Authored by Simon White, Bloomberg macro strategist,

Stocks may end up with nosebleed valuations similar to the tech bubble if the US avoids a near-term recession. This, along with a probable re-acceleration in inflation next year, makes the Federal Reserve’s next move more likely to be a hike.

US shares are already getting expensive, but that doesn’t mean they can’t get more expensive yet before hitting a wall.

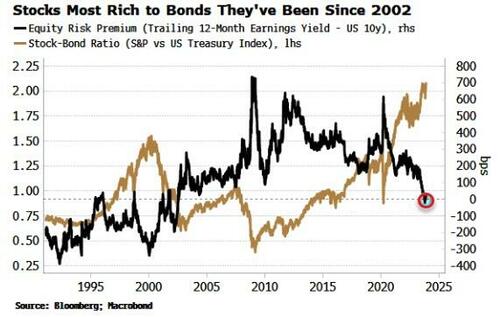

The equity risk premium for the S&P 500 (trailing 12-month earnings yield versus US 10-year yield) is close to zero, making stocks as pricey as they’ve been versus bonds since 2002.

Generally the stock-bond ratio moves inversely to the ERP. Recently bonds have been outperforming stocks, but to see much lower yields would likely need much clearer signs of an impending downturn, and that does not look the case at the moment. Growth is slowing, but there are few signs it will soon become recessionary, with several reliable leading data points showing positive momentum.

The stock-bond ratio is thus poised to begin rallying again, with stocks rising more than bonds, and the ERP is set to become more negative. It became deeply negative at the height of the dotcom bubble in 1999/2000, and there’s nothing to say such freneticism won’t happen again.

That will complicate the Fed’s task as growth slows while financial conditions loosen. But add in inflation that is showing signs it will reheat next year, and the balance of risks starts to tilt in favor of the next move being another rate hike.

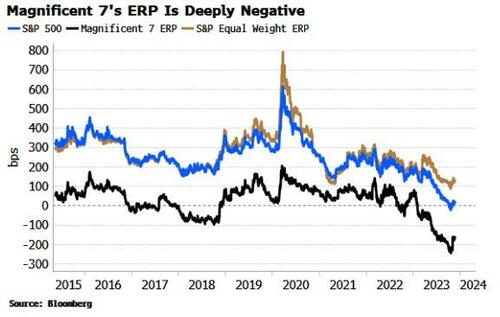

The megacap-shaped elephant in the room is - how is the ERP skewed by the biggest stocks?

The Bloomberg Magnificent 7’s ERP is already deeply negative. The remaining stocks, proxied by the S&P equal weight index, are less expensive, but at ~140 bps, are not exactly cheap.

Still, the S&P 500’s P/Es in 2000 had a similar distribution to today, with some stocks with very high valuations, but many others with lower valuations.

Nonetheless that did not stop the worst bear market since 1929 taking place after the index peaked in 2000.