Most Asian countries have publicly stated that they will not retaliate against President Trump's "Liberation Day" tariffs - except for China, which announced a 34% increase on all imports from the United States, effective next Thursday.

Notably, two Asian nations, Vietnam and Taiwan, have signaled a willingness to negotiate, seeking to de-escalate trade tensions and move toward what Trump has wanted: "fair trade."

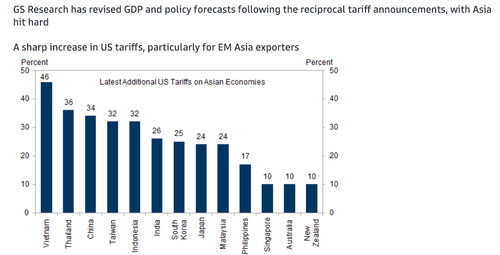

And why did Vietnam and Taiwan capitulate? Goldman's research desk shows just why.

Bloomberg published a note Sunday warning that a tariff escalation between Trump and Asian countries could impact the price of America's beloved smartphone: Apple iPhones:

Since the debut of the iPhone X in 2017, Apple hasn't increased the starting price of its flagship model from $999. There have been smaller adjustments, such as tweaking the amount charged for storage and introducing larger models like the 11 Pro and 12 Pro Max. In 2023, for instance, Apple enacted a quasi price increase with the iPhone 15: It boosted the starting price of the Pro Max version by $100 by eliminating the lowest capacity option.

Now, with tariffs hitting Apple's major sources of production, the specter of a price increase is back in a big way. And that's raising the question of how large such a hike might be — and how consumers would feel about it. -BBG

. . .

The current $999 level is a psychological threshold that many consumers probably don't want to cross.

Trump's Liberation Day hit Asian economies the hardest, with most of the tariff shock based along Apple's supply chain:

India, where Apple is increasingly building iPhones and AirPods, will have a 26% tariff.

Vietnam, where the company now makes some AirPods, iPads, Apple Watches and Macs, will be hit with a 46% levy.

Malaysia, where Apple is increasingly producing Macs, will have a 24% tariff.

Thailand, where the company also makes some Macs, will get a 37% levy. Ireland, within the European Union, gets a 20% tariff. Apple produces some iMacs there.

Indonesia, which will soon begin making AirTags and mesh for the AirPods Max headphones, gets a 32% tariff.

The latest tariffs will be 34% for China, bringing its total level to 54%. But the overall picture suggests Apple isn't going to get as much benefit as hoped from diversifying away from that country. Apple will still be taking a hit on iPhones made in India, AirPods made in Vietnam and Macs made elsewhere in Asia.

Trade data via the supply chain platform Sayari shows that Apple suppliers range from India to Taiwan and Vietnam to China.

Here's more data from Bloomberg about Apple's complex supply chain throughout Asia.

The question becomes whether Asian countries capitulate to Trump's tariff bazooka. So far, Vietnam and Taiwan are...

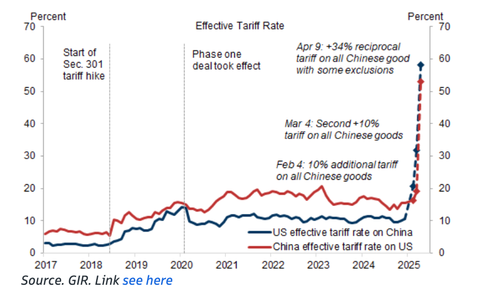

But what about China? Apple still relies on the bulk of its supply chain in the world's second-largest economy. With the effective tariff rate on Chinese goods entering the U.S. now at 54%, the question becomes: How long will Washington and Beijing continue to duke it out over trade?

Goldman data...

In the meantime, Bloomberg Technology journalist Mark Gurman asked whether Apple CEO Tim Cook will eat the tariff costs, push suppliers to reduce prices, pass on the expense to customers, or make supply chain readjustments.

Gurman explained that Cook will likely do a combination of the four as Trump's America First policies lead to a reordering of the global economy:

For one, you can bet that the company's procurement teams are pushing component makers and manufacturing partners to offer better pricing. That could help preserve profit margins.

Second, I would imagine Apple is prepared to eat a small percentage of the costs. With a typical hardware margin of around 45%, it has some room to play with if needed.

Third, while the company is still in assessment mode, I expect that Apple will seriously consider iPhone price adjustments. It helps that consumers have probably heard about the outside factors here and won't see it as a cash grab.

Finally, it's likely that Apple will pursue further supply chain changes. That probably won't involve a full-scale return to U.S. manufacturing, but the company will try to make itself less vulnerable to tariffs.

Recall that Cook visited the White House on February 20 to discuss trade policy and tariffs. The question now is whether Apple can maintain the current $999 psychological pricing threshold for the iPhone—or whether Trump will be able to de-escalate the trade war before the next iteration of the smartphone is released. Many questions.

Loading...