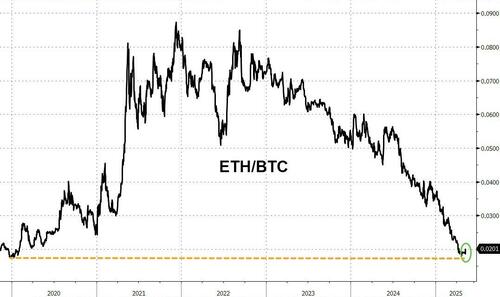

Finally, it's not just bitcoin, Ethereum is also starting to break-out...

...as it tracks a resurgence in forward inflation expectations...

The latest Pectra upgrade-fueled momentum:

“ETH could target $2,150–$2,700 in the coming weeks.”

As CoinTelegraph reports, Ethereum remains the largest layer-1 blockchain based on the total value locked (TVL) and ranks second in DEX volumes.

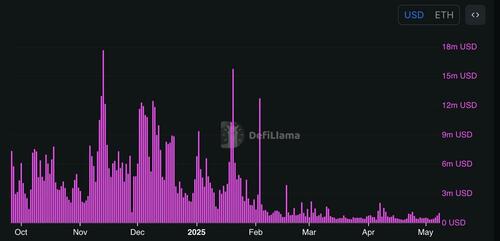

Ethereum’s TVL has risen from $44.5 billion on April 9 to $52.8 billion on May 8.

ETH TVL and transaction count. Source: DefiLlama

Additional positive signs include a 50% increase in deposits on BlackRock BUIDL, a digital liquidity fund application, a 33% increase in Spark and 25% growth in Ether.fi.

Ethereum’s daily transaction count has increased by 22% over the last month to 1.34 million transactions.

However, the 95% drop in Ethereum fees year-to-date suggests that Ethereum’s rise to $3,000 might take longer than traders may wish.

Low transaction activity on Ethereum reduces ETH burning, making it inflationary as new coins issued for staking rewards outpace the network’s burn mechanism.

In addition, US-listed spot Ether ETFs saw $39.7 million in net outflows between May 5 and May 7, while similar BTC instruments experienced net inflows of $482 million over the same period, adding to recovery concerns.

However, what comes next may push these assets into a new phase.

The Clear Crypto Podcast hosts Nathan Jeffay and Gareth Jenkinson spoke with longtime Bitcoiner and entrepreneur Dan Held, who is a proponent of building decentralized finance (DeFi) tools on top of Bitcoin, functionalities traditionally associated with blockchains like Ethereum or Solana.

“If we could bring [DeFi] back to Bitcoin, then Bitcoin could utilize not just spot speculation... but these other speculative games then would allow bitcoin to grow even faster.”

That includes borrowing, lending, and staking, all mechanisms that allow users to interact with Bitcoin beyond simple holding or trading.

Jenkinson echoed the potential, highlighting a shift in attitude:

“If you can use [Bitcoin] and bring DeFi to it, you’re basically allowing people to use digital gold as the underlying asset... It’s a very hard thing to do, because most hardcore Bitcoin maximalists don’t want people to give up their Bitcoin for something else.”

That tension between so-called “Bitcoin puritans” and more moderate voices is not new, Held noted. He recounted the 2017 Bitcoin Cash fork, describing it as “a civil war... brother against brother.” But unlike that contentious split, today’s evolution is happening without rewriting Bitcoin’s base rules.

“No one’s proposing to change the rules of Bitcoin,” Held said. “This is innovation built on top.”

To hear the full conversation on The Clear Crypto Podcast, listen to the full episode on Cointelegraph’s Podcasts page, Apple Podcasts or Spotify.

Loading...