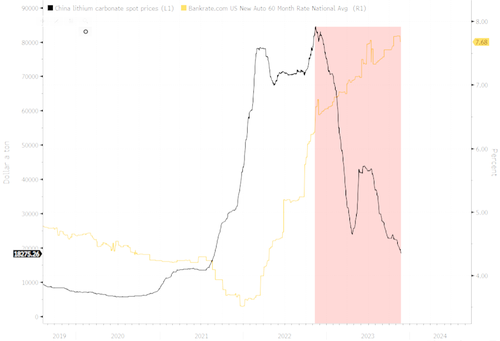

The price of battery-grade lithium carbonate has crashed in the last 12 months. This downward pressure is attributed to oversupplied markets in Asia, primarily because the global adoption rate of electric vehicles has notably slowed amid high interest rates.

Since November 2022, the average price of battery-grade lithium carbonate in China plunged from $84,500 per metric ton to $18,630, or about a 78% decline.

According to forecasts from industry consultancy Benchmark Mineral Intelligence, the global lithium market won't rebalance and return to a deficit until 2028.

General Motors, Honda, LG Energy Solution, and other auto and battery manufacturers have dialed back EV expansion plans in recent months, mainly because rising interest rates are curbing demand. This has created a global supply glut for the battery metal.

BloombergNEF's Allan Ray Restauro said, "With lithium supply growing more next year, we are likely going to see prices falling further, adding, "On the demand side, some regional differences on EV sales have been dragging sentiment down around the industry."

The world's second-largest lithium producer, Chilean miner SQM, recently blamed the plunge in lithium prices on excess inventory, especially in Asia.

Plunging prices come as the 'green' energy bubble is melting down, with the world's largest offshore wind farm developer, Orsted A/S, abandoning US projects, and solar stocks crashing on sliding demand.