In the intricate landscape of global finance, where the credibility of nations is constantly under the microscope, credit ratings emerge as crucial indicators. These ratings, determined by the big three of the financial world – Standard & Poor’s (S&P), Moody’s, and Fitch Ratings – serve as a barometer for a country's financial stability and its ability to repay debts.

In short, these ratings assess the probability of a nation defaulting on its financial obligations. A higher rating, a symbol of economic strength and stability, often translates into lower borrowing costs for a country. Conversely, a lower rating can be a red flag, leading to increased borrowing costs or, in more severe cases, restricted access to capital.

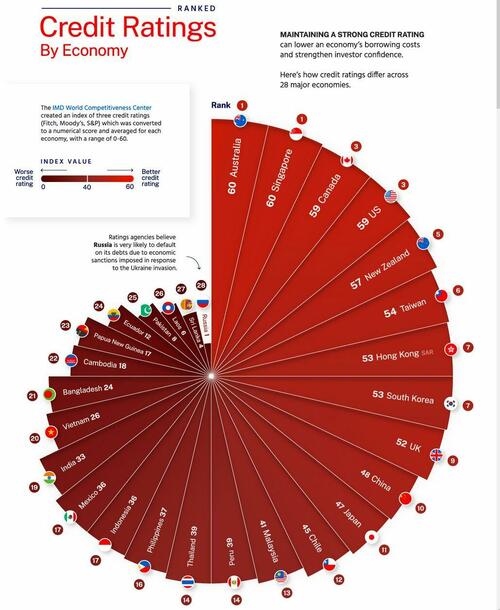

These rankings are illustrated below by The Hinrich Foundation via visualcapitalist.com, which analyzed the creditworthiness of 28 major economies. The graphic is an amalgamation of indices from the three juggernauts of the rating world (S&P, Moody’s, Fitch).

The data is drawn from the 2023 Sustainable Trade Index (STI), a collaborative effort between the Hinrich Foundation and the IMD World Competitiveness Center.

To produce the STI’s credit rating metric, ratings from S&P, Moody’s, and Fitch were converted to a numerical score and averaged for each economy, with a range of 0-60 (60 being the highest). All data are as of 2022. -Visual Capitalist

And while the STI obviously factors in 'green' initiatives, it's useful to gauge who's most able to 'sustain' various 'green' programs, whether they're total boondoggles or not - given that most of the west is heavily committed to them.

More via Visual Capitalist,

Countries with advanced economies and stable political structures typically receive the highest credit ratings, but this is always subject to change. For example, in August 2023, Fitch Ratings announced it had downgraded the U.S. to an AA+ from AAA (the highest possible).

From Fitch’s press release:

The rating downgrade of the U.S. reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.

Speaking of downgrades, one country that has received numerous in recent years is Russia, due to sanctions it faces as a result of the prolonged invasion of Ukraine. For example, S&P reduced Russia’s sovereign credit rating to a CCC-, which implies a default is imminent in the near future.